LNG | LNG Insight | NGI All News Access | NGI The Weekly Gas Market Report

Implications Seen for U.S. LNG as Nord Stream 2 Nears Finish Line

Russia will likely complete by next year the undersea Nord Stream 2 (NS2) natural gas pipeline to Germany despite ongoing U.S. efforts to scuttle the $11 billion project, analysts said.

The start-up of the 5.3 Bcf/d NS2 could curb a potential recovery of U.S. LNG exports even if the Covid-19 pandemic recedes next year, said BTU Analytics LLC energy analyst Connor McLean.

“If Nord Stream 2 comes online as expected, the influx of supply into Europe could place further pressure on a U.S. LNG recovery in 2021,” McLean said in a recent post on the firm’s website.

McLean predicted that NS2 could be completed late this year or in 2021 even though U.S. lawmakers last month introduced bipartisan legislation to try to halt the project by significantly expanding the number of entities that could face sanctions for aiding it in any way, such as construction, financing, insuring or certification.

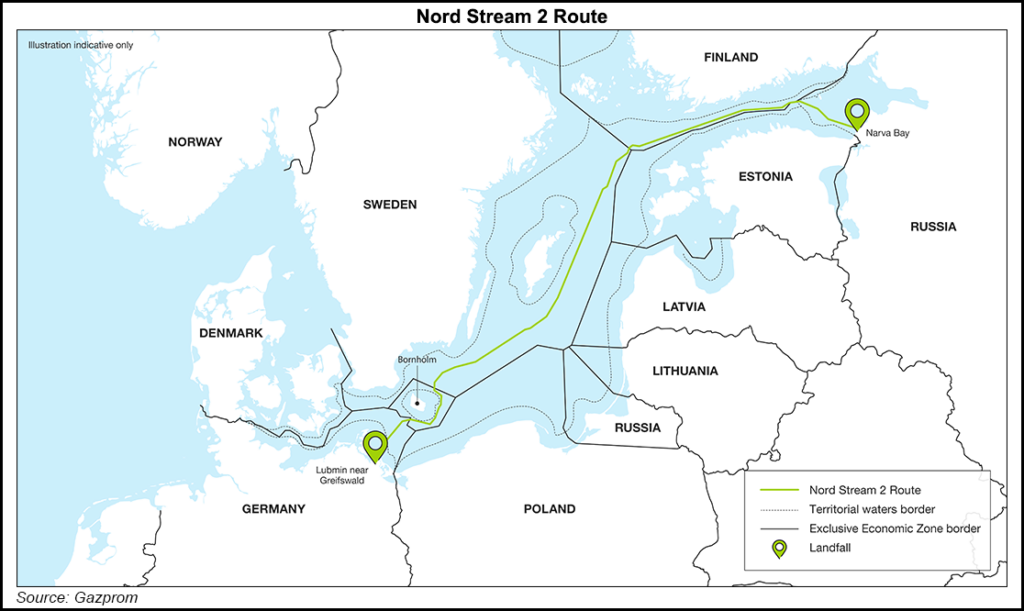

The United States has already delayed completion of the 745-mile line by imposing sanctions in December on pipe-laying activities in the Baltic Sea, which NS2 would traverse on its route from Ust-Luga, Russia, to Greifswald, Germany. Those sanctions caused privately-held Allseas to suspend its pipe-laying work, which in turn prompted Russia to develop its own ships to try to complete the line. The work was delayed after NS2 had already been built within 100 miles of the German coast at a cost of $10.5 billion.

To combat the Russian plan, Sens. Ted Cruz (R-TX), Jeanne Shaheen (D-NH), John Barrasso (R-WY), Tom Cotton (R-AR) and Ron Johnson (R-WI) introduced a bill to sanction any entity that aids in completion of the line. That could include companies that have extensive operations in the U.S., such as Royal Dutch Shell plc, Total SA, Engie and OMV, which have stakes in parts of NS2, and Norwegian maritime classification society DNV.

A version of the bill, called Protecting Europe’s Energy Security Clarification Act (PEESCA), will likely be passed because it would be included in the fiscal year 2021 National Defense Authorization Act (NDAA), consultancy ClearView Energy Partners LLC said earlier this month.

“The NDAA funds U.S. forces, effectively making its passage a question of ‘when,’ not ‘if,’” ClearView said in a note to clients, adding that it does not expect NDAA to be approved before the fourth quarter.

The Russian plan needed Danish regulatory approval because one of the two ships Russia wants to use would need to be anchored in the Baltic Sea. Denmark typically requires pipe-laying in its territorial waters to be conducted with ships that have advanced positioning systems and thus don’t have to be anchored, because of the threat of unexploded mines from World War II. The Danish Energy Agency this week approved NS2’s request to use one older ship that does not have the advanced positioning system and construction could be completed in about three months, Tudor, Pickering, Holt & Co. (TPH) said this week.

2021 Completion Likely

TPH analysts also expect NS2 to be completed by next year despite the proposed additional sanctions.

“We’re currently modeling Russian pipe flows to Europe increasing by 1.5 Bcf/d in 2021, with European storage levels again filling to capacity,” the analysts said.

NS2 spokesperson Irina Vasilyeva declined to say when the project will be completed, telling NGI this week that “we are still considering different options and will inform about our plans in due time.”

Anna Mikulska, a nonresident fellow for the Center of Energy Studies at Rice University’s Baker Institute for Public Policy, agreed with the analysts that NS2 would ultimately be built, but she declined to predict when it might be completed because the tougher sanctions could lead to significant delays.

“At this moment I think it’s not only a gas project, it becomes a matter of honor to make sure it’s built,” said Mikulska, an expert on the European energy market.

“I think Putin will do everything he can to build it,” she added. “That being said, if the [tougher] U.S. sanctions are put on a lot of the participating companies, that will create an issue…I wouldn’t be surprised if it’s finished, but definitely it will be more delayed and definitely it will be more costly.”

Another major hurdle the project still needs to overcome is a European Union (EU) requirement for new pipelines to provide third-party access and to unbundle transportation from supply. NS2 has applied for a German waiver from the regulation, as the project is partly premised on the prospect of increasing energy security in Europe by reducing Russian gas transit through Ukraine, which in the past has been interfered with by the siphoning of supplies and by Ukrainian desires for higher transit fees.

The EU and German courts have so far not supported the waiver request. As a result, the project could be delayed if Russia needs to partner with other entities to unbundle transportation and supply and provide third-party access, Mikulska said.

She was surprised at the proposed tougher U.S. sanctions in light of the EU stance. She said she does not believe that U.S. legislators are solely motivated by a desire to help the financial prospects of U.S. LNG developers, as the U.S. government cannot control where American LNG would go or from where Europe would import it. But she acknowledged that even if Europe imports more LNG from Qatar and Russia, it could create more opportunities for U.S. LNG in other parts of the world.

NS2 would run roughly along the path of the original 5.3 Bcf/d Nord Stream line from Germany to Russia, doubling capacity through the Baltic Sea and reducing reliance on Ukrainian transit.

After it was evident that NS2 would be significantly delayed by the first round of U.S. sanctions, Russia and Ukraine last winter agreed on a new transit deal for about 6.3 Bcf/d in 2020 that would step down to about 3.9 Bcf/d in 2021-24.

“If NS2 is completed by year end, the 2.4 Bcf/d step down in Ukrainian volumes becomes a moot point, as the new conduit would backfill the loss and provide space for Russia to increase flows by an incremental 2.9 Bcf/d,” TPH said.

Impact on U.S. LNG exports

An additional 5.3 Bcf/d of low-cost Russian gas from NS2 would “surely overwhelm the European market,” McLean said, adding that the new volumes would likely displace existing sources of supply.

Although Germany does not have LNG import facilities, gas flow to Germany from NS2 could still curb European LNG imports because of “knock-on effects,” McLean said.

Germany has more than 770 Bcf of storage capacity, ranking it only behind Ukraine in European gas storage capacity, he added. Ukraine’s storage capacity is significantly larger at 1.1 Tcf.

”Excess supply from Russia being absorbed by storage in Germany would significantly hamper the ability for Europe to absorb excess LNG cargoes, predominantly from the U.S., as it has over the past two years,” McLean said.

The United States must compete with other LNG suppliers to Europe such as Russia and Qatar. The United States briefly became the top European supplier earlier this year, but Qatar has re-emerged as the top supplier and does not plan to slow deliveries despite high storage volumes, he said.

“European storage is already in a precarious position requiring sustained cuts to U.S. LNG to avoid reaching capacity,” McLean added.

Germany imports more than 90% of its gas supply, with most of those imports coming from Russia, followed by Norway and the Netherlands, he said.

“With Europe no longer able to serve as a sink for excess LNG, attention will once again turn to Asia where a resurgence in gas demand would be key for U.S. LNG producers,” McLean said.

Pipeline imports from existing sources, including Russian gas from other sources, would likely be among the first supplies to be displaced. In addition to reducing Ukrainian flows, Russia could also decrease flows through the 3.2 Bcf/d Yamal pipeline that traverses Poland, especially after Poland recently levied a fine against Russian state-controlled gas company Gazprom for not cooperating in an anti-monopoly investigation, McLean said.

With low European gas prices making U.S. LNG exports to Europe a money-losing proposition compared with simply paying liquefaction fees of $2.25-$3/MMBtu to not take LNG, feed gas to the six U.S. LNG export plants has significantly dropped this year, consultancy RBN Energy LLC said Thursday.

“Combined feed gas deliveries to the facilities hit a single-day peak of 9.5 Bcf/d in late January and averaged 8.6 Bcf/d that month and through the first quarter,” RBN analyst Sheetal Nasta said. She added that in May feed gas volumes declined to 6.4 Bcf/d, or 67% of terminal capacity, as operators by then likely had been notified of cancellations for June liftings, particularly at Cheniere Energy Inc.’s Sabine Pass and Corpus Christi terminals.

“In June, all six facilities together consumed only 3.9 Bcf/d on average, representing little more than 40% utilization, and in July to date, they’ve slipped still further to just 3.2 Bcf/d, down about 2 Bcf/d compared with this time last year,” Nasta said.

Germany and the EU could push back against the proposed tougher sanctions as the United States has been viewed as meddling in their affairs, Mikulska told NGI. Countries such as Poland and Lithuania may support the tougher sanctions because they have historically suffered through their heavy reliance on Russian gas, she said. Poland and Lithuania both import U.S. LNG for their domestic needs, with the goal of distributing gas regionally.

NS2 spokesperson Vasilyeva said the project would improve European energy security.

“The long-term trends of the European market remain unchanged: the EU’s own gas production is expected to halve in the next fifteen years,” she said. “For example, the giant Groningen field in the Netherlands, which produced 54 billion cubic meters (Bcm) in 2013, will close in 2022. At the same time, European gas demand has been growing by 3% a year since 2014.”

NS2 predicts Europe will have an import gap of up to 120 Bcm/year by the mid-2030s.

“This gap needs to be filled by LNG and piped gas from Russia through both existing and new infrastructure,” Vasilyeva said. “Fair competition between different gas suppliers and infrastructure is a necessary condition of a functioning market — and the intention of the European regulator.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |