A plan purportedly under consideration by the Trump administration to replace tariffs on steel imported from Canada and Mexico with a quota system would “cripple expansion of U.S. oil and natural gas production because of supply restrictions,” according to the Texas Independent Producers and Royalty Owners (TIPRO).

Markets

Articles from Markets

West Texas Woes Bring More Negative Spot Prices as Natural Gas Futures Steady

Natural gas bulls and bears duked it out in a split decision Tuesday as futures held steady after testing both sides of even. In the physical markets, at least one West Texas seller paid to get its gas out of the constrained region as reports of negative spot prices emerged for a second straight day; the NGI National Spot Gas Average climbed 5.0 cents to $4.345/MMBtu.

Natural Gas Futures Test Both Sides of Even; More Negative Trades for West Texas Cash

Natural gas bulls and bears duked it out in a split decision Tuesday as futures held steady after testing both sides of even. In the physical markets, at least one West Texas seller paid to get its gas out of the constrained region as reports of negative spot prices emerged for a second straight day; the NGI National Spot Gas Average climbed 5.0 cents to $4.345/MMBtu.

Mid-December Milder Weather Risks Weigh as Natural Gas Futures Called Slightly Lower

December natural gas futures were trading 1.8 cents lower at $4.230/MMBtu shortly before 9 a.m. ET as forecasters continued to point to risks for milder temperatures by the middle of next month.

Long-Range Pattern Uncertain as December Natural Gas Called Lower

December natural gas futures were trading at $4.074/MMBtu shortly before 9 a.m. ET Monday, down 23.4 cents from Friday’s settle as forecasters were pointing to an uncertain outlook for temperatures toward the second half of next month.

Alberta Doubles Subsidies to Attract Petrochemical Investments

The Alberta government has doubled, to C$2 billion ($1.6 billion), a subsidy program for new petrochemical projects that increase demand for natural gas and liquid byproducts from wells and processing sites across the province.

Canadian Drillers Expect Poor Prices, Flat Well Count in 2019

Pipeline capacity shortages, supply backlogs and competition in the United States will add up to poor prices and hard times in 2019 for Canadian natural gas and oil, industry service firms predicted.

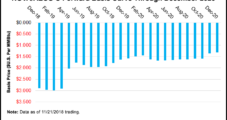

Mid-December Looking Warmer as Natural Gas Futures Bulls Give Ground; Negative Cash Trades in West Texas

Natural gas futures slid over the holiday weekend and Monday, with indications of a milder pattern developing for mid-December potentially discouraging the bulls. In the spot market, prices generally followed the futures lower, while constrained West Texas points saw prices veer into negative territory for the first time on record in the United States; the NGI Spot Gas National Avg. dropped 60.0 cents to $4.295/MMBtu.

NatGas Futures Slide on Risks for Warmer Mid-December; West Texas Cash Hits Negative Territory

Natural gas futures slid over the holiday weekend and Monday, with indications of a milder pattern developing for mid-December potentially discouraging the bulls. In the spot market, prices generally followed the futures lower, while constrained West Texas points saw prices veer into negative territory for the first time on record in the United States; the NGI Spot Gas National Avg. dropped 60.0 cents to $4.295/MMBtu.

Potentially Bullish EIA Report on Tap as December Natural Gas Called Higher

December natural gas futures were trading 12.2 cents higher at $4.645/MMBtu shortly before 9 a.m. ET Wednesday, with the market awaiting the Energy Information Administration’s (EIA) first reported storage withdrawal of the season.