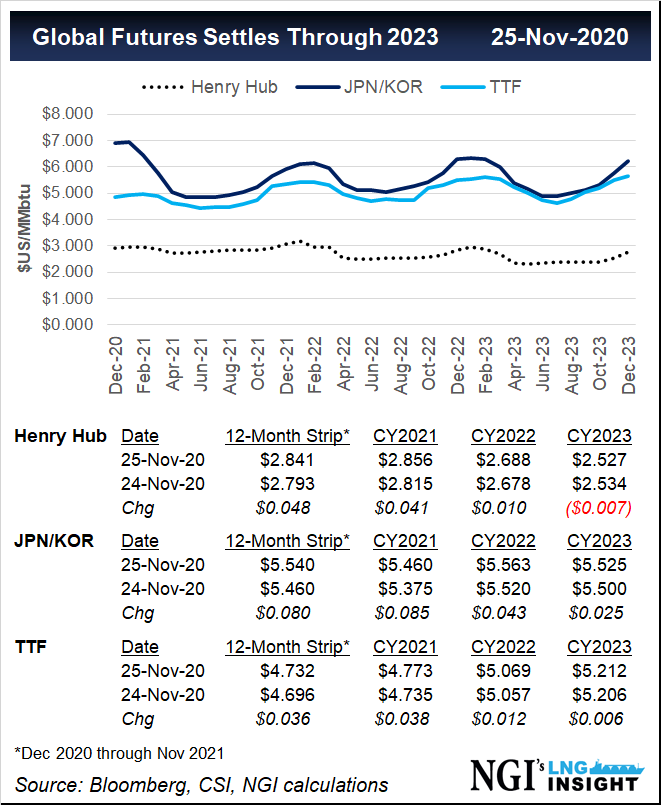

U.S. natural gas prices are forecast to average $3.30/MMBtu in 2021, with even higher prices predicted next summer, according to BofA Securities.

The analyst team led by Francisco Blanch, head of commodities and derivatives research, discussed the outlook for energy overall during a webcast on Tuesday.

“The bottom line is that higher prices are needed in 2021 to balance the U.S. natural gas market,” Blanch said, which is driving the average price next year about 55 cents above the forward curve.

By comparison, the Energy Information Administration, in its most recent Short-Term Energy Outlook published earlier this month, said monthly average spot prices are forecast to be above the $3 mark through 2021, averaging $3.14 for the year. That’s a $1 improvement over the...