E&P | NGI All News Access | NGI The Weekly Gas Market Report

Dearth of Lower 48 Well Completions Sends Hi-Crush into Bankruptcy

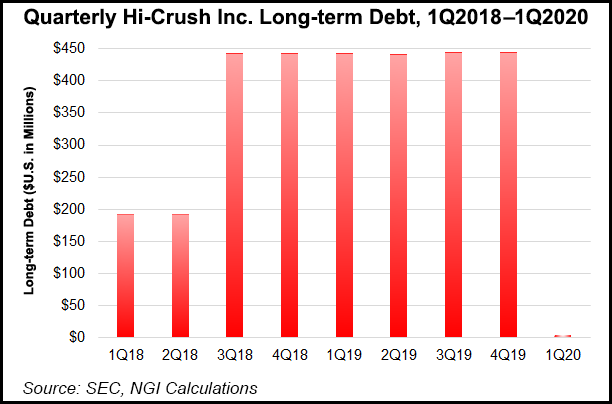

Houston-based Hi-Crush Inc., one of the leading Lower 48 northern white sand providers, is seeking voluntary bankruptcy protection under Chapter 11 to reduce its debt.

The operator filed for protection on Sunday in U.S. Bankruptcy Court for the Southern District of Texas, noting it has a prearranged restructuring support agreement with creditors. The agreement, if completed, would allow Hi-Crush to eliminate $450 million of debt and reduce annual interest expenses by more than $43 million.

“The agreement will allow Hi-Crush to maintain normal operations and continue delivering high quality services to our customers,” CEO Robert E. Rasmus said. “We will also significantly improve our balance sheet and enhance our company’s financial flexibility over the near- and long-term.

“The exchange of debt for equity is a clear indication of the high confidence our noteholders have in the future of Hi-Crush,” he said. “The agreement itself will simplify and accelerate the restructuring process, and we expect to emerge from this process in an even stronger market position, with an enhanced ability to execute on our operational strategy and grow our business over the long-term.”

During the Chapter 11 proceedings, expected to take up to three months, plans are to operate without disruption and have sufficient liquidity to meet financial obligations. The company has received commitments from its various pre-petition lenders for $65 million in debtor-in-possession and exit financing to meet working capital needs.

Management said “substantially all trade vendors who will have an ongoing business relationship with the company will be paid for goods and services in the normal course of business without interruption.”

Hi-Crush last Friday paid substantial retention bonuses to Rasmus, COO Michael Alan Oehlert, general counsel Mark C. Skolos and CFO James Philip McCormick, according to a Securities and Exchange Commission Form 8-K filing “with the requirement that the gross amount of such bonus be repaid to the company in the event that the retention bonus is not earned.”

Rasmus was paid $1.35 million as a bonus, Oehlert was paid $693,750, Skolos received $552,750, and McCormick was paid $360,000. To retain the bonuses, the executives must remain employed through June 30, 2021, or until the company emerges from bankruptcy. The Chapter 11 process is expected to take only 60-90 days, Hi-Crush indicated.

If the executive is “terminated without cause, dies or becomes disabled or resigns for good reason prior to the vesting date, then the executive will not be required to repay the retention bonus, subject to the executive’s execution and non-revocation of a general release of claims,” Hi-Crush noted. “If the executive does not execute or revokes the release, or if the executive is terminated for cause or resigns without good reason prior to the vesting date, then the executive will be required to repay the retention bonus to the company.”

Under the retention agreements, each executive also said he would forgo eligibility for an annual bonus for 2020 and forfeit any outstanding awards under the company’s long-term incentive plan.

Lazard is acting as financial adviser, while Latham & Watkins LLP is legal counsel, and Alvarez & Marsal is acting as restructuring adviser. Hunton Andrews Kurth LLP also is advising Hi-Crush in its Chapter 11 filing.

The oilfield services sector has been hit particularly hard by the downturn in North American activity. North America’s No. 1 pressure pumper, Halliburton Co., has made deals with Hi-Crush to provide northern white sand for its Lower 48 business.

During the 1Q2020 conference call, Halliburton CEO Jeff Miller warned the company was no longer seeing a “flight to quality,” but a flight to anywhere, as customers dealt with the Covid-19 pandemic and low commodity prices.Haynes and Boone LLP, which compiles statistics on North American energy sector bankruptcy filings, also noted last week that the exploration and production sector should continue to face credit challenges to the end of the year.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |