Spot natural gas for Friday delivery continued to work lower in Thursday’s trading as the market was pressured by myriad forces. New England recorded the biggest drops as a warming trend was expected to bring Boston to above normal temperatures by the weekend, and the West Coast softened as the Pacific Northwest hydro situation improved.

High

Articles from High

Tesoro Starts Open Season on Bakken Expansion

A unit of San Antonio-based refiner/transporter Tesoro Corp. started an open season Tuesday for its proposed crude oil processing terminal and pipeline expansion in the Bakken Shale play in North Dakota. The first of the expansions is to be operable by July 1.

Physical, Futures, Waltz Lower as Storage Builds, Karen Threatens

Natural gas prices for Friday delivery fell a nickel on average Thursday as most traders elected to get their deals done ahead of a government storage report that was expected to have bearish overtones.

Broad Physical Advance Continues, Yet Futures Slip

Natural gas for Thursday delivery rose 6 cents on average nationally on Wednesday as short-term weather forecasts continued to prove unrelenting in their call for unseasonably warm temperatures. Only a handful of points were in the loss column and many points were up a dime or more. Great Lakes locations were up about 4 cents and Midcontinent locations gained a couple of pennies to a little more than a nickel.

Marcellus, Midcontinent No Match For Broad Cash Weakness; Futures Flounder

Physical natural gas prices for Tuesday delivery overall fell a penny on average Monday as most points fluctuated within a few cents of unchanged. Modest strength in the Midcontinent and double-digit gains at certain Marcellus points were unable to offset broad weakness elsewhere. At the close of trading October futures had retreated 8.5 cents to $3.602 and November was off 8.6 cents to $3.677. November crude oil dropped $1.16 to $103.59/bbl.

Cash and Futures Tread Water Before and After Storage Data

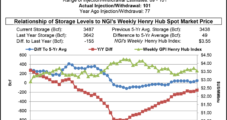

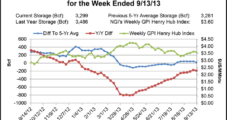

Friday deliveries of physical natural gas on average were unchanged in Thursday’s trading as most traders elected to get their deals done ahead of what can often turn into a market broadside once the Energy Information Administration (EIA) releases storage figures at 10:30 a.m. EDT.

Surging Cash Outdoes October Futures, Which Notch Eight-Week High

Natural gas prices for delivery Wednesday added an average 10 cents in Tuesday’s trading. Strong pricing in the East and Great Lakes as well as a firm screen were able to offset a mixed Northeast and free-falling quotes in the Marcellus, which ratcheted below $1 and in at least two cases, recorded new all-time lows.

Rockies Force Majeure, Firm California Lead Gains; Futures Rise

Tuesday deliveries of physical natural gas overall on average rose 11 cents in Monday’s trading. A strong screen as well as warm temperatures kept California points at double digit gains and in the Northeast capacity constraints kept New England locations solidly in the black. At the close of futures trading October had added 6.1 cents to $3.738 and November was up by 5.9 cents to $3.814. October crude oil fell $1.62 to $106.59/bbl.

Weak Northeast and East Spark Broad Cash Decline; Futures Advance

Physical natural gas prices for Friday delivery fell an average 9 cents in Thursday’s trading. Physical traders will typically try to get their deals done before the release of government inventory figures, but physical prices had their own volatility to deal with in the form of sharp changes in the near-term weather picture.

National Oilwell Varco Sees Record Backlog as Equipment Orders Double

Backlog for capital equipment orders in National Oilwell Varco’s (NOV) rig technology segment was $13.95 billion at the end of 2Q2013, a record high, 8% higher than at the end of 1Q2013 and 24% higher than at the end of 2Q2012, the company said Tuesday.