Markets | NGI All News Access | NGI The Weekly Gas Market Report

U.S. ‘Beyond the Golden Age’ for Natural Gas, with China Coming on Strong

The United States is “beyond the golden age” for natural gas, and North America’s gas surfeit now is in “full swing,” the International Energy Agency (IEA) said Tuesday. China, meanwhile, is entering the golden age, while Mexico is a strong candidate in the future.

The international energy watchdog issued its 2014 Medium-Term Gas Market Report, with Executive Director Maria van der Hoeven joined by Laszlo Varro, who heads the gas, coal and power markets.

Three years ago, IEA proclaimed that the world was entering a golden age for gas based on growing supplies from unconventional plays, environmental concerns about coal-fired power plant emissions and a lack of nuclear energy growth (see Daily GPI, June 7, 2011). That epoch has been “firmly established in North America” and is quickly expanding to China and beyond.

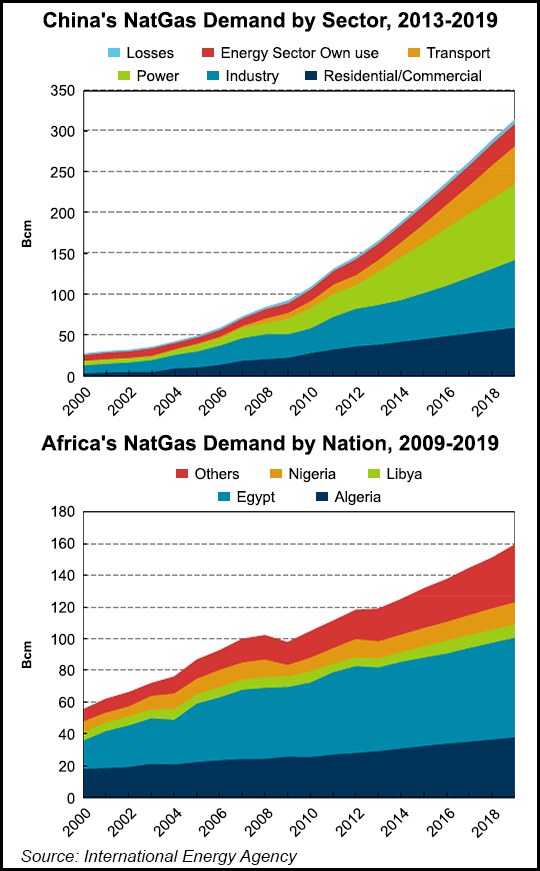

Global gas demand to 2019 is seen rising by 2.2%, compared with a 2.4% rate projected in 2013’s analysis. Global gas demand last year increased only 1.2% from 2012 to about 3,500 bcm [billion cubic meters] on a slowing economy, competition from coal/renewables and supply constraints in developing regions, according to IEA. Gas growth lagged that of oil (1.4%), coal (3-4%) and renewables (less than 4%). World gas demand is expected to total 3,980 bcm by 2019.

What’s compensating for a relative stagnant growth for gas demand is a strengthening China market, where demand is expected to almost double in the next five years to more than 300 bcm, said van der Hoeven.

China’s golden age of gas “has arrived,” she said during a webcast. She noted that China recently secured the biggest gas deal in history by agreeing to buy $400 billion of Russia’s natural gas over 30 years (see Daily GPI, May 23; May 21). “The recently signed supply deal with Russia is actually only a relatively small part of the story, and one that will take some time to come onstream.

“No, the main story here is domestic demand that will nearly double over the next five years…driven by pollution concerns and more generally by economic growth…The single biggest new supply source in China is domestic production, which is set to grow from 117 bcm in 2013 to 193 bcm in 2019, a rise of 65%. That’s enough to meet half of China’s demand growth over the period.” This growth “is a major shift, yet China will clearly remain a growing importer.”

Liquefied natural gas (LNG) will meet much of the new demand in China, with new pipelines also playing a big role. “We also expect that strong domestic supply, expanding infrastructure links, domestically and with Central Asia, and, further out, Russian piped gas, will again change the dynamics of the globally traded market for LNG,” van der Hoeven said.

North America’s golden gas age is in “full swing” and continuing to strengthen, said Varro.

“Our current projections are much more optimistic” than they were three years ago. “The United States is beyond the golden age…but this golden age is now arriving in China…and could begin in other resource-rich countries as well, he said, but it depends on whether the domestic unconventional resources can be developed and the prices in the gas markets.

“One good candidate is Mexico,” Varro said, noting the recent reforms initiated by the government (see Daily GPI, May 2). “The reforms are very, very exciting and have the potential to turn Mexico into a country that now relies on gas imports into a very large producer with a very important role…Another strong candidate is Argentina, which has a huge share of resources, better than the United States,” but an unfriendly regulatory environment.

“Arguably, Russia has always had the golden age of gas,” he said. “It has limitless resources, but it has been using them very, very inefficiently…” An improving Russian economy should change that scenario, offering it the potential to “emerge as a major gas supplier to the Asia-Pacific as well.”

There are warnings for North America’s optimistic list of LNG export projects now in the queue.

“Recent talk of plentiful LNG being available from the U.S. shale boom is simplistic,” said van der Hoeven. “The necessary export facilities are not yet in place, and we must remember that gas is an expensive fuel to transport and is sold into a global market dominated by current high prices in Asia.

In fact, with currently weak European demand and Russian gas, there is the guarantee of gas supply to Asia as major utilities redirect their LNG from Europe to the East, but this may well change. Big Australian projects will expand supply to Asia, but the race is on to keep up with demand growth there.

“Other LNG projects will predominantly require more than five years to come on stream due to the combination of policy barriers and investment lead times. I’m afraid this is true for most Canadian projects as well.” Canada’s west coast projects obviously have a price advantage over the U.S. Gulf Coast, even if the wider Panama Canal provides a shorter route, Varro said. However, the British Columbia projects still face higher upfront costs because of the mountainous geography and stringent regulations — including hurdles to meet First Nations demands.

Over the period to 2019, North America and Australia are expected to account for 40% of additional gas supply — and most of the international trade expansion.

“Given the abundance of gas in the U.S. domestic market, the recovery of gas production in Canada will be conditional on finding new markets for that gas, either in Asia in the form of LNG, or domestically in the transportation sector,” said van der Hoeven. “One of the key drivers for the massive and rapid expansion of the sector within these economies has been the private sector’s ability to raise capital. In dollar terms, more upstream investment is flowing to North America than to the Middle East and Russia combined.”

Pricing will be key.

“High LNG prices are threatening to crimp demand as many countries are increasingly unwilling, or unable, to afford these supplies — and that could open the door to coal. Looking ahead, unless we see timely investment in new production and LNG facilities and the reversal of the recent cost inflation of LNG, only a very strong climate policy commitment could redirect Asia’s coal investment wave to gas.”

In a shift away from the traditional dominance of state-owned gas suppliers, private sector investment in the LNG trade has taken the lead in Australia, Canada and the United States which is forecast to reach 450 bcm in 2019. Half of the new exports would originate from Australia, while North America would account for around 8% of global trade by 2019.

“We are entering the age of much more efficient natural gas markets, with additional benefits for energy security,” said van der Hoeven, who presented the report at the Conference of Montreal. “While demand growth is driven by the Asia-Pacific region — and especially China — supply growth for the international gas trade is dominated by private investments in LNG in Australia and North America.”

In contrast to the dynamic growth projected in Asia, IEA’s forecast paints a starkly different picture in Europe because of low power demand growth and robust policy support for renewable energy. European gas consumption is not expected to recover to its 2010 peak over the next five years. Moreover, no “meaningful diversification” of European gas supply is forecast through the end of the decade.

Surprisingly, the Middle East also will struggle to achieve its full gas production potential, despite abundant geological resources. Some Middle Eastern countries even may experience gas shortages because of “unrealistically low regulated gas prices that hinder upstream investment and encourage wasteful consumption,” said van der Hoeven.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |