Lilis Energy Inc., which plies its exploration talents across the Permian Basin, on Monday sought voluntary protection under Chapter 11 to reduce debt. The filing came one day after onshore giant Chesapeake Energy Corp. filed for voluntary bankruptcy. Fort Worth, TX-based Lilis filed petitions in U.S. Bankruptcy Court for the Southern District of Texas, Houston…

Tag / Permian Basin

SubscribePermian Basin

Articles from Permian Basin

Finally Toppled by Debt, Chesapeake in Bankruptcy

Chesapeake Energy Corp., once a symbol of the American natural gas industry’s revival and a disruptive leader that helped spark the nation’s unconventional boom, filed for Chapter 11 protection on Sunday to wipe out $7 billion of debt. The move follows months of speculation and years of cost-cutting initiatives at the Oklahoma City-based independent, which…

Oxy Eyeing $6-9B in Oil, Gas Impairments on Covid-19, Depressed Oil Prices

Occidental Petroleum Corp., which made a $57 billion bet last year to take over Anadarko Petroleum Corp. in part to secure its Permian Basin position, said Thursday it expects to write down the value of its oil and gas assets during the second quarter by $6-9 billion.The Houston-based independent, better known as Oxy, in March…

North America Takes Biggest Global Hit as Upstream Valuation Slumps $1.6T on Oil Price Crash

The oil price debacle, brought about in part by the demand-crushing pandemic, has wiped an estimated $1.6 trillion from the valuation of the global upstream industry, with North American losses leading the way, a new analysis by Wood Mackenzie has found. Global upstream development spend overall this year has been knocked down by 30% from…

Producer Deals for U.S. LNG Said Unlikely Amid Covid-19

The Covid-19 pandemic has made it difficult for U.S. liquefied natural gas (LNG) developers to sign additional long-term natural gas supply deals with producers to help fund new liquefaction capacity, an industry analyst said. Cheniere Energy Inc. signed two long-term deals last year with Permian Basin producers to buy natural gas at prices linked to…

Dramatically Warmer Weather Forecasts ‘Final Nail in the Coffin’ for Natural Gas

A major shift in weekend weather forecasts that may solidify this winter as one of the warmest on record sent Nymex natural gas futures plunging to fresh lows on Monday. The March Nymex contract tumbled 9.2 cents to settle at $1.766/MMBtu. April fell 8.8 cents to $1.804.

Laredo Beats 2019 Oil, Gas Guidance in Permian on Efficiencies, Wider Spacing

Permian Basin independent Laredo Petroleum Inc. exceeded oil and natural gas guidance for 2019, claiming a 19% increase year/year, with total proved reserves climbing by 23%.

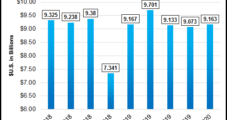

Kinder Morgan Accelerating Plans to Tackle Permian Natural Gas Bottleneck

Kinder Morgan Inc. (KMI) management said late Wednesday it would pump $2.4 billion into growth projects this year, up $200 million from the previous forecast, as it lays the groundwork to debottleneck the juggernaut that is the Permian Basin, where oil and associated natural gas production is booming.