Almost twice as many ships were needed to deliver U.S. liquefied natural gas (LNG) on an equivalent unit basis in the third quarter compared to the global average, the head of shipper GasLog Ltd. said Tuesday.

“U.S. exports are the most shipping intensive as the distance to most major discharge destinations is above the global average,” said GasLog CEO Paul Wogan during a third quarter conference call. During the third quarter, he said about 2.5 ships were needed for every 1 million metric ton (mmt) of exported gas, “nearly twice the global average.”

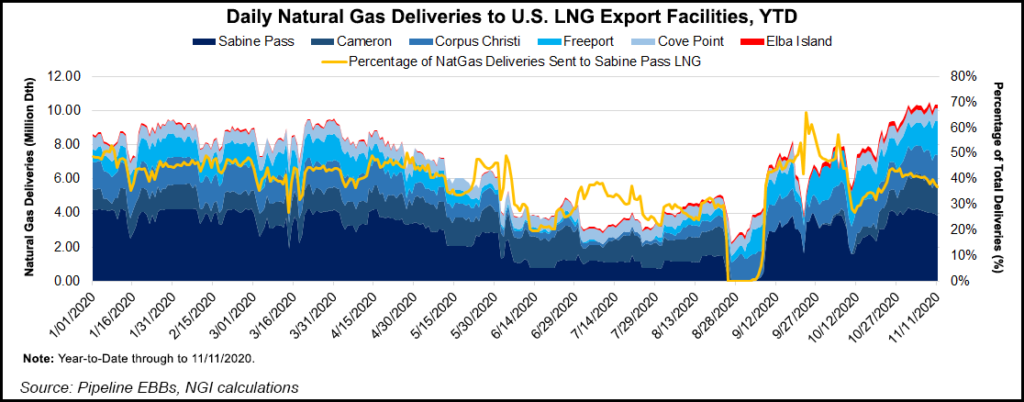

The recent surge in U.S. exports after a significant reduction in the third quarter “is strongly positive for shipping demand.”

During the third quarter, 111 spot LNG shipping hires were reported globally, with 288 in...