A roundup of news and commentary from NGI’s LNG Insight Gazprom PJSC did not book any of the 63.7 million cubic meters/day of interruptible natural gas pipeline capacity through Ukraine at a monthly auction on Tuesday. It was the fourth consecutive month that Gazprom did not take additional volumes. The company has been booking additional…

Russia

Articles from Russia

Germany, U.S. Reach Compromise on NS2, but European NatGas Supply Uncertainty Remains

The United States and Germany have reached a compromise on Russia’s Nord Stream 2 (NS2) pipeline, clearing a path for the project to finish unencumbered. In a joint statement issued Wednesday, the countries pledged their support for Ukraine and agreed to sanction Russia if it uses the pipeline or energy supplies for geopolitical advantage. “The…

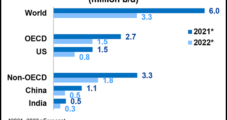

With Demand Rebounding, OPEC-Plus Reaches Deal to Lift Crude Production Through 2021, into 2022

The Organization of the Petroleum Exporting Countries and its allied group of leading oil producers headed by Russia, aka OPEC-plus, on Sunday reached a deal to further boost production through the end of the year and into 2022. The member countries, led by Saudi Arabia, committed to bringing back all the crude supply they had…

Russia Snubs Additional Natural Gas Capacity to Europe Via Ukraine — The Offtake

A roundup of news and commentary from NGI’s LNG Insight Russia did not book additional interruptible pipeline transportation capacity for July through Ukraine at the Sudzha entry point at an auction Tuesday. It was the third month in a row that Gazprom PJSC elected not to take interruptible capacity to move more supplies to Europe. …

U.S. Waiving Some Nord Stream Natural Gas Pipeline Sanctions, but Still Opposes European Project

The State Department this week waived fresh sanctions on the Nord Stream 2 AG (NS2) consortium that is building the natural gas pipeline from Russia to Europe as the Biden administration looks to strengthen relationships in the region. The 745-mile, 5.3 Bcf/d line as designed would traverse the Baltic Sea from Russia, to Greifswald, Germany.…

Novatek Secures Buyers for All Arctic LNG 2 Volumes

PAO Novatek, Russia’s largest independent natural gas producer, has contracted all of the supply from its proposed Arctic LNG 2 export project under development north of Siberia on the Gydan Peninsula. The company said it has signed 20-year sales and purchase agreements (SPA) with the project’s participants for its 19.8 million metric tons/year capacity. Arctic…

Southern Gas Corridor Makes Historic Delivery to Europe

Europe has received its first shipment of natural gas via a $40 billion infrastructure project that took seven years to complete, further diversifying the continent’s energy supplies. For the first time ever, Azerbaijan’s natural gas reached Europe through a direct pipeline connection as the last segment of the Southern Gas Corridor — the Trans-Adriatic Gas…

New Nord Stream Sanctions Draw Scrutiny, Stir Ire of Stakeholders

The Trump administration has unveiled a potentially quixotic effort to halt the controversial $11.4 billion Nord Stream 2 (NS2) natural gas pipeline from Russia to Germany by threatening to sanction companies that help complete the last 100 miles of the 745-mile line. The State Department plans to alter the Countering America’s Adversaries Through Sanctions Act…

Implications Seen for U.S. LNG as Nord Stream 2 Nears Finish Line

Russia will likely complete by next year the undersea Nord Stream 2 (NS2) natural gas pipeline to Germany despite ongoing U.S. efforts to scuttle the $11 billion project, analysts said. The start-up of the 5.3 Bcf/d NS2 could curb a potential recovery of U.S. LNG exports even if the Covid-19 pandemic recedes next year, said…

NGI The Weekly Gas Market Report

U.S. Lawmakers Push More Nord Stream 2 Sanctions as Russia Searches for Workarounds

U.S. lawmakers have introduced bipartisan legislation to expand sanctions targeting the Nord Stream 2 (NS2) natural gas pipeline as Russia pushes ahead to complete the project and move more supplies into Europe.