CME Group went on the defensive last Wednesday after The Wall Street Journal (WSJ) in a front-page expose said high-speed traders using powerful computers are trying to profit from being able to see their futures market orders executed milliseconds before the rest of the market is able to see them.

After

Articles from After

CME Group Working to Fix High-Speed Trading ‘Latency’ Issues

CME Group went on the defensive Wednesday after The Wall Street Journal (WSJ) in a front-page expose said high-speed traders using powerful computers are trying to profit from being able to see their own futures market orders executed milliseconds before the rest of the market is able to see them.

Linn Finds Better Hog Shootin’ in Oklahoma

After drilling some disappointing wells targeting the Hogshooter interval of the Granite Wash in the Texas Panhandle, Linn Energy LLC is now concentrating its efforts on the Oklahoma Hogshooter, where the reservoir is seen to be of better quality with less variability, CEO Mark E. Ellis said Thursday.

Another Deepwater Strike in Gulf of Mexico

Another deepwater well in the Gulf of Mexico (GOM) appears to be a success after the Phobos-1 prospect in the Lower Tertiary Trend encountered 250 feet net of “high-quality oil pay,” said Anadarko Petroleum Corp.

FracFocus Groups Fire Back at Harvard

One day after a report by Harvard Law School researchers leveled withering criticism against FracFocus, the two organizations that jointly manage the oil and natural gas disclosure registry fired back for what they claim were misrepresentations of the site.

U.S. Onshore Rig Activity to Rise through 2013, Says Baker Hughes

After five consecutive quarters of falling rig counts, U.S. onshore rig activity will improve through the rest of the year, according to a forecast issued on Friday by Baker Hughes Inc.

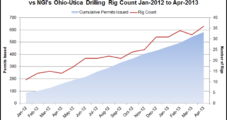

Ohio Surpasses 600 Permits Issued in Utica Shale

Regulators with the Ohio Department of Natural Resources (ODNR) passed a milestone in the Utica Shale last week, after having cumulatively issued more than 600 permits for horizontal wells targeting oil and natural gas.

NatGas the New Gold? Goldman Thinks So

With the price of gold now down nearly 30% from its record September 2011 high of $1,920.30/oz to around $1,377, analysts looking for a commodity to be bullish about have turned their focus to natural gas as a new commodity “safe haven,” thanks to the shale revolution.

Pennsylvania Midstreamers to Improve Facilities in EPA Agreements

Two natural gas midstream operators in western Pennsylvania have agreed to improve their facilities after the U.S. Environmental Protection Agency (EPA) said they failed to comply with Clean Air Act (CAA) rules to prevent accidental releases of flammable substances.

2000-01 Energy Crisis Legal, Regulatory Cases Still Around

Thirteen years after the 2000-01 energy market meltdown there are still parts of old legal and regulatory cases emerging in California that carry potentially multi-billion dollar consequences. Two cases emerged the first two weeks of April — one in the U.S. 9th Circuit Court of Appeals in San Francisco and other at California’s state regulatory commission in the same city.