ConocoPhillips’ LNG business should not be affected in the near term by a freeze on federal approvals for new export capacity, executives said Thursday. The Biden administration’s current pause on authorizations for new liquefied natural gas exports to non-free trade agreement (FTA) countries is “unfortunate” and “clearly more politically driven than fundamental,” said CEO Ryan…

Tag / Conocophillips

SubscribeConocophillips

Articles from Conocophillips

Alaska Looking to Secure Vital Natural Gas Supplies Via Cook Inlet

As reserves in the Cook Inlet Basin dwindle, Alaska leaders are warning of natural gas shortages as early as 2027. Natural gas production in the basin has fallen to about 70 Bcf/year, according to the Alaska Department of Natural Resources (DNR). The reduced production was cited for shuttering operations at the Agrium Kenai Nitrogen Plant…

Chihuahua Government Backs Mexico Pacific’s Proposed 2.8 Bcf/d Sierra Madre Natural Gas Pipeline

Mexico Pacific Ltd. LLC has reached an agreement with the government of Chihuahua state to facilitate development of the proposed 2.8 Bcf/d Sierra Madre natural gas pipeline. Sierra Madre would supply Permian Basin gas from the U.S. border across the states of Chihuahua and Sonora to Mexico Pacific’s proposed Saguaro Energía LNG export terminal envisioned…

ConocoPhillips Inks Deal to Export More LNG Into Europe

Houston-based ConocoPhillips has signed another deal securing more capacity to move volumes from its growing LNG supply portfolio into Europe as the continent continues to replace Russian imports. The independent said it booked 2 billion cubic meters (Bcm) annually, or roughly 70 Bcf/year of regasification capacity at the Gate import terminal in the Netherlands, one…

Mexico LNG Project in ‘Oversubscribed Territory’ After ConocoPhillips Joins as Anchor

ConocoPhillips agreed Thursday to buy 2.2 million metric tons/year (mmty) of LNG from Mexico Pacific Ltd.’s (MPL) Saguaro Energia export terminal planned for the country’s west coast, pushing the project closer to a final investment decision (FID). MPL CEO Ivan Van der Walt said ConocoPhillips’s commitment pushed the company’s sales volumes for trains one and…

ConocoPhillips Taking Full Ownership of Canada’s Surmont for $3B

ConocoPhillips will raise its profile in the top rank of Canadian natural gas users, the Alberta oilsands, by way of its purchase of a bitumen underground extraction asset for about $3 billion. The Houston-based firm exercised its contractual right to double ownership to 100% of the 140,000 b/d Surmont oil site near Fort McMurray. The…

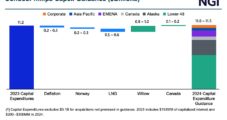

ConocoPhillips Raising 2023 Production Forecast as Port Arthur LNG, Willow Projects Advance

ConocoPhillips raised its full-year 2023 production forecast after achieving record output domestically and worldwide during the first three months of the year. The company is targeting full-year 2023 production of 1.78-1.80 million boe/d, a 10,000 boe/d increase at the midpoint from previous guidance. This would be up from full-year production of 1.74 million boe/d recorded…

China’s Sinopec Takes Equity Stake in QatarEnergy’s North Field East LNG Project

China Petroleum and Chemical Corp., aka Sinopec, has agreed to take a stake in QatarEnergy’s North Field East (NFE) LNG expansion project, the first equity deal between a Chinese state-owned firm and the major natural gas exporter. Sinopec negotiated a 5% stake in one of the four 8 million metric ton/year (mmty) capacity trains outlined…

ConocoPhillips Could Take Over APLNG Upstream if Brookfield, EIG Acquire Origin Energy

A consortium of investment groups is planning to acquire Origin Energy Ltd., Australia’s largest integrated utility, in a deal that could make ConocoPhillips upstream operator of the natural gas fields that feed the Australia Pacific LNG (APLNG) facility. Brookfield Renewable Partners LP and U.S.-based institutional energy investor EIG reached an agreement with Origin’s board to…

Sempra Green Lights Port Arthur LNG in Second U.S. FID This Month

Sempra on Monday gave the green light to the first phase of the $13 billion Port Arthur LNG export project in Texas, announcing a positive final investment decision (FID) for the facility and closing the necessary financing to move ahead. The company said it also issued a final notice to proceed with the project to…