M&A | Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

BP Strikes $5B Deal to Sell Petrochemicals Business to Ineos as Energy Transition Escalates

BP plc on Monday announced it is selling off its substantial petrochemicals business, much of it in the United States, in a $5 billion deal with chemicals giant Ineos Group.

The sale, designed as “the next strategic step in reinventing BP,” would strengthen the balance sheet and deliver on the supermajor’s $15 billion total planned divestment target one year early.

“This is another significant step as we steadily work to reinvent BP,” CEO Bernard Looney said. “These businesses are leaders in their sectors, with world-class technologies, plants and people. In recent years they have improved performance to produce highly competitive returns and now have the potential for growth and expansion into the circular economy.”

The decision “will come as a surprise” to BP employees, he said, “and we will do our best to minimize uncertainty. I am confident, however, that the businesses will thrive as part of Ineos…

“Strategically, the overlap with the rest of BP is limited, and it would take considerable capital for us to grow these businesses. As we work to build a more focused, more integrated BP, we have other opportunities that are more aligned with our future direction.

“Today’s agreement is another deliberate step in building a BP that can compete and succeed through the energy transition.”

Under the terms of the agreement, Ineos is to pay a deposit of $400 million and $3.6 billion when the transaction is completed, which is anticipated by the end of this year. An additional $1 billion would be deferred and paid in three separate installments of $100 million next March, April and May, with the remaining $700 million payable by the end of June 2021.

Ineos also has an option to acquire or lease BP’s research complex in Naperville, IL.

BP CFO Brian Gilvary, who led the negotiation with the Ineos, said the two UK-based companies have had a “long relationship…and this agreement reflects the mutual respect and trust that exists between us. It is a strategic deal for both parties that recognizes both the high quality of the businesses and that Ineos in many ways a natural owner for them.”

In total, BP petrochemicals businesses employ more than 1,700 people worldwide, and they are expected to transfer to Ineos when the sale is completed.

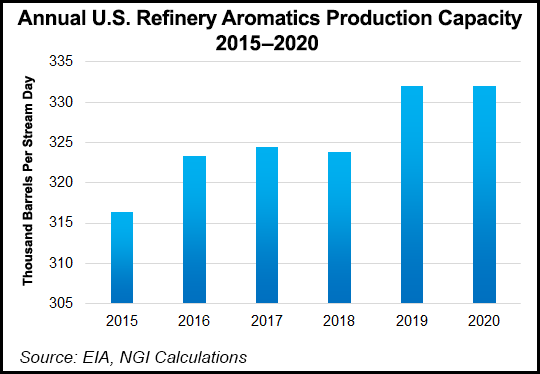

BP, the leading North American natural gas marketer, is focused on two main petrochemicals businesses, aromatics and acetyls. In total, the businesses have interests in 14 manufacturing plants in Asia, Europe and the United States.

BP’s aromatics business produces purified terephthalic acid (PTA), a key feedstock in manufacturing polyester plastics, and its precursor paraxylene (PX). The business’s largest manufacturing plants are in Belgium, China and the United States. BP also licenses its PTA production technology to producers around the world.

In 2019, BP’s petrochemicals segment produced 9.7 million metric tons.

In the Americas, Ineos would be taking over 100% of the Cooper River, SC, PTA facility and 100% of the Texas City, TX, PX and metaxylene facilities. In addition, it is acquiring the Eastman BP Texas City production agreement for acetic acid. Ineos also agreed to buy BP’s 36.9% stake in the Atlas Methanol, Point Lisas, Trinidad & Tobago methanol projects.

Ineos’ petrochemicals network, which employs about 22,000 people worldwide, spans more than 180 sites in 26 countries. Over the past two decades, it has acquired several businesses from BP, most notably in 2005, when it paid $9 billion for Innovene, a subsidiary that comprised most of BP’s chemicals assets at the time, as well as two refineries.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |