NGI Archives | NGI All News Access

Warren’s Atlantic Rim Acquisition Adds 18.3 Bcf of Proved Reserves

Warren Resources Inc. Monday said it closed on its previously announced deal to acquire additional natural gas and midstream assets from subsidiaries of Anadarko Petroleum Corp. in the Atlantic Rim Project area in Wyoming’s Washakie Basin.

After learning this past summer that Anadarko was soliciting bids for all of its operated coalbed methane (CBM) assets in the Atlantic Rim Project (see Shale Daily, Oct. 3; Sept. 6), Warren, which was a working partner with Anadarko on a number of the assets, decided to exercise its preferential rights to purchase Anadarko’s share.

Under the deal, Warren acquired 79% of Anadarko’s working interest in the Spyglass Hill Unit area within the Atlantic Rim Project, representing approximately 37,142 net leasehold acres and an approximate 32.8% additional total unit working interest therein, for a purchase price of $11.4 million, which increased its working interest in the entire unit from 30.1% to 62.9%. Warren’s working interests in the three currently producing participating areas (PA) increased as follows: (A) the Doty Mountain PA increased from approximately 40% to 73%; (B) the Sun Dog PA increased from approximately 42% to 67%; and (C) the Grace Point PA increased from approximately 45% to 86%.

Warren also acquired 26.5% of Anadarko’s interest in the Catalina Unit area within the Atlantic Rim Project, representing approximately 1,121 net leasehold acres and an approximate 5.2% additional total unit working interest therein, for a purchase price of $0.7 million, which increased its working interest in the entire unit area from 16.9% to about 22%. Warren’s working interest in the currently producing Catalina Unit PA increased from approximately 8.0% to 12.5%.

In addition, Warren acquired all of Anadarko’s 50% interest in the gas gathering, compression and pipeline midstream assets within the Atlantic Rim Project for a purchase price of $4 million. The midstream assets consist of gathering and compression equipment and a 59-mile long pipeline that transports gas from the gathering systems throughout the Spyglass Hill Unit area to the Wyoming Interstate Company (WIC) interstate gas transportation pipeline.

While CBM is currently the main target in the region, some of the acreage is expected to have Niobrara and Green River formation prospects. During an August conference call to discuss 2Q2012 earnings, Price said that while Warren was interested in the Niobrara and Green River formations down the road, it currently had no plans to do any “deep testing” on the CBM.

As a result of the transaction, Warren’s estimated proved developed reserves in the Atlantic Rim increased by approximately 18.3 Bcf. Additionally, the acquisition will add natural gas production of about 7.8 MMcf/d. As a result Warren acquired proved developed reserves at a price of $0.65/Mcf, or approximately $1,550 per flowing Mcf, of natural gas production.

Warren exercised its preferential rights to purchase Anadarko’s interests after Anadarko advised Warren that it had entered into an agreement to sell these assets to Double Eagle Petroleum Co. on Aug. 16.

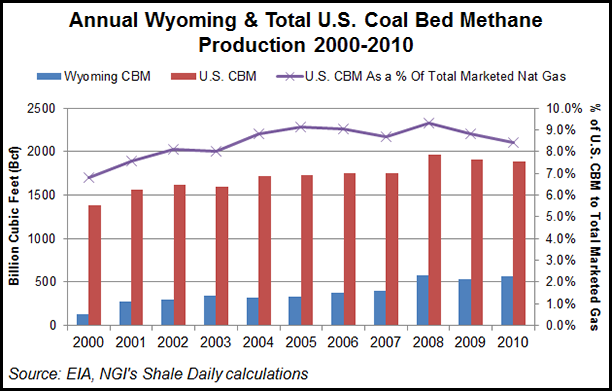

With the arrival of shale gas development and depressed natural gas prices, CBM production as a share of total U.S. gas production in the United States has declined every year since 2008.

According to the Energy Information Administration (EIA) and data compiled by NGI’s Shale Daily, Wyoming saw the most CBM production in 2010 within the United States with 566 Bcf. Colorado and New Mexico were second and third with 533 Bcf and 402 Bcf, respectively. Overall, CBM production accounted for 8.4% of total U.S. marketed natural gas in 2010, but that percentage has fallen each year since reaching a 10-year peak of 9.3% in 2008.

Complete statistics from the EIA are not available for 2011, but CBM most likely contributed even less to the overall U.S. production picture in 2011, given the continued rise in shale and other unconventional drilling, and the general lack of drilling capital that producers dedicated to dry gas areas in recent months. CBM plays are almost 100% methane and therefore do not receive any economic uplift from natural gas liquids production.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |