Growing requirements for industrial chemistry to improve natural gas and oil pipeline flows and drilling results lifted second quarter results for CES Energy Solutions Corp., a barometer of activity in Canada and the United States. The Calgary-based company said “the recovery in global energy demand, combined with several years of lower investment in the upstream…

Recession

Articles from Recession

Contraction Possible for Texas Upstream as Natural Gas Prices Fall, Says Top Economist

The upstream natural gas and oil industry in Texas is at risk of slowing in part as natural gas prices have plunged by more than 160% year/year, according to the Texas Alliance of Energy Producers (TAEP). NGI’s spot natural gas price at the Henry Hub was $2.090/MMBtu at the start of April, down more than…

Oilfield Services Employment Hits Highest Level Since Onset of Pandemic

Employment in the U.S. oilfield services and equipment sector (OFS) increased by 2,907 jobs in March and reached its highest level in three years, according to an analysis of federal data by the Energy Workforce & Technology Council. Total OFS jobs climbed to 656,368 last month, a high mark since the onset of the coronavirus…

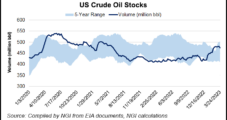

Domestic Crude Production Holds Strong, Prices Recover Despite Banking Crisis

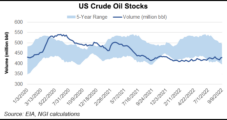

U.S. exploration and production (E&P) firms last week approached the pandemic-era peak oil output level as catalysts for global demand gather and benchmark crude prices recover from fears imposed by financial system upheaval. E&Ps churned out 12.2 million b/d for the week ended March 24, according to the U.S. Energy Information Administration’s (EIA) Weekly Petroleum…

U.S. Oil Production Holds Steady Even As Near-Term Demand Slips Further

Domestic crude production matched the pandemic-era peak, while demand last week declined and extended a trend early in 2023. The U.S. Energy Information Administration (EIA) said Wednesday output for the period ended Jan. 20 clocked in at 12.2 million b/d – matching the high mark of the past two years and on par with the…

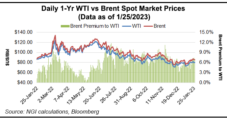

Oil Prices Slide Amid Signs of Weaker Domestic, Global Demand in 2023

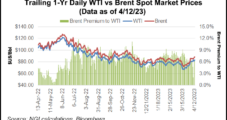

U.S. and global crude prices opened the New Year mired in a slump, led lower by uneven domestic demand and hints of global sluggishness amid intensifying expectations of recession. After dropping Tuesday, West Texas Intermediate (WTI) prices in the United States slid below $74/bbl in intraday trading Wednesday, down more than 4%. Brent crude, the…

Domestic Crude Production Flat as Demand Dips, Global Economic Headwinds Gather

U.S. oil production held steady last week, just shy of the pandemic-era high, even as demand slowed amid warnings of economic headwinds. The Energy Information Administration (EIA) said Wednesday that output for the week ended Nov. 11 was on par with the previous week at 12.1 million b/d. That kept production levels within 100,000 b/d…

Specter of Recession Looms Large Over Global Natural Gas, Oil Markets

Threats of recession in the United States and across Europe are gathering force amid festering inflation and rapidly rising interest rates, developments that already tapered oil consumption and could impact commercial and industrial natural gas demand. The latest indicator: The U.S. Labor Department on Friday reported the job market remains tight but hiring is slowing.…

Domestic Crude Production Falls as Recession Threats Intensify, Prices Pull Back

U.S. oil output declined last week as prices descended and concerns mounted about global recession and geopolitical tumult tied to Russia’s invasion of Ukraine. Production for the week ended Sept. 23 declined by 100,000 b/d to 12.0 million b/d, the U.S. Energy Information Administration (EIA) said Wednesday in its Weekly Petroleum Status Report. The drop…

Recession Fears, Europe Supply Woes Weigh on North American Natural Gas Markets Ahead of Winter

With a U.S. recession appearing more likely in 2023 and uncertainty swirling around natural gas flows from Russia to Europe, natural gas markets may be in for a bumpy ride heading into the shoulder and winter seasons. “Our baseline is that you will see a recession in 2023,” Macquarie Group Ltd.’s David Doyle, head of…