LNG | LNG Insight | NGI All News Access | NGI The Weekly Gas Market Report

Argentina Fetches Lowest Price in 12 Years for Full Complement of Winter LNG Cargoes

Argentina’s state-owned Integración Energética Argentina (Ieasa) has purchased 28 liquefied natural gas (LNG) cargoes for the Southern Cone winter at a record price of $2.87/MMBtu on average, the company said on Monday.

Despite growing domestic gas production from the Vaca Muerta formation and plans to develop large-scale LNG facilities, Argentina continues to import LNG in winter months to meet seasonal demand.

The prices this season were the lowest ever in the 12-year history of the state firm, and will be of “substantial benefit to the country and its resources,” Ieasa said.

Cargoes this Argentine winter, which runs from about May to October, were ordered principally from Qatar, the United States and Trinidad and Tobago, the company said. Ieasa said LNG is supplying about 25% of the country’s natural gas needs during the winter.

Because of growing domestic production, Argentina shut one of two gasification terminals in 2018, and now imports only via the Escobar plant in Buenos Aires province.

Argentina received 26 LNG shipments in 2019 to cover winter demand at an average price of $5.92/MMBtu and in 2018, it purchased 34 cargoes at $8.12/MMBtu, Ieasa said.

The country also imports gas from Bolivia during the winter, while during warmer months it has started exporting surplus gas to nearby Chile.

Crucial projects for the natural gas sector such as a pipeline from Vaca Muerta to Buenos Aires have been put on hold by the new government, and Argentina’s upstream sector has also been severely hit by the coronavirus pandemic.

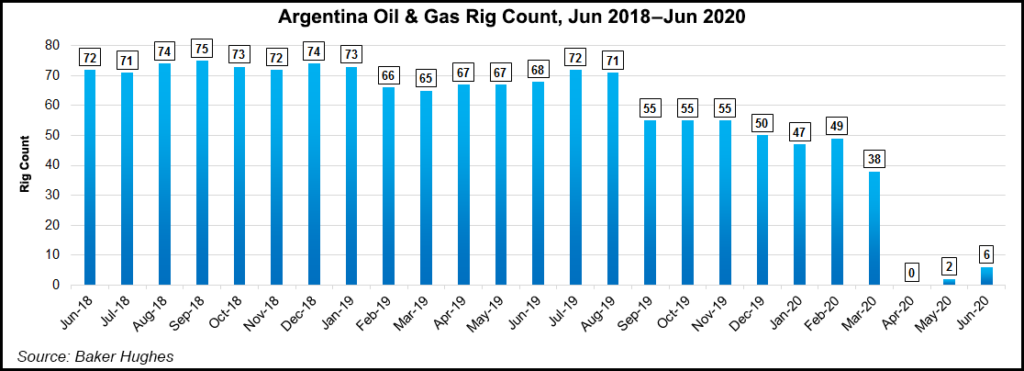

Argentina had only six oil rigs running in June, compared to two in May and zero in April.

Activity has begun to pick up slowly in unconventional plays in the Vaca Muerta in western Argentina, according to media reports based on information from services company NCS Multistage. There were 196 hydraulic fracturing (fracking) stages completed in Argentina in June, compared to 28 in May and zero in April. By comparison, the country in 2019 saw an average of 700 frack stages per month.

As a sign of how quickly Argentina’s gas boom has unraveled, Belgian shipping company Exmar said at the end of June it had received a force majeure notice from Argentine state oil company YPF SA for the Tango floating export project, which it chartered last year as a first step toward sending out LNG to export markets.

Exmar called the notice unlawful. “YPF claims that effects of the coronavirus (Covid-19) pandemic both worldwide and in Argentina have hindered YPF’s ability to perform its obligations under the agreements, including but not limited to its ability to pay the invoices due for services performed for the period starting the second half of March 2020,” it said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |