Leticia Gonzales joined Natural Gas Intelligence as a markets contributor in 2014 after nine years at S&P Global Platts, where she was involved in producing the daily and forward price indexes for U.S. electricity and natural gas markets. She joined NGI full time in 2019 to cover North American natural gas markets and news and in 2021 was appointed Price & Markets Editor. In this role, Leticia oversees NGI's Daily Gas Price Index, including the process for calculating, monitoring, and publishing its natural gas daily prices.

Archive / Author

SubscribeLeticia Gonzales

Articles from Leticia Gonzales

Natural Gas Futures Pull Back Amid Ho-Hum Storage Data, Cooler Weather Outlooks

Storage data that proved to be a non-event made for the third quiet trading session this week for natural gas futures prices. The September contract settled Thursday at $2.159, down 1.1 cents, and October slipped 1.4 cents to $2.163.

Autumn Preview Drives Natural Gas Forwards Lower

After somewhat of a breather earlier in August, natural gas forward prices resumed their slide during the Aug. 16-21 period as weather outlooks showed the intense heat that has suffocated much of the United States this week finally easing. With cooler air set to move in and linger through early September, forward prices were down a nickel or more through the winter strip, with smaller shifts of a few pennies further out the curve, according to NGI’s Forward Look.

Natural Gas Futures Inch Lower as Fundamentals Hold Steady; Cash Slides Further

The battle over $2.15 natural gas waged on Friday, with bears already pouring their pumpkin-spiced lattes as weather models maintained a fall-like U.S. pattern through early September. Near-record production and liquefied natural gas (LNG) intake also held firm, leaving little reason for a significant move for the September Nymex futures contract, which settled Friday at $2.152/MMBtu, down seven-tenths of a cent on the day. October fell by the same amount to $2.156.

Heat Not Enough to Prevent Massive Weekly Declines for Some NatGas Markets

Scorching temperatures did little to significantly boost weekly cash prices, with Texas posting gains of less than a nickel at most pricing hubs and Permian Basin prices crumbling under pipeline maintenance-induced pressure.

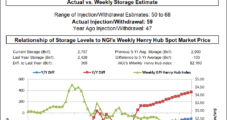

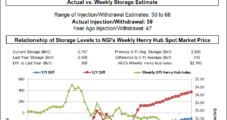

EIA Reports Ho-Hum 59 Bcf Natural Gas Storage Injection; Futures Quiet

The Energy Information Administration (EIA) reported a 59 Bcf injection into storage inventories for the week ending Aug. 16, which fell well within the range of estimates, though a few Bcf below several highball projections.

Easing Temperatures Take Chunk Out of September Natural Gas Prices; Cash Slips

After netting barely 2 cents over the previous two sessions, natural gas futures took a more definitive turn on Wednesday as widespread summer heat appears to be drawing to a close. Following a steep sell-off in cash markets, the September Nymex futures contract tumbled 4.8 cents to $2.17, and October fell 4.2 cents to $2.177.

Natural Gas Bears Get Upper Hand, Drive Forwards Lower Amid Cooler Weather, Record Production

After somewhat of a breather last week, natural gas forward prices resumed their slide during the Aug. 16-21 period as weather outlooks showed the intense heat that has suffocated much of the United States this week finally easing. With cooler air set to move in and linger through early September, forward prices were down a nickel or more through the winter strip, with smaller shifts of a few pennies further out the curve, according to NGI’s Forward Look.

Natural Gas Futures Slip as EIA Reports On-Target Storage Build; Cash Weakens Again

Storage data that proved to be a non-event made for the third quiet trading session this week for natural gas futures prices. The September contract settled Thursday at $2.159, down 1.1 cents, and October slipped 1.4 cents to $2.163.

Quiet Session Ends With Natural Gas Futures Relatively Stable; Spot Gas Mixed

An increasingly bullish background for the natural gas market is building with the onset of commercial liquefied natural gas (LNG) export operations along the Gulf Coast, but production is proving to be a tough barrier for prices to overcome. With long-term weather outlooks once again trending cooler, the September Nymex gas contract swung in and out of positive territory before going on to settle only eight-tenths of a cent higher Tuesday at $2.218/MMBtu. October rose six-tenths of a cent to $2.219.

Weak Cash, Bearish Weather Pressure Natural Gas Futures Ahead of EIA Report

After netting barely 2 cents over the previous two sessions, natural gas futures took a more definitive turn on Wednesday as widespread summer heat appears to be drawing to a close. Following a steep sell-off in cash markets, the September Nymex futures contract tumbled 4.8 cents to $2.17, and October fell 4.2 cents to $2.177.