NGI The Weekly Gas Market Report | E&P | Markets | NGI All News Access | NGI Data

Another Rough Road in 1Q2020 for Top U.S. Natural Gas Marketers

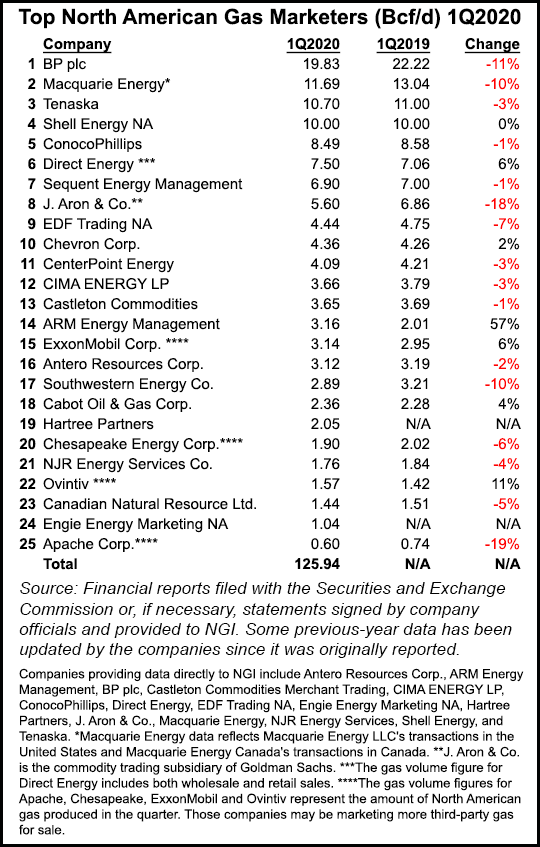

The year started as 2019 had ended for leading natural gas marketers, with 1Q2020 continuing the sales declines that have hampered the industry for four consecutive quarters, according to NGI’s Top North American Natural Gas Marketers rankings.

The 23 gas marketers that participated in both NGI‘s latest quarterly survey and the year-ago survey reported combined sales transactions of 122.85 Bcf/d in 1Q2020, a 4% decline compared with 127.63 Bcf/d in 1Q2019. The addition of two marketers since the 1Q2019 survey — Hartree Partners (2.05 Bcf/d) and Engie Energy Marketing NA (1.04 Bcf/d) — brought the 1Q2020 survey total to 125.94 Bcf/d.

It was the fourth consecutive quarterly NGI survey to report year/year declines. Prior to decreases reported in the 2Q2019 survey, marketers had reported year/year increases in six consecutive surveys. The NGI survey ranks marketers on sales transactions only. The Federal Energy Regulatory Commission Form 552 tallies both purchases and sales.

In the latest survey, seven of the survey’s Top 10 marketers, including the three leaders, as well as 16 companies overall, reported lower numbers in 1Q2020 than in the year-ago period. Substantial year/year declines were reported by BP plc (19.83 Bcf/d, compared with 22.22 Bcf/d in 1Q2019) and Macquarie Energy (11.69 Bcf/d from 13.04 Bcf/d in 1Q2019), the survey’s perennial No. 1 and No. 2, respectively.

London-based BP, for years the top gas marketer in North America, in February set ambitious targets to become a net zero carbon emitter by at least 2050. Last year, BP’s shareholders voted overwhelmingly to approve a resolution aligning the business strategy with the 2015 United Nations climate change accord, aka the Paris Agreement.

Year/year declines were less dramatic for Tenaska (10.70 Bcf/d, a 3% decline compared with 11.00 Bcf/d in 1Q2019) and Shell Energy NA (9.90 Bcf/d) was unchanged compared with the year-ago period. ConocoPhillips (8.49 Bcf/d) reported only a 1% decline.

Direct Energy (7.50 Bcf/d) bucked the downward trend, reporting a 6% increase compared with 1Q2019, enough to bump it up one spot to No. 6 in the NGI survey.

Rounding out the Top 10 were Sequent Energy Management (6.90 Bcf/d, a 1% decrease), J. Aron & Co. (5.60 Bcf/d, an 18% decrease), EDF Trading NA (4.44 Bcf/d, a 7% decrease), and Chevron Corp. (4.36 Bcf/d, a 2% increase).

With Covid-19 mitigation efforts only recently beginning to be relaxed and the Atlantic hurricane season off to a roaring start, 2Q2020 might not provide marketers with any better opportunities than 1Q2020.

“Drilling and production have been pulling off at a historic pace and this could continue into the second quarter, although the recent recovery in oil prices to near $40/bbl could moderate this trend as some oil wells become economic in low cost areas such as the Permian Basin,” said NGI market analyst Nate Harrison.

“While the ”curve’ of new daily cases of Covid-19 continues to flatten/decline, there has been a recent uptick over the past week, likely due to the protests sweeping the nation. While some speculate the close-quarters gatherings of protesters could spark a new wave of cases, it’s unclear whether a second wave of the virus could lead to lockdown measures being reimposed later this year.

“Volatility in the benchmark Henry Hub futures price has been in decline since the middle of May, with the Bollinger bands contracting the most over the past week. Contracting Bollinger bands, especially when accompanied by lower trading volumes, are often a leading indicator of a technical breakout.”

U.S. dry gas production averaged 92.2 Bcf/d in 1Q2020, but in 2Q2020 output has stumbled to 87.7 Bcf/d through Monday (June 8).

“Domestic dry gas production has rebounded a bit since bottoming at 82.7 Bcf/d, and has been anywhere between 83.8 Bcf/d and 84.5 Bcf/d thus far in June,” said NGI’s Patrick Rau, director of Strategy and Research. “Meanwhile, industrial and liquefied natural gas demand continue to trend lower, although power generation demand has stepped up to help fill the void. As such, there could very well be a bit of a shakeup in the 2Q2020 rankings versus the first quarter of the year.”

The equation for marketers could be further complicated by what forecasters say could be more active than normal Atlantic hurricane season. Though storms don’t pack the same punch they once did on gas supplies, they now can have a more pronounced impact on the demand side. Already the 2020 hurricane season, which officially began June 1, has produced Tropical Storm Arthur, Tropical Storm Bertha, and Tropical Storm Cristobal, which forced some shut-ins as it crossed the Gulf of Mexico and came ashore in Southeast Louisiana Sunday.

Other highlights of NGI’s 1Q2020 survey included a 57% increase year/year for ARM Energy Management (3.16 Bcf/d), a 6% increase for ExxonMobil (3.14 Bcf/d), a 4% increase for Cabot Oil & Gas Corp. (2.36 Bcf/d), and an 11% increase for Ovintiv (1.57 Bcf/d), formerly Encana Corp.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |