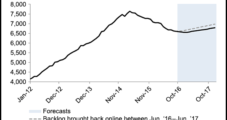

Energy stocks were rising with oil prices after countries closely aligned with the Saudi Arabian-led Organization of the Petroleum Exporting Countries (OPEC), including Russia, signaled on Saturday they would reduce their production for at least six months beginning Jan. 1. However, the U.S. response may already be underway, as rigs rise in the onshore.

Goldman

Articles from Goldman

Baker Hughes Launches North American Onshore Pressure Pumper with CSL, Goldman Assist

Baker Hughes Inc. late Tuesday said it was teaming up with a Goldman Sachs unit and a private equity firm to create a pure-play North American land pressure pumping company under the BJ Services Co. brand.

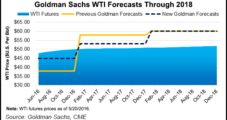

Goldman Credits ‘Shale Productivity Scenario’ in Higher U.S. Oil Price Forecast

U.S. oil prices should hold between $50-60/bbl through 2020 on improved unconventional productivity and increased overseas supplies, Goldman Sachs is forecasting.

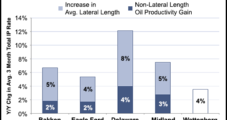

Plethora of Productive Oil Wells in U.S. Onshore, Says Goldman

Productivity gains made in U.S. unconventional oilfields were solid last year and now are melding into more quality driven gains, improved by optimizing targets and increasing fractures, Goldman Sachs & Co. said Wednesday.

Plethora of Productive Oil Wells in U.S. Onshore, Says Goldman

Productivity gains made in U.S. unconventional oilfields were solid last year and now are melding into more quality driven gains, improved by optimizing targets and increasing fractures, Goldman Sachs & Co. said Wednesday.

NGI The Weekly Gas Market Report

Goldman Cuts U.S. NatGas Price Forecast Again

Goldman Sachs analysts on Wednesday reduced their outlook for domestic natural gas prices for the second time since late July, as output is proving to be much stronger than anticipated and is seen eclipsing demand growth by a wide margin.

U.S. NatGas Price Outlook Lowered By One Analyst, Another Says Shale Output Decline Visible By 4Q2015

Goldman Sachs analysts on Monday cut their forecast for 3Q2015 U.S. natural gas prices by 55 cents and dropped 4Q2015 expectations by 50 cents.

Goldman Cuts U.S. NatGas Price Outlook, Sees Need for Coal-to-Gas Switching

Goldman Sachs analysts on Monday cut their forecast for 3Q2015 U.S. natural gas prices by 55 cents and dropped 4Q2015 expectations by 50 cents.

U.S. Shale Oil, OPEC Fighting for Market Share, Says Goldman

U.S. shale oil breakevens have fallen by $20/bbl in one year and may decline more on field efficiencies, resulting in a duel with OPEC for market share, while the rest of the industry fights for relevance, according to Goldman Sachs.

U.S. Shale Oil, OPEC Fighting For Market Share, Says Goldman

U.S. shale oil breakevens have fallen by $20/bbl in one year and may decline more on field efficiencies, resulting in a duel with OPEC for market share…