E&P | NGI All News Access | NGI The Weekly Gas Market Report

Offshore In Pain as Rowan Execs Take Pay Cut, Hercules Once Again Files For Protection

Top executives of offshore contract driller Rowan Cos. plc have agreed to take a 10% reduction in their base pay for at least one year.

In a Securities and Exchange Commission Form 8-K filing on Thursday, each of the Houston-based operator’s seven senior executive officers requested a voluntary base salary reduction of 10% effective July 1, which would be in effect at least one year. The board also has agreed to a voluntary 10% reduction in their retainers. The pay cuts would impact stock awards and other benefits that are calculated through salary.

“The reduced base salaries will also be used for purposes of calculating awards and payments under the company’s salary-based compensation and benefit plans,” the filing stated. “Senior executives implemented these pay reductions in light of market conditions in the offshore drilling industry, ongoing cost control efforts, and to show good faith with the company’s shareholders and employees during this steep and sustained downturn in the price of oil.”

Agreeing to a salary reduction were CEO Thomas P. Burke, whose base salary in 2015 was $800,000, and Executive Board Chairman Matt Ralls, who made $700,000 last year. Also agreeing to pay cuts were CFO Stephen Butz, Executive Vice President of Business Development Mark A. Keller, General Counsel Melanie M. Trent, Chief Accounting Officer Dennis Baldwin and Treasurer Darin Gibbins.

Rowan, which began business in 1923, provides high-specification jack-up rigs and ultra-deepwater drillships. At the end of 2015, it had 31 mobile offshore drilling units, including 27 jack-ups and four drillships.

Meanwhile, Houston-based Hercules Offshore Inc. has entered into a restructuring support agreement (RSA) with lenders holding nearly all (99%) of its debt. The agreement seeks to maximize value for the stakeholders through an orderly sale of the assets.

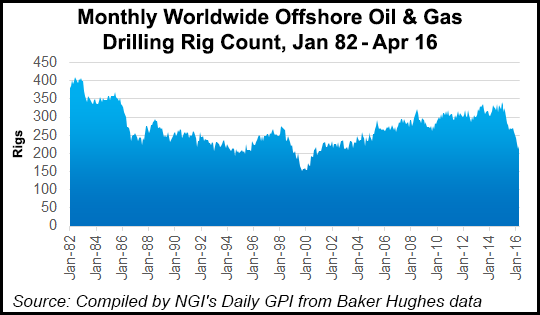

Last August Hercules and 14 affiliates filed for voluntary protection, emerging from bankruptcy last November with a new $450 million senior secured credit facility in place (see Daily GPI, Nov. 9, 2015; Aug. 17, 2015). Activity in the U.S. Gulf of Mexico (GOM) last November was lower “than any time since the early days of the offshore drilling industry,” CEO Jack Rynd said at the time.

Since emerging from bankruptcy, “the ongoing decline in oil prices, the consolidation of its U.S. customer base and the addition of new capacity have negatively impacted dayrates and demand for Hercules’s services,” management said Friday.

In February Hercules, which does most of its work in the shallow waters of the GOM, created a special committee comprised of all the independent members of its board to explore strategic alternatives. The RSA “is the outcome of that process and follows a thorough sale process, which did not yield results that would have been better for stakeholders than what is contemplated by the plan.”

Under the terms of the RSA, Hercules and U.S. subsidiaries are soliciting acceptances/rejections of its pre-packaged Chapter 11 plan and would place all of the company’s unsold assets into a wind-down vehicle to ensure their continued, safe operation until they may be sold. The international subsidiaries are not included as part of the Chapter 11 cases but would be part of the sale process.

If Hercules shareholders vote as a class to accept the plan, they would receive cash recoveries over time, including a payment of $12.5 million once Chapter 11 is completed, as well as cash distributions with the sale of the assets.

As part of the bankruptcy process, Hercules has agreed to transfer the right to acquire its newbuild harsh environment jack-up rig, formerly named Hercules Highlander, to a subsidiary of Maersk Drilling for $196 million. The newbuild already was contracted.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |