NGI Archives | NGI All News Access

Marathon’s U.S. Trio: Eagle Ford, Bakken, Oklahoma

Marathon Oil Corp.’s $5.2 billion capital, investment and exploration budget for 2013 is about 65% targeted toward liquids-rich areas, particularly the Eagle Ford Shale of South Texas.

CEO Clarence P. Cazalot Jr. said the spending would generate a 6-8% year-over-year increase in total company production, particularly from liquids-rich resource plays in the United States.

“About one-third of our overall budget, or $1.9 billion, is allocated to the Eagle Ford Shale play in South Texas where we demonstrated our ability to deliver very strong results in 2012 and recently raised our 2013 production target there to 85,000 net boe/d [see Shale Daily, Nov. 8],” he said. “The economics and well performance we’re achieving in the Eagle Ford, along with our ability to drive efficiencies, make this play a focal point of our growth strategy.

“The Bakken Shale in North Dakota and the Oklahoma resource basin are our other two critical plays in the U.S.”

In the Eagle Ford the company plans to drill 215-250 net wells (275-320 gross, all company operated) next year. Included in Eagle Ford spending is $190 million for central batteries and pipeline construction. In October the company said it was selling some of its Eagle Ford holdings to sharpen its focus in the play (see Shale Daily, Oct. 17).

The $1.9 billion slated for the Eagle Ford is a portion of the company’s planned $3.4 billion allocated to growth projects. Marathon plans to spend nearly $800 million in the Bakken Shale and $150 million in the Oklahoma resource basin. With that, it plans to drill 65-70 net wells (190-220 gross, 60-70 company operated) in the Bakken and 15-19 net wells (42-50 gross, 12-14 company operated) in Oklahoma.

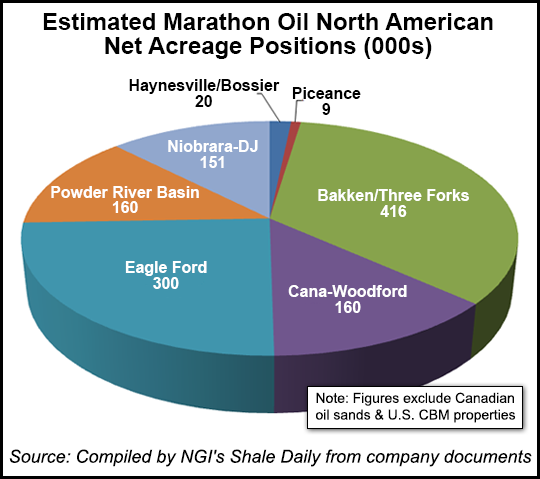

Marathon holds an estimated 416,000 net acres in the Bakken/Three Forks and another 300,000 net acres in the Eagle Ford. The company also has significant holdings in the Cana-Woodford (160,000 net acres), Powder River Basin (160,000 net acres) and Niobrara-DJ (151,000 net acres).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |