The Railroad Commission of Texas (RRC) on Tuesday adopted lower production thresholds at which the state’s low-producing oil/natural gas wells may attain “active” status and avoid being shut in.

Months

Articles from Months

Report Raises North Dakota’s $100M/Month Question — Flaring

Without dramatic intervention North Dakota’s natural gas flaring — already costing about $100 million/month — is going to get worse even if the percentage of total production flared goes down, as state and industry officials predict, according to a report released Monday by Boston-based social responsibility nonprofit organization Ceres.

Questar Unit Adding More Wyoming Natural Gas Assets

Questar Corp.’s exploration and production subsidiary on Monday agreed to pay $106.4 million to bolt-on more natural gas wells to an existing leasehold in Wyoming.

Tennessee Offering Capacity on Cameron LNG Terminal Supply Pipe

Nearly two months after securing Mitsubishi Corp. as its foundation shipper, Tennessee Gas Pipeline is holding an open season through Aug. 9 for its Southwest Louisiana Supply Project, which is designed to provide transportation from various supply basins in Ohio, Pennsylvania, Texas and Louisiana to Cameron Interstate Pipeline, which connects directly to the proposed Cameron LNG export terminal in Hackberry, LA.

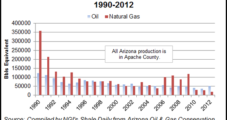

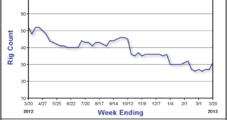

Arizona Geological Survey Eyes Shale Potential

In recent months, the Arizona Geological Survey (AZGS) has examined shale oil and natural gas potential in southeastern and westerly parts of the state, in addition to the already exploratory drilled northern formations, particularly in the northeast Four Corners area in which the Mancos Shale is found.

Marcellus Gas Wells — Dry or Wet — Competing with Bakken Economics

Given current commodity prices, natural gas wells drilled in the Marcellus Shale — wet or dry — compete favorably with marginal Bakken Shale oil wells, but that’s the only gas play in the U.S. onshore that today can compete with Bakken oil well economics, according to an analysis by Barclays Capital.

Smartening Meters Is SoCalGas’ Biggest Capex Project

Sempra Energy’s Southern California Gas Co. utility is only seven months into a five-year program, but when it finishes installing more than 6 million advanced meter devices for its vast array of residential and small business customers, the nation’s largest gas utility will have finished its largest capital expenditure ever.

Chesapeake Jettisons More Pennsylvania Acreage to EQT

Chesapeake Energy Corp. on Friday agreed to sell an estimated 99,000 net acres in southwestern Pennsylvania, including 10 wells, to EQT Corp. for $113 million, which puts the sale price at roughly $876/acre.

AEP’s Fuel Switching Leans Toward Coal

Bucking the recent fuel switching trend, American Electric Power (AEP) in the first three months of 2013 became more dependent on coal and used significantly less natural gas to generate electricity, said CFO Brian Tierney.

Quicksilver Inks Long-Sought Barnett Deal

A unit of Tokyo Gas Co. Ltd. is buying an undivided 25% interest in the Barnett Shale assets of Quicksilver Resources Inc. for $485 million, marking a milestone for the debt-laden Fort Worth, TX-based producer, which has long sought a Barnett partner.