Russia’s Gazprom PJSC will reportedly increase its ownership of Sakhalin 2 LNG project, placing more of the country’s export capacity under state-owned company’s control as sanctions continue to pressure its oil and pipeline gas revenues. According to the Russian government, a 27.5% stake valued at $1.6 billion is to be sold to Gazprom, increasing its…

Shell

Articles from Shell

Shell’s ‘Competitive Advantages’ Centering on LNG Trade, Lowering Emissions, Says CEO

At the right “price point,” global demand for natural gas will continue to expand, Shell plc CEO Wael Sawan said Monday. On the opening day of CERAWeek by S&P Global in Houston, Sawan told the industry audience that the transition to become a net-zero producer remains a goal by 2050. However, alternatives remain too expensive…

Shell to Expand LNG Trading, Carve Out Lower Emissions through AI and Efficiencies

Shell plc upended its energy transition strategy on Thursday, citing lower power sales and stronger demand for natural gas, but it still expects to reach net-zero carbon emissions by 2050. Under pressure from investors to focus on the core oil and natural gas business, the London-based major updated its carbon reduction ambitions in the Energy…

Qatar Takes Another Leap to Expand North Field Project, Boost LNG Output by 85%

Qatar on Sunday advanced plans to increase the country’s LNG production capacity by 85% from current levels, upping a bet that more natural gas will be needed as progress at other liquefaction projects appears to slow. CEO Saad Sherida Al-Kaabi, of state-owned QatarEnergy, said an appraisal program had determined that the productive layers of the…

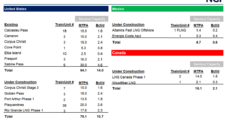

Venture Global Asks FERC for 1-Year Extension of Calcasieu Pass LNG Commissioning

Work at Venture Global LNG Inc.’s Calcasieu Pass export facility could stretch on until the end of the year, requiring the firm to seek an authorization extension from FERC, the company disclosed in a recent filing. The Virginia-based company has asked the Federal Energy Regulatory Commission to grant it an extra year to complete the…

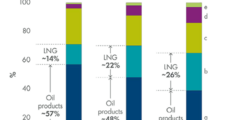

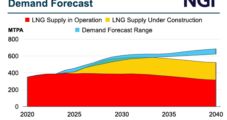

Energy Majors, Traders Betting on Big Future for LNG

Energy majors and commodities traders are playing an outsized role in supporting a global LNG export buildout that ultimately could saturate the market with the super-chilled fuel later this decade, bring prices down and stoke future demand. About 150 million metric tons/year (mmty) of additional liquefaction capacity is under construction across North America and in…

Ksi Lisims Nets First Offtaker as Shell Builds Western Canada LNG Footprint

The development team behind Ksi Lisims LNG in British Columbia (BC) has inked a long-term sales and purchase agreement (SPA) with Shell plc as the supermajor looks to grow its collection of western Canadian volumes for the Asian market. Ksi Lisims LNG Ltd., a co-venture between the Nisga’a Nation, Rockies LNG Ltd. and Houston-based Western…

Shell Forecasting Strong Integrated Gas Results in 4Q, as Price Volatility Lifting LNG Trading

Shell plc’s Integrated Gas trading arm, which includes global LNG, is expected to report “significantly higher” sequential results for the final three months of 2023 “due to seasonality and increased optimization opportunities.” The London-based major on Monday provided an update of its projected fourth quarter results, with solid operations from the world’s No. 1 liquefied…

Gulf of Mexico Auction Draws Most High Bids in Years as E&Ps Step Up Competition

Interest in the final oil and natural gas auction in the Gulf of Mexico for the year – and potentially the only one until 2025 – was strong on Wednesday, with the highest bid total since 2015. Following a series of delays because of lawsuits, the Interior Department’s Bureau of Ocean Energy Management (BOEM) held…

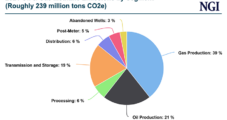

BP, Chevron, EQT, ExxonMobil, Oxy, Shell Vow to Curb More Natural Gas, Oil Emissions as EPA Unveils Stringent Methane Rules

The Biden administration’s final revisions to the nation’s methane regulations, launched on Saturday, drew sharp criticism from energy trade groups, even as 50 of the world’s largest natural gas and oil producers pledged more emissions cuts. Long expected, the U.S. Environmental Protection Agency (EPA) final rulemaking revised the Clean Air Act (CAA) methane and volatile…