Berkshire Hathaway Inc. Monday agreed to pay Phillips 66 an estimated $1.4 billion with stock it already owns in the operator to acquire a pipeline flow improver business.

Berkshire

Articles from Berkshire

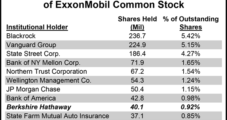

Berkshire Takes $3.45B Stake in ExxonMobil

Berkshire Hathaway Inc. disclosed Thursday that it owns 40.1 million shares of ExxonMobil Corp. currently worth an estimated $3.45 billion.

Industry Briefs

Las Vegas, NV-basedNV Energy Inc.’sshareholders on Wednesday “decidedly” approved the power utility’s acquisition by billionaireWarren Buffett-led Berkshire Hathaway’ MidAmerican EnergyHoldings Co., a $5.59 billion deal announced last May (seeDaily GPI,May 31). Speaking at a special stockholders’ meeting called for the vote, NV Energy CEOMichael Yackirasaid the transaction is expected to close in the first quarter next year, assuming that all customary closing conditions are met, including approvals from theFederal Energy Regulatory Commissionand theNevada Public Utilities Commission.

Berkshire Hathaway Unit Buying NV Energy

A Berkshire Hathaway Inc. unit agreed Wednesday to buy Las Vegas utility NV Energy Inc. in a deal that values the company at about $5.59 billion with an enterprise value of close to $10 billion.

Constellation to Sell Downstream Gas Trading Operations

With its acquisition by Berkshire Hathaway’s MidAmerican Energy Holdings working its way through the regulatory process and plans to divest itself of its upstream gas assets and international coal and freight businesses already announced, Constellation Energy said Thursday it also intends to sell its Houston-based downstream gas trading operations.

Constellation to Sell Downstream Gas Trading Operations

With its acquisition by Berkshire Hathaway’s MidAmerican Energy Holdings working its way through the regulatory process and plans to divest itself of its upstream gas assets and international coal and freight businesses already announced, Constellation Energy said Thursday it also intends to sell its Houston-based downstream gas trading operations.

Constellation Energy Partners for Sale as Sponsor’s Merger Moves Forward

Two weeks after its sponsor, Constellation Energy Group, fell on hard times and agreed to be acquired by Berkshire Hathaway’s MidAmerican Energy Holdings, Constellation Energy Partners LLC (CEP) has put itself on the “for sale” block.

Constellation Faces Wave of Buyout Lawsuits

Constellation Energy Group is facing a wave of lawsuits from shareholders who are seeking to block the company’s $4.7 billion buyout by Berkshire Hathaway’s MidAmerican Energy Holdings Co. and who claim that Constellation Energy inflated its financial results and intentionally mislead investors.

MidAmerican-Led Group Backs Out of Alaska Project, Says State Failed to Accept Terms

A group led by Berkshire Hathaway’s MidAmerican Energy Holdings Co. said Thursday it withdrew its application with the state of Alaska to build a $6.3 billion Alaska portion of a pipeline to deliver North Slope natural gas to the Lower 48 states. The news was the latest blow to the more than 30-year effort to build a long-line Alaska gas transportation system.

Billions of Dollars in Energy Investments Await PUHCA Repeal in Energy Bill

Berkshire Hathaway Inc. (BHI) has $15 billion burning a hole in its pocket to invest in the energy industry and there is $100 billion of other investors’ money “waiting on the sidelines” to see if Congress passes a broad energy bill this year that repeals the Public Utility Holding Company Act (PUHCA), MidAmerican Energy’s David Sokol told a natural gas strategy conference in Denver last week.