The Occidental Petroleum Corp. (Oxy) board on Friday adopted a limited duration stockholders rights plan, known commonly as a “poison pill,” in an effort to dilute activist billionaire shareholder Carl Icahn’s growing stake in the Houston-based independent.

M&A

Articles from M&A

Columbia Gas Exiting Massachusetts in $1.1B Deal, Paying Record Fine in Wake of 2018 Explosions

NiSource Inc. subsidiary Columbia Gas of Massachusetts (CMA) has agreed to plead guilty and pay a $53 million fine in connection with the series of deadly natural gas explosions that rocked three communities north of Boston in September 2018.

NGI The Weekly Gas Market Report

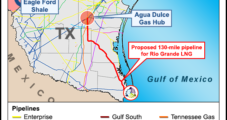

Enbridge Expands Role in LNG Exports with Deal to Buy Rio Bravo Pipeline

Enbridge Inc. has agreed to acquire the Rio Bravo Pipeline Co. and assume full ownership of the 4.5 Bcf/d system that would feed NextDecade Corp.’s proposed RioGrande liquefied natural gas (LNG) export facility.

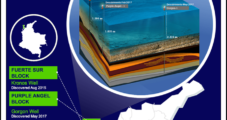

Shell, Ecopetrol Form Deepwater Natural Gas Alliance Offshore Colombia

A subsidiary of Royal Dutch Shell plc has acquired a 50% operating stake in three ultra-deepwater natural gas blocks from Colombian national oil company Ecopetrol SA, the companies said Friday.

NGI The Weekly Gas Market Report

Occidental Casting Off Anadarko’s Legacy Western Midstream Partnership

Houston independent Occidental Petroleum Corp., working to improve shareholder confidence after sharply increasing its debt load with the Anadarko Petroleum Corp. takeover, has executed several agreements to enable Western Midstream Partners LP (WES) to operate as an independent company.

U.S. Oil, Gas Dealmakers Still Prowling for Quality Assets, Bargains

Following an overall paltry return for Lower 48 oil and gas property sales in 2019, the dealmaking market may be looking for a repeat, as well-financed operators prowl for quality assets at bargain prices, according to energy data specialist Enverus.

KKR, Alberta Investors Taking Majority Stake in Western Canada’s Coastal GasLink

KKR and Alberta Investment Management Corp. agreed to become majority stakeholders in TC Energy Corp.’s 2.1 Bcf/d Coastal GasLink Pipeline Project now underway, which is to serve anchor customer LNG Canada in British Columbia.

W&T Snaps Up Stakes in Deepwater Magnolia Field from ConocoPhillips

Houston-based W&T Offshore Inc. has become the operator and majority owner of the Magnolia field in the deepwater Gulf of Mexico (GOM) in a $20 million acquisition from ConocoPhillips.

NGI The Weekly Gas Market Report

EQT Puts $1.5B of Assets on Market in Push to Cut Costs Further

EQT Corp.’s new management team plans to slash spending significantly next year and unload up to $1.5 billion in assets to help cut debt and fulfill the promises made by CEO Toby Rice when he campaigned for control of the company.

Xcel CEO Sees More Opportunities to Buy Natural Gas Assets

Minneapolis-based Xcel Energy Inc. is seeing opportunities to buy more natural gas assets after agreeing to spend $650 million for Mankato Energy Center, according to CEO Ben Fowke.