Energy and stock markets steadied themselves Monday after last week’s swoon over Covid-19 fears, and natural gas futures followed the broader trend, rebounding decisively despite a lack of weather-driven demand in the forecast. The April Nymex contract added 7.2 cents to settle at $1.756/MMBtu, while May picked up 6.5 cents to $1.797.

Topic / Coronavirus

SubscribeCoronavirus

Articles from Coronavirus

Natural Gas Tumbles; Demand ‘Falling Off a Cliff’ as Coronavirus Spreads Fear of Slowdown

Against a backdrop of global economic anxiety over the coronavirus outbreak, the prospect of an early spring offered natural gas futures bulls no quarter in early trading Friday. Following a steep 8.5-cent sell-off in the previous session, the April Nymex contract was down another 7.6 cents to $1.676/MMBtu shortly after 8:30 a.m. ET.

4Q2019 Earnings: Continental’s Hamm Says Coronavirus Impacting Oil, Gas Demand

Amid an oversupplied market and demand uncertainty made worse by the coronavirus outbreak, Continental Resources Inc. is trimming its near-term guidance for capital expenditures (capex) and production growth, Executive Chairman Harold Hamm said Thursday.

NGI The Weekly Gas Market Report

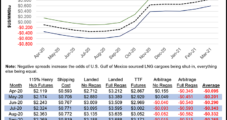

No Doomsday Scenario Seen for U.S. Energy Market in Tricky Predictions of LNG Shut-Ins

U.S. liquefied natural gas (LNG) terminals are unlikely to shut in significant amounts of the super-chilled fuel this year, but as the export market confronts historically low prices and a global supply glut, it’s not a possibility that can be easily ruled out or even defined.

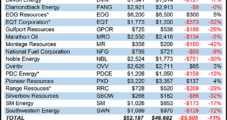

Oil, Gas Operators Forecast to Slash E&P, Project Spending on Coronavirus Impacts

Global exploration and production (E&P) investments may take a substantial hit this year because of the coronavirus, as staffing and supply shortages at key construction yards in Asia and beyond delay project deliveries by up to a year.

Covid-19 Fears Combine with Warmer Weather Forecasts to Send Natural Gas Futures Below $1.70

After being driven sharply lower by an increasingly mild weather forecast, natural gas futures sustained even more damage on Friday as global fears of the coronavirus continued to hammer stocks and energy commodities. The April Nymex gas futures contract plunged to an intraday low of $1.642/MMBtu before going on to settle at $1.684, down 6.8 cents from Thursday’s close. May also fell 6.8 cents to land at $1.732.

NGI The Weekly Gas Market Report

Natural Gas Forwards Tank with Potential for Further Downside Risk

After earlier hints that this week’s cold blast could linger into March, a few warmer revisions during the Feb. 20-26 period sent natural gas forward prices crashing, according to NGI’s Forward Look. The March contract rolled off the board an average 13 cents lower during that time, while April fell 10 cents on average.

NGI The Weekly Gas Market Report

Analysts Slash 2020 Natural Gas Price Forecast; More Cuts Said Needed as Coronavirus Hits Crude

As the market prepares to exit a decidedly underwhelming winter, Goldman Sachs Commodities Research analysts are slashing their 2020 natural gas price forecast from $2.50/MMBtu to $2.20.

4Q2019 Earnings: Chesapeake to Cut NatGas Production, Keep Oil Volumes Flat to Weather Downturn

Chesapeake Energy Corp. executives said Wednesday the company is no longer in jeopardy of filing bankruptcy, noting that a series of cost-cutting initiatives and financial measures aimed at reducing debt have put it back on track.

NGI The Weekly Gas Market Report

4Q2019 Earnings: Cheniere Cites ‘Tougher’ Market for Sanctioning, Confirms Two Canceled Cargoes

Management for Cheniere Energy Inc., the largest liquefied natural gas (LNG) producer in the United States, does “not view significant or prolonged curtailment of U.S. LNG production as a likely scenario” despite the recent cancellation of two cargoes and growing uncertainty about the impacts of the coronavirus.