The use of natural gas for power generation in the Lower 48 is expected to increase to 1.6 billion megawatt hours (MWh) by 2040, a 1.3% average annual increase, in part due to development of several shale plays, according to the U.S. Energy Information Administration (EIA).

Topic / Haynesville Shale

SubscribeHaynesville Shale

Articles from Haynesville Shale

Shell Selling Spree Continues With Haynesville, Pinedale Exit

Royal Dutch Shell plc on Thursday announced two more agreements in a bid to restructure its North American portfolio and realign its shale operations with the divestiture of 126,000 net acres in North Louisiana’s Haynesville Shale and the Pinedale Anticline of Wyoming.

Calumet Acquires Specialty Oilfield Solutions for $30M

Calumet Specialty Products LP said it has acquired substantially all of the assets of one of its competitors, privately-held Specialty Oilfield Solutions Ltd. (SOS), in a cash deal valued at $30 million.

Freeport Marketing More U.S. Onshore Assets

Freeport-McMoRan Inc. is marketing up to $5 billion of onshore assets in the United States to concentrate resources on Gulf of Mexico opportunities, the company said Wednesday.

Industry Brief

Exterran Partners LP is buying some Fayetteville Shale-based natural gas compression units from a Chesapeake Energy Corp. subsidiary for $135 million. The purchase from MidCon Compression LLC includes 162 compression units with 110,000 hp that primarily serve BHP Billiton Petroleum Ltd. properties in Arkansas. A five-year contract with BHP would be assigned to Exterran at closing. Exterran Holdings services customers in about 30 countries; Exterran Holdings Inc. owns an equity interest. For Chesapeake, the transaction continues an ongoing plan to sell noncore assets.

Gas Export Authorization Could Bring on Haynesville Production; Export Pricing a Problem

It wouldn’t be a stretch for the United States to ramp up production to serve a 10 Bcf/d liquefied natural gas (LNG) export market by 2020, but whether the prospective exports would cause higher domestic natural gas prices could hinge on whether those exports are tied to Henry Hub gas or to or higher Brent crude equivalents, according to Patrick Rau, Natural Gas Intelligence (NGI) director of strategy and research.

Chesapeake Raises ’14 Outlook as Output, Profits Surge

Chesapeake Energy Corp. is more than making do with its smaller portfolio and reduced spending plans, with its first quarter natural gas and oil production increasing by 11% and revenues surging 47%.

Sabine-Forest Combo to Be an East Texas Pack Leader

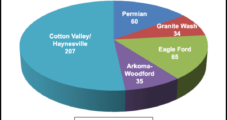

East Texas and Eagle Ford Shale players Sabine Oil & Gas LLC and Forest Oil Corp. announced an all-stock merger that will create a Houston-based publicly traded company with acreage also in the Granite Wash, Permian and Arkoma basins.

February Texas Oil Production ‘the Most Since 1980’

An index of oil and natural gas upstream activity in Texas reached a new high for February with increasing production — for oil the highest since 1980 — higher commodity prices at the wellhead following along with a booming workforce.

Northeast Prices May Have Marcellus Drillers Heading South, EIA Says

Unusually cold weather that remained in place over portions of the country into the last days of winter helped drive working natural gas in storage to an…