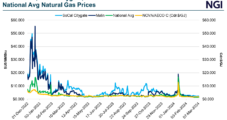

Canadian natural gas production and storage are both elevated heading toward shoulder season – much like in the United States – and bearish pressure on prices persists. There are hints that exploration and production (E&P) companies may pull back, following the lead of their Lower 48 brethren and creating the potential for supply/demand balance this…

Paramount

Articles from Paramount

Apache Exits Canada in Favor of Permian Basin, Overseas Assets

Apache Corp. completed its exit from Canada on Thursday, announcing it would sell its Apache Canada Ltd. subsidiary to Calgary-based Paramount Resources Ltd. in a deal that signifies a broader exodus of foreign companies from the country’s energy sector.

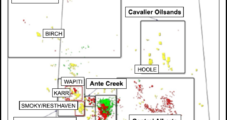

Seven Generations Boosting Montney Shale NatGas Focus in C$1.9B Deal With Paramount

Calgary-based Seven Generations Ltd. (7G) on Wednesday struck a C$1.9 billion ($1.47 billion) deal to expand its natural gas opportunities in the Montney Shale in a transaction that also would bring aboard cross-town rival Paramount Resources Ltd. as a 10% stakeholder.

Pembina, Paramount Agree to Processing, Capital Agreement in Montney Shale

Pembina Pipeline Corp. will acquire 250 MMcf/d of sour gas processing capacity and associated infrastructure in the Montney Shale region of Alberta from Paramount Resources Ltd., and the two companies also agreed to a 20-year midstream services agreement, in a cash and capital commitment deal valued at C$591 million (US$451.7 million).

Industry Briefs

Dominion has closed the sale of its Canadian natural gas and oil exploration and production (E&P) operations to Canadian-based Paramount Energy Trust and Baytex Energy Trust. The Canadian operations were sold to the trusts in May (see NGI, June 4). The closing price was US$624 million, based on currency exchange rates on Monday. At the end of 2006, the Western Canada operations included 267 Bcfe of proved natural gas and oil reserves, with average production of 60 MMcfe/d. Dominion is in the process of selling almost all of its E&P operations as it refocuses on the power generation and energy distribution, transmission, storage and retail businesses. In early June, Dominion made a deal to sell nearly all of its U.S. onshore E&P properties in a two-way transaction with Loews Corp. and XTO Energy Corp. for $6.5 billion (see NGI, June 11). In late April, the company sold its offshore E&P business to a subsidiary of Italy’s Eni SpA for $4.76 billion. Only Dominion’s Midcontinent properties remain to be sold, and that process is expected to begin in July and be completed by the end of the year. Dominion plans to retain its Appalachian Basin operations, which include 1 Tcfe of proved reserves. The operations are considered lower-risk and a strategic fit with the company’s gas gathering, pipeline and storage systems.

Dominion Completes Canadian E&P Sale

Dominion has closed the sale of its Canadian natural gas and oil exploration and production (E&P) operations to Canadian-based Paramount Energy Trust and Baytex Energy Trust.

Energy Execs Say Declining Reserves ‘Irreversible’

Government support to develop renewable energy sources is paramount to overcome an irreversible decline in oil and natural gas reserves, according to a survey of energy executives by KPMG LLP.

Survey: Energy Execs Say Declining Reserves ‘Irreversible’

Government support to develop renewable energy sources is paramount to overcome an irreversible decline in oil and natural gas reserves, according to a survey of energy executives by KPMG LLP.