Coronavirus | LNG | LNG Insight | NGI All News Access | NGI The Weekly Gas Market Report

Shell CEO Sees Covid-19 as Opportunity for ‘Green Recovery,’ as Net-Zero Emissions Goals Advance

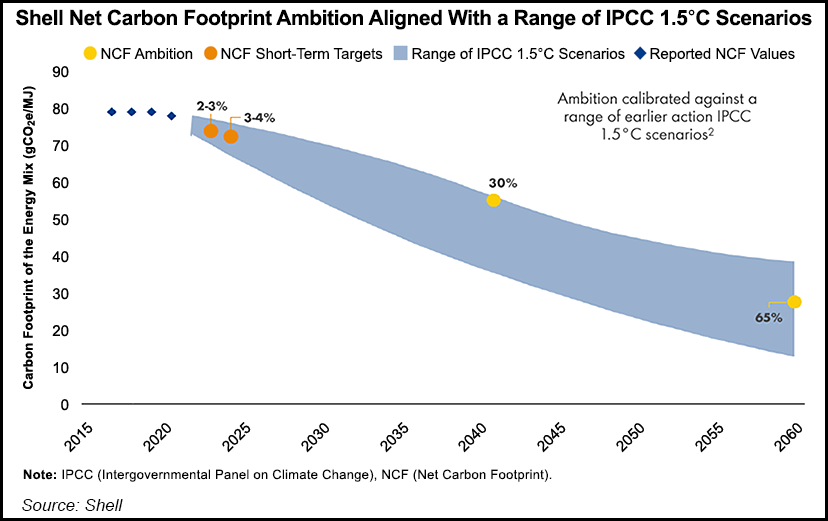

Royal Dutch Shell plc is not backing off its ambition to become a net-zero emissions energy operator by 2050, and in fact, management expects Covid-19 to accelerate the energy transition.

In a recorded video for the global workforce, CEO Ben van Beurden said Tuesday there was an “opportunity of a green recovery” as the world slowly emerges from the pandemic.

“This is a key moment for us all,” he said, “for governments, for businesses and individuals, to pull together to make sure that as the world emerges from this unprecedented crisis, we all make the right choices for a better world.”

Society “must remain focused on the longer-term challenge of climate change because it hasn’t gone away. It still needs urgent action.”

Shell’s ambition to become a net-zero emissions energy business by 2050, introduced in April, remains “so crucial,” the CEO said.

“Our current business plans will not get us to where we need to be, and we will have to change those plans over time,” he told the workforce. “It won’t be easy, and of course, there will be obstacles to overcome. But like many others, I believe that society now has a unique opportunity to accelerate toward a cleaner energy future.”

BP plc CEO Bernard Looney made similar remarks earlier this month. The London-based supermajor in February also has set a net-zero emissions goal by 2050.

The “combined health and economic shock” from Covid-19 “is bound to reshape the global economic, political and social environment in which we all live and work,” Looney said. “It has the potential to accelerate emerging trends and create opportunities to shift the world onto a more sustainable path.”

In the face of the pandemic, as consumers change their lifestyles, “it feels like we are at a pivotal moment,” the BP chief said. “Net zero can be achieved by 2050. The zero-carbon energies and technologies exist today; the challenge is to use them at pace and scale, and I remain optimistic that we can make this happen.”

Shell has for some time been undergoing a restructuring to better adapt to the changing needs of its customers by “looking hard at what we do and where we invest,” said van Beurden.

Shell in February joined Dutch natural gas company Gasunie to undertake a feasibility study regarding a massive green hydrogen plant in the northern Netherlands. The plant, to be fueled by a wind farm off the coast of Groningen, could be designed to produce 800,000 metric tons of hydrogen by 2040.

Another Shell-backed investment in Norway would capture carbon dioxide and store it under the sea, van Beurden noted.

“With Covid-19, many people have experienced a sudden change, and the impact of the virus has been severe,” he said. “But this is also a moment of opportunity for people to re-evaluate what is important in their lives and emerge more united in tackling the urgent challenge of climate change.”

In related news, Wells Fargo on Wednesday said it has structured renewable energy agreements with Shell Energy North America (US) LP and Shell subsidiary MP2 Energy LLC to secure 150,000 megawatt hours a year. The energy, said the financial firm, would provide 100% of the consumption of about 1,200 Wells Fargo properties in California and the Mid-Atlantic states, and meet 100% of the company’s eligible load in California, Delaware, Maryland, New Jersey, Illinois, Ohio, Pennsylvania and the District of Columbia.

The Shell Energy contract is for seven years, while the MP2 contract is for 6.7 years.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |