Markets | Coronavirus | E&P | NGI All News Access

Oil Price Outlook Brightens Amid Expectations for Demand to Recover Faster Than Production

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |

Markets

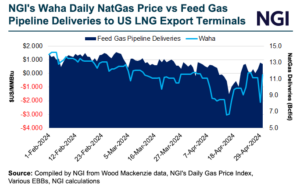

Natural gas futures gave up early gains on Tuesday, trading down more than 13 cents from the day’s high as doubts about Freeport LNG’s recovery lingered and markets braced for bearish monetary policy news Wednesday. At A Glance: Freeport ramps to 38% capacity Production falls to 96.9 Bcf/d Northeast leads cash gains The June Nymex…

April 30, 2024International

By submitting my information, I agree to the Privacy Policy, Terms of Service and to receive offers and promotions from NGI.