An affiliate of Chesapeake Energy Corp. is being sued by the U.S. government for failing to pay taxes in 2001 through 2003. Chesapeake Appalachia LLC is the successor company of Triana Energy Inc., which Chesapeake purchased in 2005 as part of a transaction with Columbia Natural Resources LLC. The deal gave Chesapeake entry into the relatively unexplored Marcellus Shale, with acreage in Pennsylvania, West Virginia, Ohio, New York and Kentucky. According to a complaint filed in U.S. District Court for the Southern District of West Virginia, the United States assessed taxes against Triana in 2001 through 2003 for a total of $431,988, which as of May 17 it “has failed, neglected or refused to pay” (U.S. District Court for the Southern District of West Virginia at Charleston, No. 2:13-cv-11988). Federal officials are seeking the tax assessment and statutory additions accrued.

Additions

Articles from Additions

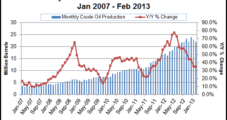

North Dakota Sets More Records in February

Although overall month-over-month totals were down, production rates set all-time high marks for oil and natural gas in February in North Dakota, state officials reported Tuesday.

National Fuel Looks to Marcellus for Production, Pipeline Boost

The promise of production from seven “exceptional” wells brought online in January in Pennsylvania’s Marcellus Shale and continuing additions to its pipeline business paint an expanding future for National Fuel Gas Co. (NFG) in 2013, CEO Dave Smith said during a conference call with analysts.

Natural Gas Shale Takes Money to Make Money…Eventually

Natural gas shale plays have become “relatively well delineated,” which is sending production costs south in many onshore basins, a trend that should continue as adequate infrastructure opens the door to more opportunities, according to Credit Suisse’s energy team.

Statoil Buys Another 70,000 Net Acres in Marcellus

Norway’s Statoil ASA on Wednesday said it has snapped up another 70,000 net acres in liquids-rich areas of the Marcellus Shale for $590 million in cash. The portfolio additions, which give the producer full or joint partnership in close to 750,000 net acres in the play, are spread across West Virginia and Ohio.

Halcon Sees Output More Than Doubling in 2013

Upstart onshore operator Halcon Resources Corp. expects to produce 17,000-20,000 boe/d in the final three months of this year and should produce 40,000-45,000 boe/d in 2013, management said Thursday.

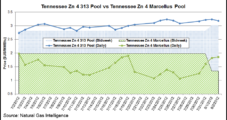

Marcellus Shale Price Drops Stand Out Among August Bidweek Gains

August natural gas bidweek prices saw stout gains across the board except for a handful of Marcellus Shale trading points as NGI’s National Spot Gas Average came in 28 cents higher than the previous month at $3.00/MMBtu, according to Natural Gas Intelligence (NGI), which has unveiled a number of new market pricing locations with its latest monthly price survey.

Marcellus Will Push Back Canadian Gas, Says Bentek

Marcellus Shale gas will push out some gas traditionally imported from Dawn, ON, later this year as new pipeline expansions come online, Bentek Energy LLC said in a market note.

ExxonMobil Buying, Drilling More Liquids Acreage in North America

ExxonMobil Corp., whose North American portfolio washes across eight million net acres, is scooping up more liquids-weighted land and has begun to shift some of its natural gas development to more oily plays, the company’s top guns told financial analysts on Thursday.

North America Onshore Rig Count Flat in 2012, Says Schlumberger

North America’s land rig count is expected to be flat this year, with natural gas-directed drilling on the decline while liquids and oil drilling will strengthen, Schlumberger Ltd.’s CEO said Friday.