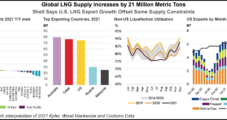

Shell plc has tempered its expectations for peak LNG demand over the next two decades, but the top natural gas trader still expects the current buildout of export capacity led by the United States to fall short of rising global consumption driven by Asia. In its latest liquefied natural gas market outlook, the London-based integrated…

Outlook

Articles from Outlook

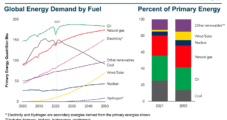

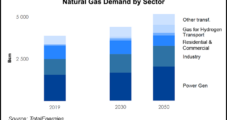

ExxonMobil Sees Global Natural Gas Demand Jumping by 20%-Plus to 2050

Natural gas use is projected to increase worldwide by more than 20% in 2050, even as solar and wind resources rise sharply, according to ExxonMobil. In the Global Outlook to 2050 published on Monday, the Houston-based integrated major said global gas consumption would continue to climb, “given its utility as a reliable and lower-emissions source…

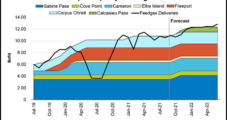

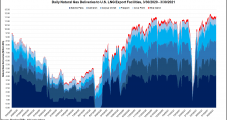

Strong Natural Gas Production Should Help Balance Market Against Chilly Winter, LNG Demand, AGA Says

Heating demand could prove stronger this winter than last, given National Weather Service (NWS) forecasts for colder temperatures in northern markets. But robust production levels this fall should help balance prices and meet domestic market needs and increased international demand for LNG. That assessment is according to the American Gas Association’s (AGA) winter outlook, delivered…

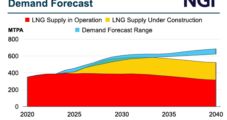

Worldwide LNG Consumption Forecast to Jump 90% by 2040, Shell Says

Global demand for liquefied natural gas (LNG) is expected to cross 700 million metric tons/year (mmty) by 2040, a 90% increase from 2021 consumption, according to Shell plc. In Shell’s latest LNG Outlook, the energy major said Asia was expected to consume most of the growth as “domestic gas production declines, regional economies grow and…

Exports, Industrial Sector Seen Driving U.S. Natural Gas Demand This Winter

A growing industrial sector and record-high export activity are expected to be key drivers of increased U.S. natural gas demand this winter, according to a leading trade group. Liquefied natural gas (LNG) exports are expected to grow by 16% over last winter, while pipeline exports to Mexico are expected to get an 18% boost, the…

OPEC Says More Energy Sector Investment Needed; Oil Dominance to Hold Through 2045

Already falling short of projected demand growth, a lack of investment in the oil industry threatens to lead to further volatility and a future energy shortfall, according to the Organization of the Petroleum Exporting Countries (OPEC). In its 15th Annual World Oil Outlook (WOO) released Tuesday, the Saudi-led cartel said underinvestment remained one of the…

TotalEnergies Sees Oil Demand Plateauing, but Natural Gas Key to Energy Transition

Global oil demand should plateau earlier than estimated, likely before 2030, but natural gas will continue to play a key role in the energy transition, TotalEnergies said Monday. The Paris-based multi-energy major provided its third annual short-term forecast in the Energy Outlook (EO) 2021. Ahead of the upcoming United Nations (UN) Climate Change Conference, also…

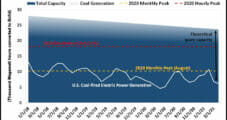

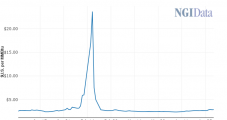

Even at $4.00, Higher Natural Gas Prices Needed, Says Raymond James

Natural gas prices crested the $4.00/MMBtu mark last week, and though the gains may have come quickly, price may need to be higher to incentivize more coal in power generation to help balance the market, according to Raymond James & Associates Inc. Coal’s share of the power generation stack would have to increase by more…

Higher Commodity Prices, Strengthening Economies Improve Outlook for Global Energy Demand, Moody’s Says

Moody’s Investors Service has upgraded its outlook for the global energy industry, citing a sustained increase in commodity prices and expectations for global economic growth to drive increased oil and gas demand over the next 12 to 18 months. The firm said it expects that, as vaccine programs become prevalent and the coronavirus outbreaks fade,…

No U.S. LNG Export FIDs Predicted in 2021, Says Wood Mackenzie

No U.S. liquefied natural gas (LNG) projects are expected to be sanctioned this year, marking the second year in a row developers may postpone moving ahead with facilities, according to Wood Mackenzie. Consultants during a webcast last week said domestic final investment decisions (FID) were unlikely as sponsors struggle to secure long-term contracts “Generally, we’ve…