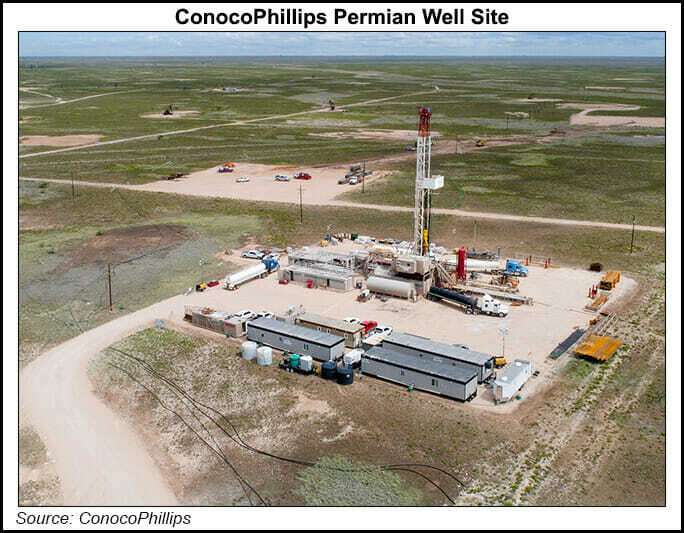

Houston-based ConocoPhillips reported higher earnings in 2Q2021 as it benefited from higher commodity prices and production driven by its recent acquisition of Permian Basin pure-play Concho Resources Inc.

Excluding output from its Libya operations, the super independent reported 2Q2021 output of 1.55 million boe/d, a 566,000 boe/d increase over the same period of 2020. The figure was also higher than the 1.5-1.54 million boe/d ConocoPhillips had previously predicted.

“This increase was primarily due to new production from the Lower 48 and other development programs across the portfolio, partially offset by normal field decline,” management said.

In the Lower 48, production averaged 794,000 boe/d compared to 311,000 boe/d in the same period a year ago. The latest figures...