Long-term offtakers of Venture Global LNG Inc.’s Calcasieu Pass terminal in Louisiana are again pressing FERC to make the export project developer provide information about the facility, this time targeting a request to extend the commissioning process. Earlier this month, Venture asked the Federal Energy Regulatory Commission to extend the deadline for its 10 million…

Bp

Articles from Bp

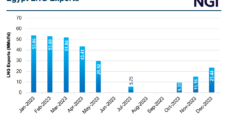

BP, Adnoc East Mediterranean Partnership to Advance Egyptian Natural Gas

Abu Dhabi National Oil Co. (Adnoc) and BP plc are creating a joint venture (JV) focused on Egyptian natural gas production as conflict in Israel and Palestine continues to pressure Eastern Mediterranean energy exports. The new JV, majority-owned by BP (51%), would include the London-based major’s interest in three offshore development concessions, as well as…

Venture Global Asks FERC for 1-Year Extension of Calcasieu Pass LNG Commissioning

Work at Venture Global LNG Inc.’s Calcasieu Pass export facility could stretch on until the end of the year, requiring the firm to seek an authorization extension from FERC, the company disclosed in a recent filing. The Virginia-based company has asked the Federal Energy Regulatory Commission to grant it an extra year to complete the…

Former BP Chief’s ‘Serious Misconduct’ Results in Steep Compensation Losses

The former chief of BP plc, Bernard Looney, is set to forfeit more than $40 million in compensation after he “knowingly misled” the board about his previous relationships with colleagues. Looney, who resigned abruptly in September, gave the board “inaccurate and incomplete assurances” as part of an investigation that began in 2022, according to the…

Middle East Shipping Chokepoint Pushes Global Natural Gas Prices Higher – LNG Recap

Global natural gas prices bounced back Monday, lifted by escalating tensions in the Middle East, where increasing attacks in the Red Sea have impacted commercial shipping operations. BP plc joined a growing list of major shipping companies in announcing that it would halt all of its oil and natural gas cargoes in the Red Sea.…

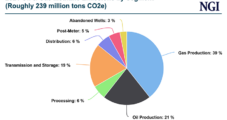

BP, Chevron, EQT, ExxonMobil, Oxy, Shell Vow to Curb More Natural Gas, Oil Emissions as EPA Unveils Stringent Methane Rules

The Biden administration’s final revisions to the nation’s methane regulations, launched on Saturday, drew sharp criticism from energy trade groups, even as 50 of the world’s largest natural gas and oil producers pledged more emissions cuts. Long expected, the U.S. Environmental Protection Agency (EPA) final rulemaking revised the Clean Air Act (CAA) methane and volatile…

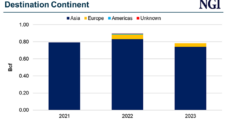

Oman Pushes Global LNG Supply Position ‘Beyond 2024’ with Latest BP LNG Deal

Oman has extended its LNG supply relationship with BP plc for an additional nine years as it progresses its “Beyond 2024” initiative to remain a significant natural gas player through the decade. BP inked a liquefied natural gas sales and purchase agreement (SPA) with Oman LNG for 1 million metric ton/year (mmty) on a free-on-board…

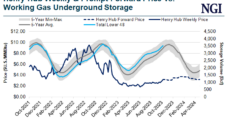

BP’s Natural Gas Trading Stumbles in 3Q on ‘Relatively Full’ U.S. Inventories

BP plc’s long-term vision remains focused on transitioning to net-zero emissions, but the value of the natural gas and oil portfolio is key for near-term success, interim chief Murray Auchincloss said Tuesday. Auchincloss, formerly the longtime CFO, took the reins in September following the resignation of Bernard Looney. During a conference call to discuss third…

Natural Gas Players Look Past Short-Term Risk to Long-Term Supply Gap with Flurry of Deals – LNG Recap

Global natural gas markets were tepid Tuesday despite growing risks of Australian LNG work stoppages. While the global natural gas community gathered in Singapore for the start of the Gastech 2023 conference, workers at Chevron Corp.’s Gorgon and Wheatstone liquefied natural gas terminals disclosed plans for walkouts. Representatives for the Offshore Alliance said workers could…

Infrastructure and ‘Pragmatic Policy’ Key to Meeting Long-Term Natural Gas Demand

Steady supplies of natural gas – and more infrastructure to deliver it – are vital for the United States to meet steady domestic consumption and elevated global demand for LNG through this decade and beyond. Such was the prevailing sentiment among industry leaders and analysts who presented last week at the LDC Gas Forums annual…