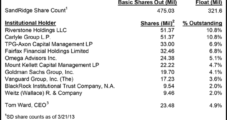

After months of haggling, hedge fund TPG-Axon Capital, which owns 7.3% of outstanding SandRidge Energy Inc. shares, has gained at least a portion of the changes it had urged at the Oklahoma City-based company, and it stands poised to remove CEO Tom Ward or take control of the board of directors.

After

Articles from After

GOM Output Seen Blowing Past U.S. Onshore Growth

Following three straight years of production declines after the Macondo well blowout, this year likely will be the first for growth in the Gulf of Mexico (GOM) since 2009, but it certainly won’t be the last, said Raymond James & Associates Inc.

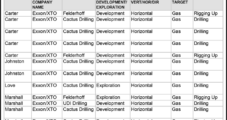

ExxonMobil Builds Woodford War Chest

ExxonMobil Corp.’s quest to remain the biggest operator in the Ardmore Basin’s Woodford Shale remains on track after the super major agreed to pay $147.5 million to buy the bulk of BNK Petroleum Inc.’s leasehold in the Tishomingo Field.

Industry Brief

After more than 17 years of trading for Morgan Stanley, TeamLevine has left the global financial services firm to form the independent brokerage, Powerhouse. Based in Washington, DC, the new company works with clients to protect profit margins and grow their business by designing and implementing hedging strategies, while focusing on price risk management using energy futures and related financial instruments. Powerhouse says its clients represent nearly all sectors of the energy supply chain, from producers to downstream distributors and retailers. Customers include gasoline marketers seeking to protect retail margins, diesel fuel distributors offering fixed and capped prices, and energy users who worry that the latest headline will affect their fuel bill. Powerhouse also serves natural gas marketers and electric utilities with risk from energy price uncertainty. Team Levine members Alan H Levine, Elaine E. Levin, David A. Thompson and Brendan Burke began trading as Powerhouse in January, and the brokerage added its hundredth new account in February. “Reactions from the marketplace have been overwhelmingly positive. As an independent firm, we can be more nimble, and offer more highly tailored services and support to our customers,” said Levin, president of Powerhouse. “This is especially important given recent volatility in gasoline prices.” The Powerhouse team, with 80 years of experience in the energy marketplace, is led by Chairman and CEO Levine, who has expertise in petroleum and natural gas pricing, transportation and supply in world energy markets. Levine was part of the group that initiated the heating oil contract for Nymex in 1977-1978. The company can be contacted at info@powerhouseTL.com or by phone at (202) 333-5380.

Hearing Scheduled for D&L Energy Shutdown Appeal

The Ohio Oil and Gas Commission has scheduled a hearing for D&L Energy Inc.’s motion for stay of the Ohio Department of Natural Resources’ (ODNR) decision to shut the company down after oilfield waste was dumped illegally in late January.

EV Energy Partners Stock Down as Sale of Utica Assets Proves Elusive

Shares of EV Energy Partners LP (EVEP) took a hit Friday after the company announced net losses for the fourth quarter and full-year 2012, and said it could take anywhere from one month to the rest of the year to sell most of its acreage in the eastern Ohio portion of the Utica Shale.

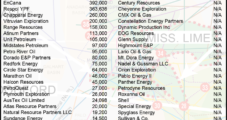

Western Gas Buys Stakes in Marcellus NGL Systems

Western Gas Partners LP is expanding its business in the Marcellus Shale after agreeing to pay $620 million-plus for stakes in two natural gas liquids (NGL) gathering systems in Pennsylvania that have combined throughput of more than 1.2 Bcf/d.

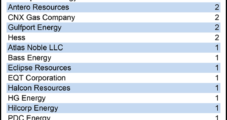

Sinopec Builds Bigger Mississippian Position in JV with Chesapeake

China’s Sinopec International Petroleum Exploration and Production Corp. has added to its considerable leasehold in the Mississippian Lime formation after agreeing to pay Chesapeake Energy Corp. $1.02 billion in cash for half of its 850,000 net acres.

Ohio Protesters Arrested After Storming Well Water Processing Company

Opposition to hydraulic fracturing (fracking) flared up in Ohio last week after about 100 protestors stormed an office and a water handling facility in one town, while an oil and gas oilfield service company threatened to take its business elsewhere if another town were to oppose drilling.

San Bruno Explosion Still Impacting PG&E

More than two years after the San Bruno, CA, natural gas transmission pipeline rupture and explosion, PG&E Corp. senior executives said the company’s bottom line is still feeling the aftershocks. The company last week reported a loss for 4Q2012 in part because of gas pipeline-related issues.