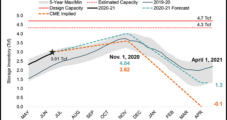

U.S. stockpiles of crude are down substantially this year amid rising demand and curtailed production, with inventories at the Cushing Hub in Oklahoma driving the downward trend. Stocks at Cushing totaled 32.9 million bbl for the week ended Sept. 10, down 42% from the start of the year, the U.S. Energy Information Administration (EIA) said…

Wti

Articles from Wti

Gulf Coast Refiners Facing Hit to Bottom Line After Deadly Mexico Blast; WTI Crude Prices Rise

Oil prices rose on Tuesday after a fire on a Petróleos Mexicanos (Pemex) processing platform in the Gulf of Mexico slashed 421,000 b/d from Mexico’s oil supply. West Texas Intermediate (WTI) for October settled at $67.54 on Tuesday, up $1.90 day/day. “Bottom pickers jumped into the void on the open on Sunday night, and then…

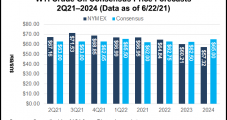

WTI Oil Price to Average $75 in 2022 and Remain Elevated for Years, Raymond James Predicts

With demand mounting and global supply in catch-up mode, oil prices are likely to climb in the second half of 2021 and hold strong for several years, as economies around the world recover from the coronavirus pandemic and drive up energy needs, analysts at Raymond James & Associates Inc. said Monday. The analysts, including John…

Oil Price Boom Forecast to Reach $100, Potentially Marking Crude’s Last Great Rally

As major economies across the globe emerge from the doldrums of the pandemic and travel surges, oil prices could further spike and reach $100/bbl by next year, according to the most bullish Wall Street forecast yet this year. It could also mark the final surge in oil prices, however, as pressure intensifies on energy companies…

Hess Raising Capex Slightly, with Focus Trained in Bakken, Offshore Guyana

Hess Corp. remains laser-focused on developing assets in the Bakken Shale of North Dakota and offshore Guyana, directing the lion’s share of its $1.9 billion exploration and production (E&P) capital and exploratory budget to the “high return, low cost” assets for 2021. The New York City-based producer in the first quarter is set to increase…

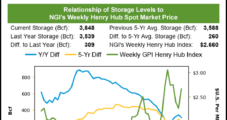

‘Smelling Salts’ Awaken Natural Gas Futures After ‘Quite Strong’ EIA Report; Cash Mixed

Natural gas bulls were on parade Thursday as the stars aligned to offer support for struggling futures prices. Thanks to lower production, a “quite strong” storage withdrawal, cooler-trending weather outlooks and solid export demand, the January Nymex futures contract settled 11.1 cents higher at $2.553. February jumped 11.4 cents to $2.570. Spot gas prices continued…

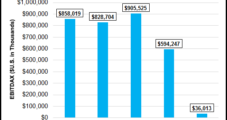

U.S. Oil Producers Escalate Hedges in Wake of Coronavirus Confusion, Price Collapse

Energy companies ramped up hedging activity as the demand and price shocks of the coronavirus pandemic roiled the oil and gas sector during the second quarter. A new U.S. Energy Information Administration’s (EIA) analysis of 2Q2020 financial disclosures from 77 publicly traded domestic crude oil producers found that the companies collectively entered into hedging contracts…

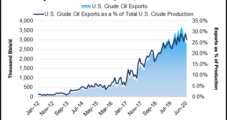

CME Adds Delivery Point for WTI Houston Futures as U.S. Crude Exports Grow

CME Group said Thursday it has added dock allocation as another delivery point for its West Texas Intermediate (WTI) Houston futures contracts on the New York Mercantile Exchange. Pending regulatory review, the new delivery point would be effective with the January 2021 contract. The move would allow WTI Houston crude futures to be delivered directly…

Continental Expects Improved Cash Flow at $40/bbl as Production to Ramp Through End of 2020

After curtailing production in the second quarter amid the extraordinary disruptions caused by the coronavirus pandemic, Continental Resources Inc. (CLR) expects to boost cash flow at $40/bbl West Texas Intermediate (WTI) pricing as it looks to ramp up output through the end of the year, management said. The Oklahoma City-based independent in its 2Q2020 earnings…

Rising Supplies Seen Keeping Lid on Henry Hub Natural Gas Prices This Summer

Although a reduction in associated natural gas supply had been constructive for Henry Hub prices heading into this winter and next year, analysts expect the ongoing reversal of U.S. supply curtailments by exploration and production (E&P) companies to keep the pressure on the U.S. benchmark for the rest of summer. In a note to clients…