Leticia Gonzales joined Natural Gas Intelligence as a markets contributor in 2014 after nine years at S&P Global Platts, where she was involved in producing the daily and forward price indexes for U.S. electricity and natural gas markets. She joined NGI full time in 2019 to cover North American natural gas markets and news and in 2021 was appointed Price & Markets Editor. In this role, Leticia oversees NGI's Daily Gas Price Index, including the process for calculating, monitoring, and publishing its natural gas daily prices.

Archive / Author

SubscribeLeticia Gonzales

Articles from Leticia Gonzales

EIA Reports ‘Quite Bearish’ 60 Bcf Injection; October Natural Gas Trims Gains

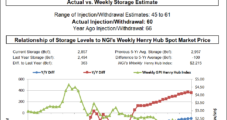

The Energy Information Administration (EIA) reported a 60 Bcf injection into storage inventories for the week ending Aug. 23.

Technical Trading, Production Drop Drive Rally for September NatGas Upon Expiration

Speculators with net short positions set the stage for a natural gas price rally on Wednesday as the September Nymex futures contract rolled off the board, with a drop in production solidifying the momentum. September surged as high as $2.277/MMBtu before going on to expire at $2.251, up 4.9 cents on the day. October, which takes over the prompt position on Thursday, rose 3.0 cents to $2.222.

Natural Gas Forwards Rally as Technicals, LNG and Cash Drive Markets

After accumulating a record number of short positions earlier in August, speculative traders drove natural gas futures prices sharply higher for the Aug. 23-28 period. Strong cash prices and a dip in production further fueled forward markets this week, with double-digit gains seen across most of the country, according to NGI’s Forward Look.

October NatGas Jumps Another 7-Plus Cents as Traders Eye Dorian; Cash Mostly Lower

Hotter trends held in the latest weather models, leading to another surge for natural gas futures. Already being driven by “heavily crowded short speculative trade,” the October Nymex contract surged as high as $2.31 before going on to settle Thursday at $2.296, up 7.4 cents on the day. November climbed 6.8 cents to $2.342.

September Natural Gas Downshifts as Long-Range Weather Seen Cooler

A price rally driven largely by short-covering failed to hold up on Tuesday as weaker cash prices and generally stable fundamentals drove natural gas futures lower. With bidweek volatility on full display, the September Nymex gas contract settled 2.8 cents lower at $2.202/MMBtu, and October dropped 4.1 cents to $2.192.

September Natural Gas Expires Nickel Higher on Push from Technicals, Cash

Speculators with net short positions set the stage for a natural gas price rally on Wednesday as the September Nymex futures contract rolled off the board, with a drop in production solidifying the momentum. September surged as high as $2.277/MMBtu before going on to expire at $2.251, up 4.9 cents on the day. October, which takes over the prompt position on Thursday, rose 3.0 cents to $2.222.

Nymex Natural Gas Futures Rally on Technical Indicators; Mexico Pipeline Spat Ends

Fundamentals were relatively steady Monday, but some technical influences ahead of natural gas futures expiration helped drive prices considerably higher to start the week. With solid gains in the cash market as well, the September Nymex gas contract jumped 7.8 cents to settle Monday at $2.230/MMBtu. October rose 7.7 cents to $2.233.

Natural Gas Futures Retrace as Long-Range Weather Outlooks Cool; Cash Mixed

A price rally driven largely by short-covering failed to hold up on Tuesday as weaker cash prices and generally stable fundamentals drove natural gas futures lower. With bidweek volatility on full display, the September Nymex gas contract settled 2.8 cents lower at $2.202/MMBtu, and October dropped 4.1 cents to $2.192.

Battle Line Drawn as NatGas Futures Slide to $2.15; Mexico Pipeline Deal Imminent

The battle over $2.15 natural gas waged on Friday, with bears already pouring their pumpkin-spiced lattes as weather models maintained a fall-like U.S. pattern through early September. Near-record production and liquefied natural gas (LNG) intake also held firm, leaving little reason for a significant move for the September Nymex futures contract, which settled Friday at $2.152/MMBtu, down seven-tenths of a cent on the day. October fell by the same amount to $2.156.

Technicals, Strong Cash Aid in Sharp Rally for Natural Gas Futures

Fundamentals were relatively steady Monday, but some technical influences ahead of natural gas futures expiration helped drive prices considerably higher to start the week. With solid gains in the cash market as well, the September Nymex gas contract jumped 7.8 cents to settle Monday at $2.230/MMBtu. October rose 7.7 cents to $2.233.