Easing Temperatures Take Chunk Out of September Natural Gas Prices; Cash Slips

After netting barely 2 cents over the previous two sessions, natural gas futures took a more definitive turn on Wednesday as widespread summer heat appears to be drawing to a close. Following a steep sell-off in cash markets, the September Nymex futures contract tumbled 4.8 cents to $2.17, and October fell 4.2 cents to $2.177.

Extreme temperatures that have plagued much of the country this week were seen dissipating over the next couple of days, leaving only California and Texas to deal with the sweltering conditions. Sharp declines in California and the Northeast led the overall decline, with the NGI Spot Gas National Avg. dropping 7.0 cents to $1.955.

The milder outlook for the coming days is just the tip of the iceberg, as long-range weather models have consistently trended cooler for the end of August and early September. “The natural gas markets must clearly know the pattern late this week onward will be far from hot enough to intimidate, yet prices have held up well,” NatGasWeather said.

Indeed, $2.15 has been viewed as a critical level of support that bulls had to sustain. On Wednesday, the September Nymex contract fell as low as $2.157 before going on to settle a few ticks above that level.

However, there could be room for another leg higher as the latest European ensemble weather data showed a large ridge anomaly redeveloping in the eastern United States at day 15, indicating that the pattern indeed should turn back hotter, according to Bespoke Weather Services, which had been calling for a warmer shift in models.

“It isn’t mid-summer any longer, of course, but we feel that demand for the month of September as a whole will still be above normal, continuing the run of hotter conditions we have seen since the collapse of the El Niño state back in the second half of June,” Bespoke chief meteorologist Brian Lovern said.

For the near term, however, the cooler weather forecast is expected to result in much lower cooling degree days for Aug. 29-Sept. 3, which could portend yet another larger-than-average storage injection, especially as the coolest of temperatures are currently forecast during the Labor Day holiday weekend. Even with bouts of heat over Memorial Day and July 4, storage injections came in well above average.

In fact, even last week’s bearish 49 Bcf injection was well above the 35 Bcf year-ago build.

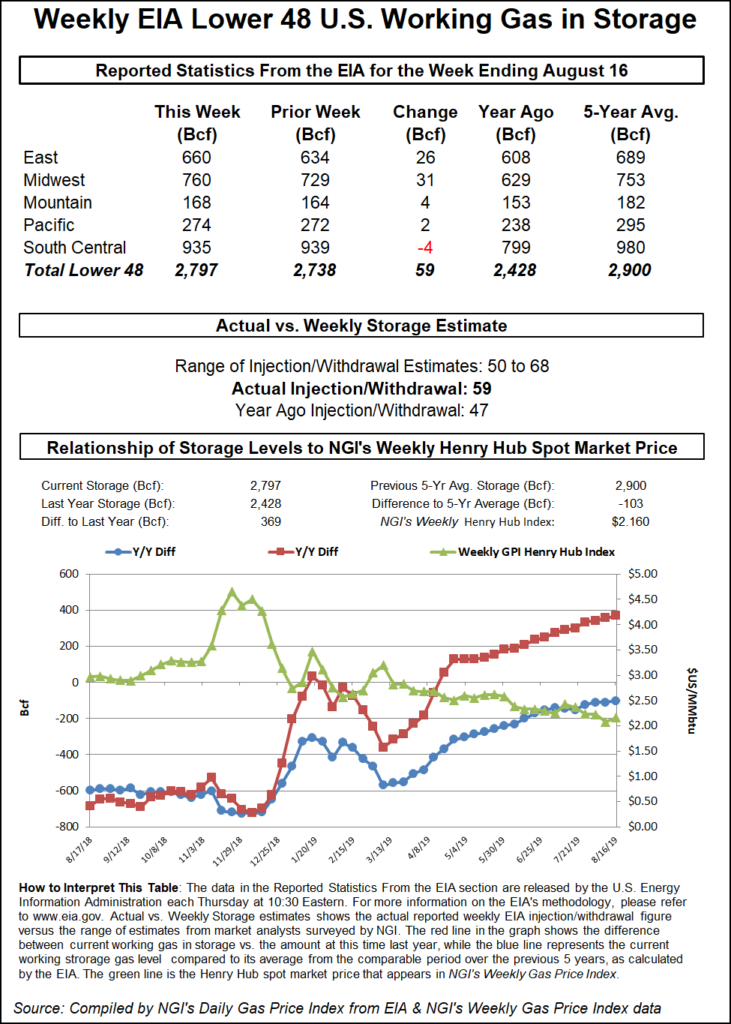

Estimates for Thursday’s Energy Information Administration (EIA) report are pointing to a build in the high 50 to low 60 Bcf range. A Bloomberg survey of 13 analysts showed a build between 50 Bcf and 68 Bcf, with a median of 56 Bcf. A Reuters poll had the same range, but a median of 60 Bcf. NGI also estimated a 60 Bcf build.

Such an injection would compare to last year’s 47 Bcf injection and the five-year average of 51 Bcf.

Meanwhile, there are several other moving parts that could add some uncertainty over the direction of prices in the coming weeks.

Feed gas deliveries to liquefied natural gas (LNG) on Wednesday reached a record high 6.27 Bcf/d, with Freeport LNG taking steady volumes and maintenance activities at the Sabine Pass and Corpus Christi terminals wrapping up, according to Genscape Inc.

In addition, exports to Mexico could soon start increasing. Mexico President Andrés Manuel López Obrador indicated earlier this week that a resolution to the standoff between Mexican utility Comisión Federal de Electricidad and natural gas pipeline developers could be reached later this week.

Meanwhile, production hit a new high of its own earlier in the week, and further growth is being only temporarily held back due to pipeline maintenance going on across the country.

Notably, support for the September contract was strong on Tuesday, just below $2.19.

“If Sabine Pass Trains 3 and 4 come back online quickly or Thursday’s storage report is bullish, a test of resistance at $2.29 is not out of the question,” EBW Analytics said.

However, there are other global headwinds that add another layer of complexity to the U.S. gas market. Some European storage facilities have already reached capacity, while overall inventories are far above year-ago levels.

However, U.S. LNG feed gas demand may remain healthy due to stronger netbacks to Asia, falling North Sea production and the possibility of using LNG tankers as floating storage to take advantage of higher-priced winter contracts, according to EBW.

In addition to Sabine Pass and Corpus Christi, Cameron LNG has begun commercial operations and Freeport LNG has started initial production, with first exports eyed by the end of the month.

“If LNG feed gas demand dips in September, however, shorts may pounce, possibly retesting support for natural gas above $2.00,” EBW said.

With the steamiest days in the rearview mirror, aside from Texas, spot gas prices moved lower across most of the United States. That cooler air comes as the first in a series of weather systems that swept across the Midwest on Wednesday, holding daytime temperatures in the 70s to lower 80s.

That weather system is expected to move East on Thursday and Friday, bringing much lighter demand to the Northeast, according to NatGasWeather. Temperatures were also forecast to fall several degrees across Texas and the South this weekend as a weather system stalls with showers.

“Where the pattern’s been a little hotter trending is early next week as a break between weather systems occurs across the southern and eastern United States,” NatGasWeather said. “However, an even cooler weather system is expected into the northern and central U.S. mid next week, then across the southern and eastern U.S. shortly after.”

As for Wednesday’s price action, Transco Zone 6 non-NY next-day gas tumbled 18.5 cents to $2.02, with several other pricing locations posting losses of less than a dime.

Declines in Appalachia were capped at less than 15 cents, with Tennessee Zn 4 Marcellus shedding 13 cents to average $1.715.

Prices across most of the country’s midsection were down less than a dime, while the ongoing maintenance on Natural Gas Pipeline Company of America (NGPL) sent NGPL Midcontinent cash down 50 cents to a 92-cent average.

In addition to the scheduled NGPL maintenance going, the pipeline company on Tuesday announced a force majeure between compressor stations 104 and 105 in the pipeline’s Midcontinent Zone. The pipeline, citing results of an in line inspection tool run, said that the force majeure would be in effect Thursday and last until further notice.

The restrictions, measured at Station 103 Ford, will impose an operational capacity of 439 MMcf/d on a throughput meter that has flowed an average of 906 MMcf/d in the 30 days prior to Aug. 20, according to Genscape.

“This force majeure further exasperates downstream constraints through Station 107 Mills in Mills County, IA,” Genscape natural gas analyst Matthew McDowell said.

Station 107 was reduced to an operational capacity of 653 MMcf/d on Tuesday due to scheduled maintenance after flowing a 30-day average of 1,341 MMcf/d.

Farther west, prices in the Rockies were mostly lower. One exception was Kingsgate, which jumped 9 cents to $1.64.

Flow capacity on Westcoast Transmission is ramping up by close to 250 MMcf/d after a monthlong maintenance event that severely limited southbound flows. This is easing concerns about constraints on the Pacific Northwest’s gas supply this winter.

Westcoast’s Station 4B in British Columbia has been limited to around 900 MMcf/d of flow capacity since July 14, but for Wednesday’s gas day, was back up to around 1,150 MMcf/d, according to Genscape.

“Flows have been coming in essentially at capacity, and early cycles for Wednesday’s gas day were no exception, showing scheduled flows increasing commensurate with the operating cap,” Genscape analyst Joseph Bernardi said. “This change is slightly earlier than expected but still roughly consistent with Westcoast’s long-term maintenance schedule, which back in February had forecasted this capacity increase for roughly Sept. 1.

More capacity increases are expected for the rest of this month, increasing up to around 1,300 MMcf/d. These reductions have been in place due to safety testing undertaken by Westcoast following the explosion that occurred last October.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |