A pair of bills designed to tap “affordable natural gas in the MarcellusShale” and bring gas service to more consumers in Pennsylvania has been approved by the state’s Senate and moved to the House of Representatives for consideration.

Means

Articles from Means

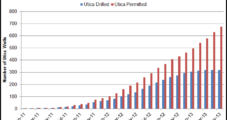

Analyst Says Ohio Figures Misleading, Predicts Surge in Gas, NGLs

Although investors were disappointed by the Utica Shale production figures released last week by the Ohio Department of Natural Resources (ODNR), a surge in production should be at hand in the play as infrastructure comes online, according to an analysis from RBN Energy LLC.

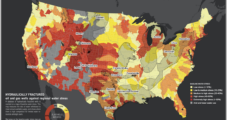

Find Fracking Solutions in ‘Water-Stressed’ U.S. Regions, Says Ceres

Energy industry efforts to reduce the amount of water used in hydraulic fracturing (fracking) through recycling and other means have to be stepped up if unconventional resources are to grow as projected, according to Ceres, which runs an influential institutional investor coalition.

FERC Approves Two Marcellus Pipeline Expansions

FERC on Friday issued certificates for two Dominion Transmission Inc. (DTI) Marcellus Shale-related projects in Pennsylvania and New York: the Tioga Area Expansion Project and the Sabinsville-to-Morrisville Project.

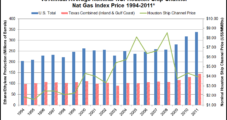

Economist Cites Texas NGLs for Petchem Boom

Everyone knows “Texas tea” means oil, but in the Lone Star state, ethylene produced from booming supplies of natural gas liquids (NGL) might come to be known as “Texas sweetened tea” for the profitability it’s bringing to the Gulf Coast petrochemical industry.

Encana Selling Chunks of Liquids Leaseholds to Aid Development

Encana Corp. plans to continue to keep its eye on the “highest-return plays” in North America, which for the near term means more liquids and oil development and no natural gas drilling, CEO Randy Eresman said Wednesday.

Most Onshore Oil Plays Economic at $65 WTI, Says Raymond James

The Permian Basin, as well as the Eagle Ford and Bakken shales, which today are considered the “big three” drivers of U.S. oil production, would remain economic at current costs if West Texas Intermediate (WTI) crude oil prices were to fall to $65/bbl, according to an analysis by Raymond James & Associates Inc. In fact, 13 of 20 onshore oil plays evaluated would breakeven below $65 using current costs, said analysts.

FERC Certificate in Hand, NJ-NY Expansion Targets 4Q2013 Start-Up

Spectra Energy’s long-under-attack New Jersey-New York Expansion on Monday received unanimous approval from FERC, which means firm natural gas transportation service into Manhattan could be operational sometime during the fourth quarter of 2013.

Oilfield Services Business Next Financial Windfall for Chesapeake?

Chesapeake Energy Corp., which has used a variety of savvy financial means to raise money for exploring and developing its vast unconventional portfolio in the United States, is preparing to launch its diverse onshore oilfield services unit through an initial public offering (IPO), a separate company that would continue to be closely tied to its main customer, the Oklahoma City-based producer.

MarkWest: Utica More Competitive Than Marcellus

The early days of the Utica Shale are proving to be far more competitive than the early days of its cousin, the Marcellus Shale, the head of a major midstream player told NGI’s Shale Daily.