BP plc clinched a 20-year contract this week worth close to $20 billion to supply China with liquefied natural gas (LNG), including from a proposed export plant in Freeport, TX, Group CEO Bob Dudley said Tuesday. A similar agreement between Royal Dutch Shell plc and China also is said to be nearing completion.

china

Articles from china

U.S. ‘Beyond the Golden Age’ for Natural Gas, with China Coming on Strong

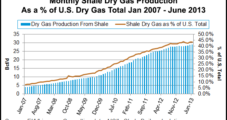

The United States is “beyond the golden age” for natural gas, and North America’s gas surfeit now is in “full swing,” the International Energy Agency (IEA) said Tuesday. China, meanwhile, is entering the golden age, while Mexico is a strong candidate in the future.

Sinopec Stepping Up China’s Shale Game; 353 Bcf by 2017

China Petroleum and Chemical Corp. (Sinopec) said Monday it has "made significant breakthroughs" in shale gas exploration…

Statoil Sees ‘Sufficient Demand’ Worldwide for Shale-Driven Natural Gas

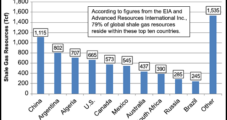

North America should find plenty of outlets for its copious natural gas reserves, but some questions need to be clarified soon, such as whether to allow manufacturers to dictate how much supply remains onshore, or whether the free market fuels an export revolution, according to Statoil ASA’s chief economist.

U.S. Gas Volatility, Higher Prices Coming Despite Shales, JP Morgan Exec Says

As part of a “U.S. Century” fueled by global shale gas dominance, domestic natural gas prices will rise and volatility will return in the next three to five years, a JP Morgan executive told participants at the LDC Gas Forum Mid-Continent in Chicago Tuesday. Colin Fenton did add the caveat that the gas volatility will not be the same as global oil prices, however.

Clean Energy Unit Inks $167M CNG Equipment Deal in China

A subsidiary of Newport Beach, CA-based Clean Energy Fuels Corp. said Thursday it has signed a three-year, $167 million deal with a Chinese-based natural gas/propane pipeline company to provide up to 416 compressed natural gas (CNG) compressors and related technologies to support development of more than 300 CNG fueling stations throughout China. Growth of CNG in China is expected to outpace U.S. expansion, Clean Energy executives said.

BC LNG Project Proposed for Wealthy Area

The number seven is a symbol of fortune and intelligence in China and that luck is being pressed by the Asian-owned seventh proposal for liquefied natural gas (LNG) exports to the Orient from the Pacific Coast of British Columbia (BC).

EIA Says China Becoming World’s Largest Net Oil Importer

The U.S. Energy Information Administration (EIA) said China is projected to pass the United States and become the world’s largest net importer of oil — on a monthly basis by October, and on an annual basis by 2014.

EIA Says China Will Be World’s Largest Net Oil Importer This Fall

The U.S. Energy Information Administration (EIA) said China is projected to pass the United States and become the world’s largest net importer of oil on a monthly basis by October, and on an annual basis by 2014.

BMO ‘More Bullish’ on Natural Gas, Less on Crude Prices

Slowing economic growth in China pushed nearly all equity markets south last week, with energy caught in a sell-off of “everything commodity-related,” but a flat natural gas rig count, combined with an eroding storage overhang, provide opportunities for U.S. gas prices and related operators to trade higher this year, said BMO Capital Markets Dan McSpirit and Phillip Jungwirth.