Global liquefied natural gas (LNG) supplies are expected to rise by 43 million metric tons/year (mmty) this summer with the United States in the lead, according to Goldman Sachs Group Inc. The investment bank’s analysts projected domestic LNG exports could grow by 35 mmty this summer from 2020 levels, as flows normalize. By comparison, leading…

Goldman

Articles from Goldman

NGI The Weekly Gas Market Report

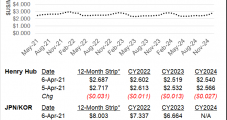

U.S. Natural Gas Seen Moving Above $3 as Operators Shut-in Oil Wells

Domestic natural gas operators are beginning to regain control of the market and could see prices move “sustainably” above $3.00/Mcf as the U.S. oil supply declines, according to analysts.

NGI The Weekly Gas Market Report

U.S. Natural Gas Seen Moving Above $3 as Operators Shut-in Oil Wells

Domestic natural gas operators are beginning to regain control of the market and could see prices move “sustainably” above $3.00/Mcf as the U.S. oil supply declines, according to analysts.

NGI The Weekly Gas Market Report

U.S. Natural Gas Price Forecasts Evolving as Coronavirus, Oil Price Slump Roil Markets

Natural gas prices are forecast to be pressured into 2021, with potential relief as associated output falls on reduced oil drilling and more coal-to-gas switching, according to analysts.

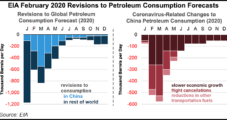

Global Fears Spread to Domestic Markets as Coronavirus Hammers WTI, Stocks

The coronavirus reasserted its influence over the Lower 48 oil price outlook Monday as reports of new cases of the disease outside of China stoked fears both at home and abroad over the outbreak’s impact on global economic activity.

NGI The Weekly Gas Market Report

Oil Prices, Stocks Plunge as Fear Spreads Alongside New Coronavirus Cases

Oil futures and stock markets fell sharply Monday as reports of new cases of the coronavirus outside of China raised fears over the potential impacts of the outbreak on global economic activity.

Insurance, Financial Support Dwindling for Oilsands, Coal and Arctic Drilling

Insurance giant The Hartford this month instituted a policy to no longer insure or invest in companies that generate more than one-quarter of their revenues or energy production from oilsands or coal.

Natural Gas Downside Seen as Saudi Attack Serves Up Stark Reminder of Oil’s Geopolitical Risks

A major attack on Saudi Arabia’s oil infrastructure over the weekend rocked crude prices, sounding an alarm that markets may have previously discounted the extent of geopolitical risks to supply, according to analysts.

Natural Gas, NGL Prices Subdued Through 2021, Says Goldman

Goldman Sachs on Friday reduced its forecast for natural gas and liquids prices for 2020-2021 because of the unrelenting onslaught in Lower 48 supplies and, barring a cold winter, lower demand.

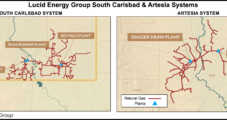

Riverstone, Goldman Paying $1.6B for Permian-Focused Lucid II Gas Processing Assets

Riverstone Holdings LLC and Goldman Sachs Group Inc. are flexing their financial muscle in the Permian Basin, agreeing to pay $1.6 billion for a portfolio of natural gas processing properties in the Delaware sub-basin of New Mexico.