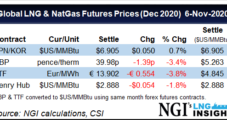

For all the intraweek volatility in the natural gas forward markets, prices ultimately capped the Nov. 5-11 period moderately higher as chilly weather crept back into the long-range forecast, according to NGI’s Forward Look. Though the colder weather may not last, Appalachia markets rallied sharply as the expected drop in temperatures coincided with gas flow…

LNG

Articles from LNG

U.S. LNG Projects Said to Face Significant Hurdles to Sell Supply

The global liquefied natural gas (LNG) supply glut, exposure to European pipeline gas price risk and Asian gas price controls make it difficult for U.S. export project developers to sign long-term deals indexed to Henry Hub prices, according to an industry executive. Potential customers are “looking at a current price scenario of $4.00-5.00/MMBtu and we’re…

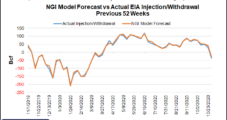

December Natural Gas Futures Rally for Second Consecutive Day as Cooler Forecasts Hold

Slightly improved weather-driven demand and rising spot prices fueled a second-straight day of gains for natural gas futures. The December Nymex contract gained 8.2 cents day/day and settled at $3.031/MMBtu on Wednesday. January advanced 7.8 cents to $3.151. NGI’s Spot Gas National Avg. climbed 13.5 cents to $2.585, a third consecutive day of gains. Wednesday’s…

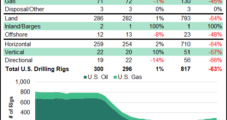

Permian Slowdown Clouds Future Gulf Coast LNG, but ‘Remodeled’ Haynesville More Attractive

Future Gulf Coast natural gas export development may become “risky” if Permian Basin associated gas production doesn’t recover, IHS Markit executive director Sam Andrus said in San Antonio this week. Speaking at the LDC Natural Gas Forum, Andrus said production economics are crucial, given the lack of capital available. After oil prices plunged to historic…

U.S. LNG Shipping Needs Almost Twice Global Average, Says GasLog

Almost twice as many ships were needed to deliver U.S. liquefied natural gas (LNG) on an equivalent unit basis in the third quarter compared to the global average, the head of shipper GasLog Ltd. said Tuesday. “U.S. exports are the most shipping intensive as the distance to most major discharge destinations is above the global…

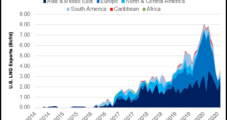

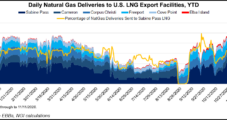

U.S. LNG Pushes Global Export Growth Higher — The Offtake

A roundup of news and commentary from NGI’s LNG Insight Global LNG exports hit their highest level in six months through October, largely from a boost in cargoes from the United States, Kpler said. Exports were 307 million tons (Mt) year to date through October, up 5 Mt from the year-ago period. “The United States…

Early in Biden’s First Year, Pandemic and Economic Stimulus to Trump Energy Policy

A resurging pandemic and potentially protracted negotiations over a new round of economic stimulus could dominate the early months of President-elect Joseph R. Biden’s tenure, overshading other priorities and likely delaying any new major legislation impacting oil and gas interests. The likelihood of a divided government, moreover, will make Biden’s energy and climate priorities among…

Qatar Petroleum LNG Trading Arm Inks First Supply Deal to Curb Climate Impacts

State-owned Qatar Petroleum (QP) has signed its first long-term deal to supply liquefied natural gas (LNG) that would detail emissions generated to produce and deliver the cargoes as more countries scrutinize the super-chilled fuel’s climate impacts. QP agreed to supply Singapore’s Pavilion Energy Trading & Supply Pte Ltd. with 1.8 million tons (Mt) annually for…

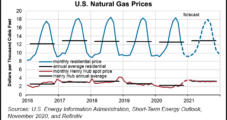

Henry Hub to Average $3.42 in January, Spurred by Rising LNG, Lower Production, EIA Says

Natural gas spot prices at Henry Hub are poised to ascend to an average $3.42/MMBtu in January on a combination of space heating demand, rising liquefied natural gas (LNG) exports and lower production, according to updated projections from the Energy Information Administration (EIA). In its latest Short-Term Energy Outlook (STEO), published Tuesday, EIA said it…

LNG Recap: Global Activity Steadies as Winter Nears

The flurry of activity and price rally that characterized October has subsided as the global natural gas market has steadied with winter nearing. LNG imports increased by 2% month/month in October, and for the first time since May, demand is up year/year as the market has tightened, according to Tudor, Pickering, Holt & Co. (TPH).…