NGI The Weekly Gas Market Report | Coronavirus | E&P | Earnings | LNG | LNG Insight | NGI All News Access

4Q2019 Earnings: Cheniere Cites ‘Tougher’ Market for Sanctioning, Confirms Two Canceled Cargoes

Management for Cheniere Energy Inc., the largest liquefied natural gas (LNG) producer in the United States, does “not view significant or prolonged curtailment of U.S. LNG production as a likely scenario” despite the recent cancellation of two cargoes and growing uncertainty about the impacts of the coronavirus.

However, CEO Jack Fusco noted the headwinds the global LNG market is facing in the near term, including back-to-back mild winters, additional supplies entering the market and the Covid-19 virus.

Speaking on a call Tuesday to discuss fourth quarter earnings results, Fusco said, “the whole sense of urgency from the customers to sign long-term contracts has dropped, and so I do think that market will be tougher for us” to “continue to get our fair share of those contracts” and to be able to commercialize for now the third stage of the Corpus Christi LNG facility in South Texas.

Cheniere had targeted this fall for reaching a final investment decision (FID) on the Stage 3 expansion of the terminal. The expansion project, approved by federal regulators in November, would include up to seven midscale liquefaction trains with a total capacity of around 10 million metric tons/year (mmty). Stage 3, together with the three trains already operating or under construction, would boost total capacity to around 25 mmty.

Cheniere is expected to finalize an engineering, procurement and construction contract with Bechtel Corp. in the “near future” for Stage 3, but the company is not moving forward unless the project achieves other parameters including “sufficient commercial offtake,” which means that no more than 20% of volumes would be uncontracted. It if fails to do so, Cheniere plans to redeploy capital to reduce leverage and return capital to shareholders.

The third production unit at Corpus Christi was about 75% complete at the end of 2019, with engineering and procurement just about wrapped up and construction at about the half-way point, according to management. Train 2 became operational last August.

Cheniere sanctioned a sixth train at the Sabine Pass terminal in Louisiana last year, and the project was nearly 45% complete at year’s end, mostly related to engineering. Construction was only about 10% complete, and substantial completion expected in the first half of 2023.

Regarding the recently canceled cargoes, Fusco said they represented “a pretty insignificant number” compared to the cargoes that Cheniere is forecast to produce and “gives us a great option” for the marketing arm if it were to elect to sell the physical cargoes back into the market. Fusco said one canceled cargo was from Sabine Pass terminal and the other was from Corpus Christi, but going forward, “it will not be our practice to describe to the market what our customers books are or what individual customers are thinking.”

In the “highly contracted” nature of Cheniere’s liquefaction projects, “volatility in the short-term LNG market has limited impact on our business. This is especially true in 2020; we have pre-sold over 95% of the expected production, thereby limiting our exposure to short-term market prices.”

The business model “is not based on speculating on global commodity markets,” rather on a risk management framework “that has positioned Cheniere such that short-term market volatility has limited impact to our economics,” according to Fusco. “We do not view our marketing volumes as speculative. We view it as strategic to our long-term growth.”

The CEO said the fundamentals of its long-term business have remained “extremely strong” since he joined Cheniere in 2016 to the end of 2019, growing about 100 mmt. “That demand is forecast to grow another 100 mmt by 2025 and a further 100 mmt by 2030. But this growth will be cyclical as the necessary infrastructure is required to be built. The LNG market is a dynamic one undergoing significant growth in evolution.”

While low LNG market prices don’t have a material impact on Cheniere’s short-term economics, they “can impact long-term project development and long-term customer urgency,” Fusco said.

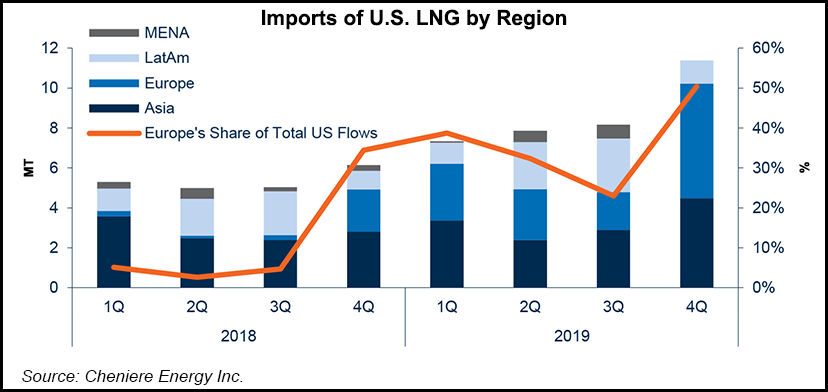

There are areas in which the low gas price environment has spurred demand that Cheniere views as more “structural” in nature, though, including northwest Europe and Iberia. The company also is seeing other tiers of response, according to COO Anatol Feygin.

“One of the more active markets over the last couple of months has been India, which has shown very good appetite at these price levels,” Feygin said. All of this builds “an amount of muscle memory” that will create structural demand that Cheniere does not think will be transient. There also have been “some very interesting responses” to the pricing downturn, especially in Southeast Asia, “where active decisions are taking place to curtail domestic production and import LNG at the margin.

“So you’re seeing a lot of the issues that we’ve kind of anticipated, especially in these, what we call displacement markets, where you have good regional gas economies with challenging domestic production profiles perhaps shifting and increasing LNG imports more rapidly now that the price signal is in place. There’s certainly a lot of room for optimism.”

Hot off the heels of a banner year in 2019 for the global LNG market in which Europe imported a record number of cargoes, Cheniere expects some of the factors that drove those record volumes to “remain important in the European power market over the medium term,” according to Feygin.

Specifically, management believes “the decline in the indigenous gas production and the commitment to environmental targets are structural elements that will likely provide upside to European gas demand and thus LNG imports in the near to medium term.”

Feygin attributed lower demand in Asia to weaker total electricity demand and stronger nuclear availability in 2019 in Japan, South Korea and Taiwan, otherwise known as the JKT region. However, growth markets in South and Southeast Asia compensated for most of the market share lost by JKT, he said. In China, slower economic growth and higher year/year domestic gas production in 2019 reduced the year/year growth rate of LNG imports.

While Cheniere awaits more clarity over the impact of the coronavirus and details surrounding the phase one trade deal signed last month with the United States, the recent actions by China’s Ministry of Finance to provide short-term exemptions to the tariffs on U.S. LNG is “a positive step,” Feygin said. “While the impact of the outbreak on China’s economic growth is uncertain, we see potential for Chinese gas demand to decrease in the near term followed by a rebound with a resumption of normal industrial activity.”

As a result of stimulus measures already being implemented by the Chinese government, longer term the United States and China “are natural partners on energy trade and are hopeful that the tariffs can be removed permanently to facilitate new long-term from agreements,” Feygin said.

Cheniere reported net income of $939 million ($3.70/share) for the fourth quarter, compared with $67 million (26 cents) in 4Q2018. For the full year, net income was $648 million ($2.53/share), compared with $471 million ($1.92) for 2018.

Cheniere last year also repurchased four million shares of stock for $249 million under its share buyback program.

For 2020, Cheniere is reaffirming the financial guidance it outlined in November, with consolidated adjusted earnings before interest, taxes, depreciation and amortization of between $3.8-4.1 billion and DCF between $1.0-1.3 billion.

Want to see more earnings? See the full list of NGI’s 4Q2019 earnings season coverage.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |