Midcontinent pure-play operator Gastar Exploration Inc. said it has closed on the sale of certain noncore assets in Oklahoma to an undisclosed buyer for $74.7 million, and that its borrowing base has been trimmed to $85 million.

Base

Articles from Base

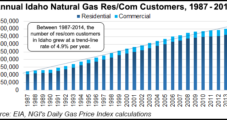

Intermountain Seeks First NatGas Base Rate Hike in 31 Years

North Dakota-based MDU Resources Group’s Boise, ID-based Intermountain Gas Co. has filed its first request to increase base rates since 1985, seeking a $10.2 million (4%) annual increase.

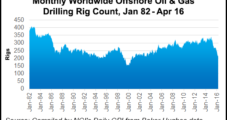

Offshore In Pain as Rowan Execs Take Pay Cut, Hercules Once Again Files For Protection

Top executives of offshore contract driller Rowan Cos. plc have agreed to take a 10% reduction in their base pay for at least one year.

PJM Auction Secures 4,800 MW of New NatGas Generation

The PJM Interconnection, trending toward more natural gas-fired generation, secured 167,004 MW, about 20% more than anticipated, for the 2017-2018 delivery year at a base price that was almost double the year-ago auction.

Shell GTL Technology Converting Gas to Motor Oils

Royal Dutch Shell plc has found another niche for global natural gas, a first-of-its-kind base oil that is the main component of motor oils.

Sanchez Doubling Production With Eagle Ford Acquisition

Houston-based Sanchez Energy Corp. is buying producing acreage in the Eagle Ford Shale for $265 million that will more than double current company-wide production and increase proved reserves by 63%.

PDC Energy Sells Assets to Focus on Utica, Wattenberg Plays

Denver-based PDC Energy Inc. has sold its Piceance and other mostly natural gas Colorado holdings to concentrate its drilling efforts in the Utica Shale in Ohio, along with Weld County’s Wattenberg field in Colorado.

Industry Brief

A recently combined and publicly held exploration and development company, Salt Lake City-based Richfield Oil and Gas Co., announced a purchase in the Graham Reservoir oilfield in Uinta County, WY. Richfield bought a shut-in well in the Wasatch National Forest (Well #16-15) from Frontier Energy for $610,000, including 640 acres of mineral leases. The company said the purchase gives it 100% working interest in a mineral lease in the Graham Reservoir, located approximately 120 miles northeast of Salt Lake City in southeastern Wyoming. The well has been shut in since 2003 and was completed in the Dakota Formation at 15,600 feet. Flow testing and production operations will get underway later in the first quarter. For Richfield, which is the product of the merger of Hewitt Petroleum Inc. and Freedom Oil & Gas Inc. in 2011, the acquisition is part of the process of “methodically building our reserve and production base” through graded acquisitions,” said CEO Douglas Hewitt.

Analysts Predict 10 Bcf/d of North American LNG Exports in 10 Years

A decade from now, North American (Canada, Alaska and Lower 48) exports of liquefied natural gas (LNG) will be about 10 Bcf/d, according to the base case of a new LNG export analysis.

Petrohawk Unit Adds to BHP’s U.S. Shale Woes

BHP Billiton Ltd.’s recent announcement of a $2.8B charge for the diminished value of its dry gas Fayetteville Shale assets (see Shale Daily, Aug. 7) wasn’t the only bad shale-related news to come from the Australian company. Its Petrohawk Energy Corp. unit has been turning in sour numbers as well.