FERC has approved a request from Spectra Energy unit Algonquin Gas Transmissions to begin a pre-filing review process for the company’s proposed Algonquin Incremental Market (AIM) Project, a significant step forward for the long-awaited pipeline, which would deliver to the Northeast critically needed gas from Pennsylvania.

Analyst

Articles from Analyst

NatGas Production to Remain Near Current Level This Year, Analyst Says

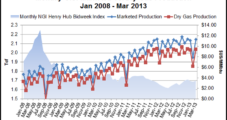

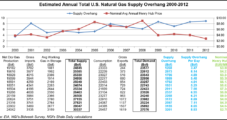

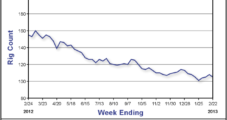

The horizontal natural gas drilling boom drove a long production growth period, but that boom topped out in September 2011, and overall monthly production has remained basically flat since then, analysts at Stephen Smith Energy Associates said in their most recent Monthly Energy Outlook. And while the number of horizontal gas rigs has fallen about 70% from its peak, several effects have worked to maintain the 18-month production plateau, they said.

BP Trumps Forecasts by $1B, Despite Sales

BP plc, which today is a much smaller operator than it was a year ago, last week smashed analyst expectations by about $1 billion on average, boosted by high margin projects and better-than-expected profits from trading.

BP Beats Forecasts by $1B, Despite Sales

BP plc, which today is a much smaller operator than it was a year ago, on Tuesday smashed analyst expectations by about $1 billion on average, boosted by high margin projects and better-than-expected profits from trading.

Shale Market Approaching ‘Guillotine Moment’

The torrent of natural gas production coming out of North America’s shale plays reminds Jim Duncan, chief analyst and commodity market strategist at ConocoPhillips Gas & Power, of the opening lines of “A Tale of Two Cities,” Charles Dickens’ epic novel of the French Revolution.

Shale Market Approaching ‘Guillotine Moment’

The torrent of natural gas production coming out of North America’s shale plays reminds Jim Duncan, chief analyst and commodity market strategist at ConocoPhillips Gas & Power, of the opening lines of “A Tale of Two Cities,” Charles Dickens’ epic novel of the French Revolution.

Goldman Lifts U.S. Natural Gas Price, Rig Forecast

Goldman Sachs on Friday joined two other analyst houses in boosting U.S. natural gas price forecasts, recommending that investors position themselves for “higher prices over the course of 2013.” The gas rig count also is predicted to surpass the 500 mark by the end of the year.

Mississippian Paying Off for SandRidge; Market Wary

SandRidge Energy Inc.’s transition from a natural gas producer to an oil explorer appears to be paying off, with the company’s Mississippian Lime operations experiencing success and its bottom line improving, but the market seems unconvinced.

Williams’ Marcellus Revisions Could Change Infrastructure Plans

The Marcellus Shale’s natural gas volumes are continuing to flow higher, but significant revisions in growth expectations by pipeline giant Williams Partners Ltd. (WPZ) has led one analyst to question whether the “excellent adventure” to establish a major natural gas hub is turning into a “bogus journey.”

Southeastern U.S. Could be Growth Area for Gas Assets

Since its analyst meeting early last year, Sempra Energy senior management has signaled that its newly designated U.S. Gas & Power (USGP) unit was intent on moving away from merchant power assets in the West and deploying more capital in the Southeast to support its gas infrastructure strategy. USGP maintains a regional headquarters in Greenville, SC.