Shale Daily | Coronavirus | E&P | Eagle Ford Shale | Haynesville Shale | Marcellus | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

4Q2019 Earnings: Chesapeake to Cut NatGas Production, Keep Oil Volumes Flat to Weather Downturn

Chesapeake Energy Corp. executives said Wednesday the company is no longer in jeopardy of filing bankruptcy, noting that a series of cost-cutting initiatives and financial measures aimed at reducing debt have put it back on track.

“We’re confident in the stability and future of the company,” said CEO Doug Lawler. “With the improvements to our margins, the changes we’ve made to strengthen our balance sheet and liquidity in the fourth quarter, the previous ”going concern’ language will not be present” in the Form 10-K filing with the U.S. Securities and Exchange Commission.

Chesapeake warned late last year that sinking commodity prices raised substantial doubt about its ability to continue. It wiped $900 million in principal debt from the books in the fourth quarter through a series of financial moves, but it still has nearly $9 billion of debt on its balance sheet.

The company also has been working to regain compliance with a delisting notice from the New York Stock Exchange and said it would pursue a reverse stock split to raise the share price. The split would require shareholder approval.

Lawler noted on a call to discuss year-end results that the second half of 2019 was marked by “rapidly falling commodity prices, particularly for natural gas, a trend that continues today, causing a much softer commodity price outlook in 2020.” He added too that commodities and the broader global economy are likely to be weakened further by the coronavirus outbreak.

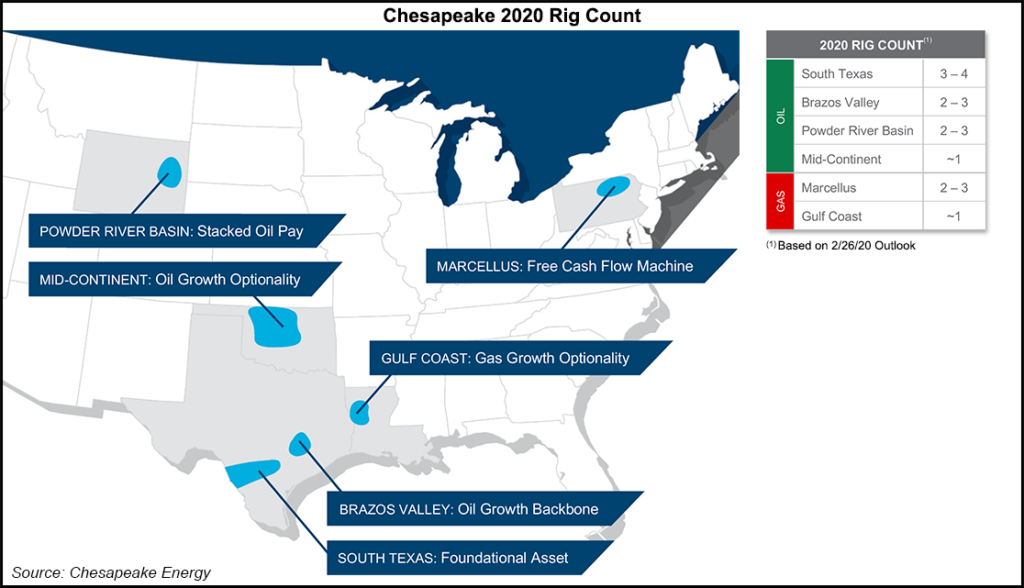

The company has plans to slash year/year spending by 30% with 2020 capital expenditures of $1.3-1.6 billion. Oil production is expected to remain flat while natural gas production is to be cut, pushing down overall volumes.

Chesapeake expects to cut lease operating and general and/administrative expenses by $100 million this year. It also reduced gathering, processing and transportation commitments this week with the buyout of some contracts, removing $169 million of costs associated with the agreements. Another $300 million of debt is maturing later in the year, and Lawler said the company would sell $300-500 million of noncore assets to meet those obligations.

Chesapeake produced 477,000 boe/d in the fourth quarter, compared with 464,000 boe/d in the year-ago period. Fourth quarter oil volumes accounted for 26% of overall production, the highest in its history. The Eagle Ford, Haynesville and Marcellus shales continued driving oil and gas production in the quarter, with each churning out more than 100,000 boe/d.

Full-year 2019 production averaged 484,000 boe/d, compared with 521,000 boe/d in 2018. Oil production increased by 30% last year, primarily because of the acquisition of Upper Eagle Ford and Austin Chalk assets in Central Texas.

Sequential production from the Powder River Basin (PRB) of Wyoming, where the company has been increasingly focused following its pivot to oilier assets, slipped in the fourth quarter as the company wrestled with underperforming wells there.

“There’s actually two zones in our acreage, the Turner and then the Frontier formation underneath that,” said Frank Patterson, who oversees exploration and production. “We thought they would act as one; they don’t appear to be acting as one. The Turner should be on two wells per section, and maybe even in a fractured area, one well per section.

“So, we’re having to rethink our development plan on the Turner,” he said. “They’re still good wells; you can’t just drill them as close to each other as what people had thought.”

Patterson said the well location count in the Turner, a tight sands oil play, would likely go down. The company may eventually add locations back when it has a better grip on the development plan in the field, he said. The company also has been bringing more PRB wells online in the Niobrara.

Chesapeake’s average realized prices fell across the board in 2019. Year/year oil prices fell from $60.00/bbl to $57.42. Natural gas prices fell from $3.00/Mcf in 2018 to $2.60 last year. Natural gas liquids prices declined from $25.84/bbl in 2018 to $15.62 last year.

Chesapeake reported a fourth quarter net loss of $346 million (minus 18 cents/share), compared with net income of $576 million (57 cents) in the year-ago period. For 2019, the company reported a net loss of $416 million (minus 25 cents), compared with net income of $133 million (15 cents) in 2018.

Want to see more earnings? See the full list of NGI’s 4Q2019 earnings season coverage.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |