Heat Not Enough to Prevent Massive Weekly Declines for Some NatGas Markets

Scorching temperatures did little to significantly boost weekly cash prices, with Texas posting gains of less than a nickel at most pricing hubs and Permian Basin prices crumbling under pipeline maintenance-induced pressure.

Even with intense heat and strong demand on the East Coast, prices there either fell or moved less than a dime higher from Aug. 19-23. The NGI Spot Gas Weekly Avg. ultimately slid a nickel to $1.935.

Prices on the West Coast were hit hard, even as some heat continued in parts of California. SoCal Border Avg. plunged 24.5 cents to $2.305. PG&E Citygate was the lone pricing hub in the region to average the week in the black, as pipeline work that restricted imports boosted the weekly average to $2.65, up 9.5 cents.

Prices across the Rockies were also significantly lower as cool air moved into the region. The steepest declines were at the Cheyenne Hub and CIG, which each fell more than a quarter to $1.505 and $1.52, respectively.

“The big weather change this week was moving cooler here in the final third of August as well as the first few days of September,” Bespoke Weather Services said.

West Texas pricing also came under substantial pressure as a slew of pipeline maintenance in and around the region limited outflows. The restrictions, combined with easing temperatures in Texas by the end of the week, sent Waha tumbling 26.5 cents to a 99-cent average.

The pipe work also took a hammer to Midcontinent markets, which had to plunge in order to compete with low-cost Permian supplies. NGPL Midcontinent weekly prices tumbled 61.5 cents to $1.175.

Louisiana markets pushed out small gains of a few cents across the board, while the Southeast saw prices move in both directions, but only by a few cents.

Appalachia prices were down less than a dime, though losses were more significant than those seen in the Northeast.

For a week that included four days of penny or less shifts in natural gas prices, bears appear to be gaining the upper hand as cooler air that arrived across much of the United States by the end of the week was seen lasting through the first part of September.

The largest day/day shift occurred midweek, once near-term heat began to wane and long-range forecasts came into agreement that the fall-like weather would linger awhile. The September Nymex futures contract fell 4.8 cents on Wednesday alone, but went on to drop 5.8 cents from Monday-Friday to end the week at $2.152. October posted similar declines as it dropped to $2.156.

With the much cooler weather on tap, all eyes will be on the resulting storage injections in the East and Upper Midwest, according to Mobius Risk Group. While Texas heat is forecast to remain above normal on average over the weekend, the possibility of heavy rainfall could cut peak afternoon temperatures “when power consumption can move parabolically.” It could also dampen overall demand due to increased wind generation.

“Unless daily salt storage injections are significantly larger than recent history, the pricing impact should be minimal along the Gulf Coast,” Houston-based Mobius sad. “However, with bidweek underway, liquidity will be drying up for the September contract.”

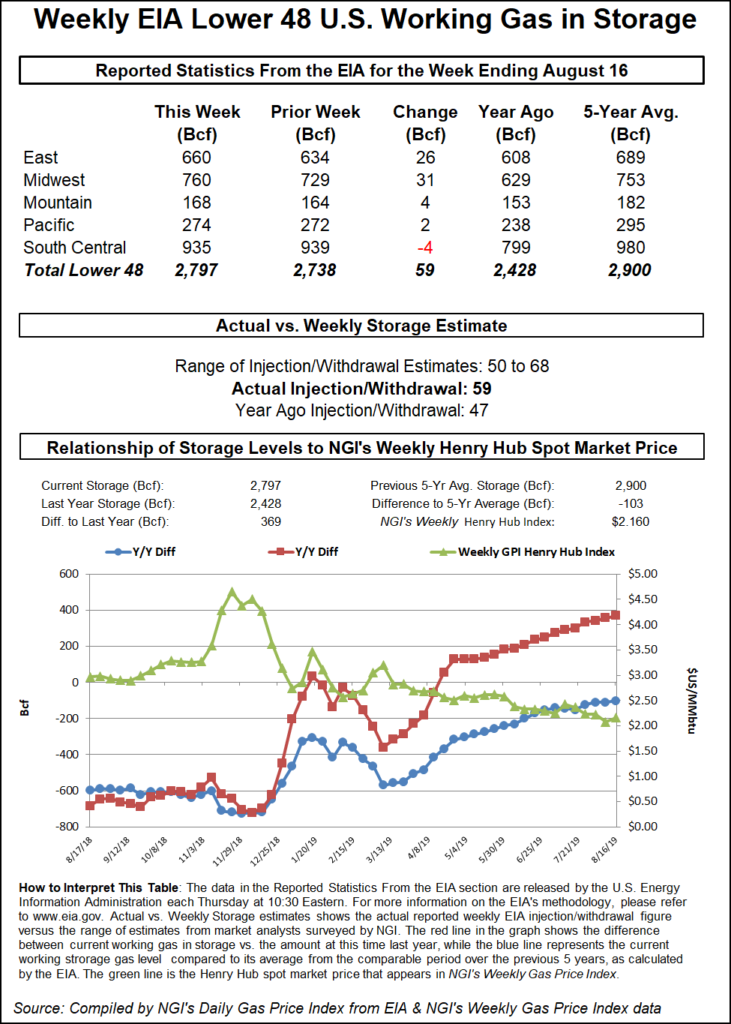

On Thursday, the Energy Information Administration (EIA) reported a net 4 Bcf withdrawal from South Central inventories for the week ending Aug. 16. This included a 9 Bcf draw from salt facilities and a 5 Bcf injection into nonsalts.

The East added 26 Bcf to stocks, while Midwest inventories rose by 31 Bcf, according to EIA.

Gas stocks in both regions are near or above historical levels, and the projected increase in injections in the weeks ahead will further ease any supply concerns for this winter.

The supply picture in the South Central is a little less clear, however. Since early May, the salt storage deficit versus the five-year average has grown from only 14 Bcf to 48 Bcf as of the week ending Aug. 16. The steep reduction in salt storage supplies is a possible bullish signal, should the market experience a cold start to winter later this year, as without robust salt storage reserves, sharply higher natural gas prices may be required to coax marketers into releasing storage inventories, according to EBW Analytics Group.

Current price indicators, however, may actually be reducing, rather than enhancing, salt storage operators to inject in the weeks ahead as the spread between the September and January 2020 Nymex contracts — one measure of potential profitability for salt storage operators hedging their business — has declined to one of the lowest spreads since May, EBW said.

For the entire Lower 48, the EIA reported a net 59 Bcf injection, boosting inventories to 369 Bcf above year-ago levels. The deficit to the five-year average sat at 103 Bcf.

The next few weeks will be tough for the natural gas market, analysts say. With mild temperatures set to ease demand at a time when production sits near highs, further downside risk looms, especially once Kinder Morgan Inc.’s Gulf Coast Express enters full service next month and as Texas Eastern Transmission completes repairs following its Aug. 1 explosion.

However, LNG intake is also at highs and some heat could return in September, as the United States has not seen a cooler-than-normal September since 2008.

“Where do we go from here? Lots of questions marks remain,” Bespoke said.

A burst of cooler and less humid air settling over the northeastern United States set the stage for an extended period of extremely mild temperatures, sending spot gas prices drifting lower to cap the week.

Steep declines were seen across Appalachia and the Northeast, where dry air was forecast to continue making its southward progress, according to AccuWeather. Typical highs during the last part of August range from the middle 70s over northern Maine and the upper Great Lakes to the mid-80s over the Ohio Valley and the Chesapeake Bay region of the Mid-Atlantic states, the firm said. Lows typically range from the mid-50s across the northern tier to the middle and upper 60s over the Ohio Valley and lower Mid-Atlantic coast.

“However, since the air and high pressure system coming in had its origins over Northern Canada, temperatures are forecast to average between 5-10 degrees below normal” for the weekend, resulting in “temperatures being slashed by an average of 10-20 degrees from their peak” of the past week, AccuWeather senior meteorologist Alex Sosnowski said.

Highs were expected to generally range from the mid-60s over the northern tier and over the higher elevations of the central Appalachians to the upper 70s and lower 80s over the Ohio Valley and Chesapeake Bay region, according to the forecaster. Early-morning lows were forecast to range from the lower 40s in the Adirondack Mountains of northeastern New York state to the upper 60s over the lower part of the Chesapeake Bay.

AccuWeather was also monitoring an area of the Atlantic along the coast from Florida to the Carolinas for potential tropical development. Exactly how close to the coast a disturbance strengthens, if any tropical storm forms, may determine if more significant rain and wind develops along the Mid-Atlantic or New England shoreline and Interstate 95 corridor, it said.

With the arrival of crisp, fall-like conditions, Dominion South spot gas prices plunged 27 cents to $1.365. Transco Zone 6 non-NY dropped 28.5 cents to $1.435.

Most spot gas losses in the southeastern United States were limited to less than a dime, including benchmark Henry Hub in south Louisiana, which fell 9 cents to $2.13.

Declines were a bit more pronounced in some areas of the Midcontinent, where ANR SW tumbled 15 cents to $1.395.

The Midwest also posted double-digit decreases, with Chicago Citygate shedding 10.5 cents to average $1.87.

Losses across Texas were rather small, while Waha managed to hold relatively steady.

On the pipeline front, a force majeure issued late Wednesday by Natural Gas Pipeline Company of America was continuing to constrain roughly 45 MMcf/d of Permian receipts intended to flow through Eddy County, NM. The pipeline cited a failure on the Indian Basin Lateral and provided no end date for the outage.

Across the northern border in Western Canada, NOVA/AECO C cash prices plunged 32 cents to average just C29 cents/gigajoule.

TC Energy Corp. invited Canadian natural gas producers to vote last Thursday on how capacity should be allocated on the NGTL system with the goal being reduced AECO volatility during shoulder season and times of maintenance, a pain point for producers in recent years. While a change in process is a positive step forward in reducing day-to-day volatility, TPH analysts said that upside would be limited given current Henry Hub pricing and a bearish outlook for the U.S. gas macro.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |