Markets | LNG Insight | Natural Gas Prices | NGI All News Access | NGI Mexico GPI | NGI The Weekly Gas Market Report | Shale Daily

Natural Gas, Oil Prices Soar as Russia Attacks Ukraine, Creating Potential Supply Headwinds

European natural gas prices spiked while oil surged above $100/bbl Thursday amid Russian military strikes across Ukraine. The aggression triggered fears of energy upheaval that could further compress already tight global supply/demand balances.

U.S. natural gas prices also climbed early Thursday, punctuating the global uncertainty imposed by Russia’s assault on the eastern European country.

Russia’s missile and airstrikes on Ukraine – along with cyberattacks – elicited condemnations across the global energy sector that amplified denunciations from the White House and its allies.

“Russia alone is responsible for the death and destruction this attack will bring, and the United States and its allies and partners will respond in a united and decisive way,” President Biden said Thursday. “The world will hold Russia accountable.”

World Watches

Prominent energy companies vowed to find ways to help Ukraine and its neighbors.

Cheniere Energy Inc. CEO Jack Fusco, for one, said “it’s tragic what’s going on in eastern Europe.” Cheniere is the largest U.S. exporter of liquefied natural gas (LNG), and Fusco said on an earnings call Thursday that Russia’s actions could galvanize the company and its peers “to increase our infrastructure and secure long-term contracts for our European customers.”

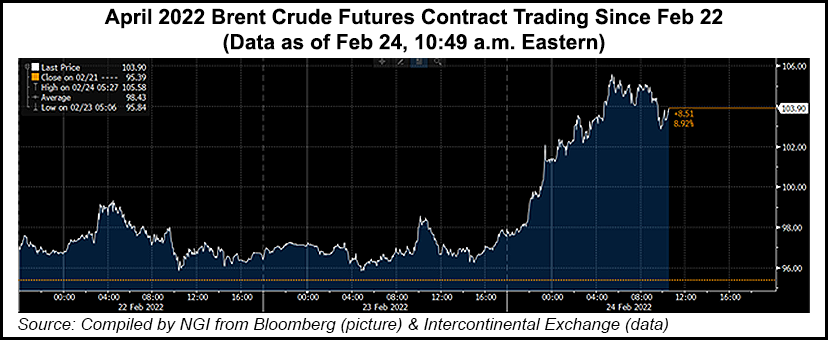

Brent crude, the international benchmark, surged 10% at one point in intraday trading, eclipsing $105 and reaching the highest level since 2014.

European gas prices shot up in tandem. The Dutch Title Transfer Facility surged across the curve Thursday, when the March contract gained almost $15 to finish close to $44/MMBtu. The prompt TTF hit an intraday high of $47.23, notching the largest single-day surge on record.

In the United States, the March New York Mercantile exchange natural gas futures contract approached $5.00, up more than 30 cents early Thursday, before giving back the gains. The contract settled at $4.568, down 5.5 cents on the day.

U.S. Global Investors Inc. head trader Mike Matousek told NGI that war in Ukraine threatens the flow of oil and gas to Europe. If protracted, he said, the conflict could affect U.S. supplies at a time when crude demand is surging amid an economic rebound from the pandemic. Natural gas consumption is also near peak levels during the late-season throes of winter.

“This presents the potential for major energy supply headwinds,” Matousek said.

In addition to supply challenges, oil and gas trading involving Russia directly or indirectly could grow increasingly complicated “because people start to worry they’ll be on the hook if this thing gets totally out of whack and you can’t execute trades…Nobody at this point can really predict exactly what comes next – it’s just crazy.”

‘Far Reaching Consequences’

The global ramifications of war in Ukraine “may prompt a rethink of the prominence of energy security across the world,” given that Russia is a top producer of both oil and gas, EBW Analytics Group senior analyst Eli Rubin said. “The violent aggression increases the risks of widespread cyberattacks threatening critical infrastructure and energy supplies in Russia and across Europe” as well as “collateral damage to longstanding Ukrainian gas and oil pipelines.”

He noted new U.S. sanctions against Russia’s government-backed natural gas pipeline – Nord Stream 2 (NS2) – that effectively froze the potential for new flows of gas to Europe at a time when the continent is already short on supplies. The supply squeeze followed a robust year of demand in 2021 and waning domestic production.

Even without NS2, Europe relied on Russia for about 20% of its natural gas before the crisis erupted Thursday, according to Mizuho Securities USA LLC. The firm also noted Russia is the second largest oil producing country in the world after the United States at 10.5 million b/d; Russia exports around 5 million b/d.

U.S. exports of LNG were already running near record levels to help meet European gas demand, meanwhile, providing support for U.S. gas prices before the tumult.

“Still, significant second-order effects may arise from soaring oil prices prompting rising oil and associated gas production,” Rubin said. Markets scrambled to reassess “the role of U.S. oil and gas production as energy security concerns leap to the forefront.”

CEO Mario Mehren, of NS2 investor Wintershall Dea AG, said the military escalation “shakes the economic cooperation between Russia and Europe that has been built up over decades. That will have far-reaching consequences. To what extent cannot yet be foreseen.”

Wintershall’s CEO, whose German oil and gas company works in Russia, also emphasized the inevitable human toll. “People are dying. We are shocked by what is happening,” Mehren said. “Many of our colleagues come from Russia or Ukraine. For them in particular, but also for all of us, this escalation on the orders of the Russian government is a hard blow.”

Sanctions And Supplies

The Biden administration did not plan further sanctions specifically on Russian oil and gas flows – because of concerns about inflation and impacts on European allies. However, President Biden announced Thursday new penalties imposed on Russia’s financial system and other corners of its economy that could indirectly result in tapered Russian oil exports, further clouding the supply/demand picture.

Mizuho Securities’ Robert Yawger, director of energy futures, said buyers of Russian oil are bound to grow increasingly cautious given elevated uncertainty. “With new sanctions,” he said, “buyers would have to take into account the availability of the Russian financial system to facilitate buying even deeply discounted barrels.”

Global oil supplies, under pressure from mounting demand for travel fuels as the global economy rebounds, could take outsized hits if Russian supplies are carved out of the energy mix amid sanctions.

Already, coronavirus “concerns are waning and countries are removing or relaxing restrictions, causing a surge in demand for oil that the current supply would struggle to meet,” Rystad Energy analysts said.

Over a four-week period ended Feb. 18, U.S. petroleum demand averaged 21.9 million b/d, up 12% from the same period last year, according to an Energy Information Administration (EIA) report on Thursday.

EIA has cited similar demand advances across Europe and Asia. At the same time, U.S. supplies in storage, excluding those in the Strategic Petroleum Reserve (SPR), are 10% below the five-year average, according to EIA.

$130 Oil By June?

U.S. crude production, while recovering from the lows imposed in 2020 by the pandemic, has been flat early in 2022 around 11.6 million b/d. This reflects in large part publicly traded producers’ collective response to investors’ calls to divert investments away from fossil fuels and toward renewable energy.

Meanwhile, OPEC and major oil producing countries that partner with the cartel are collectively struggling to ramp up output this year amid political strife and aging infrastructure. Russia’s decision to embark on war in Ukraine comes on top of the existing challenges.

Rystad’s Louise Dickson, senior analyst, said amid the near-term uncertainty, Brent prices could remain exceptionally high. Lofty prices, in turn, could necessitate supply creativity – including an emergency SPR draw – for the United States to avoid near-term supply problems as other countries that work with Russia may ramp up calls for imports from other suppliers.

“Oil prices are soaring with no end in sight as the news of Russia’s full-scale military incursion of Ukraine” is “immediately putting at risk up to 1 million b/d of Russian crude oil exports transiting through Ukraine and the Black Sea,” Dickson said.

She said disruption of oil flows is “inevitable, as Europe currently sources 25% of its oil imports from Russia, and its port terminals and infrastructure are not equipped for a sudden pivot from piped crude” to port deliveries. “Prices could approach $130/bbl by June if the Ukrainian conflict disrupts Russian crude flows, but that estimate could soar higher if additional disruptions materialize.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 | ISSN © 2158-8023 |