Russia, Saudi Arabia and other top oil producing countries plan to keep pumping more crude into early 2022, despite worries about the coronavirus Omicron variant and the potential for easing demand.

The Saudi-led Organization of the Petroleum Exporting Countries (OPEC) and its Russia-led allies, collectively known as OPEC-plus, said Thursday they would boost production by 400,000 b/d in January, continuing a pace of monthly supply increases the cartel began in August.

OPEC researchers have said that, amid a global economic rebound in 2021 from the pandemic-imposed recession a year earlier, demand for oil has steadily climbed and the increased output is needed to balance the market in the first half of next year.

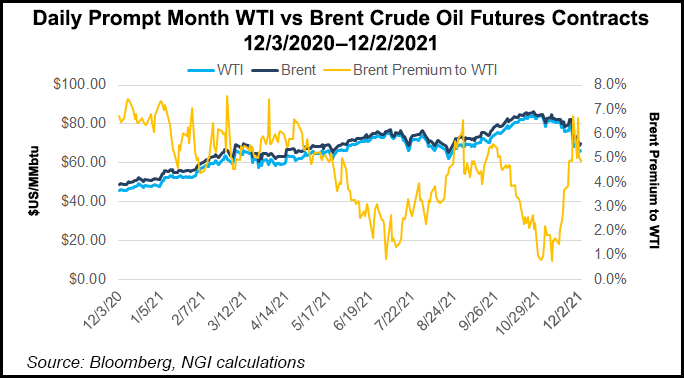

Global oil prices, however, have retreated more than 20% since...