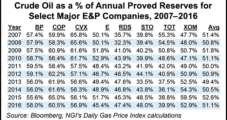

Oil and natural gas operators are entering 2018 in the best shape since oil prices collapsed in late 2014, Wood Mackenzie researchers said Thursday.

Upstream

Articles from Upstream

NGI The Weekly Gas Market Report

Oil, Gas Executives More Cautious on Prices, Prospects, Deloitte Survey Says

Oil and gas executives are more pessimistic than they were a year ago about crude oil prices and only slightly more enthusiastic about a bump in natural gas prices, according to a survey by Deloitte.

LNG to Become Big Oil’s Largest Source of Carbon Emissions Growth by 2025, Says Wood Mackenzie

With global demand increasing, liquefied natural gas (LNG) by 2025 will be the largest source of carbon emissions growth for the biggest oil and gas companies, according to an analysis by Wood Mackenzie.

Tellurian’s New Haynesville Assets Bringing Supply Closer to LNG Export Project

Houston-based Tellurian Inc. last week veered into the upstream sector, making a deal to buy gassy Haynesville Shale acreage near its planned natural gas export facility in Louisiana.

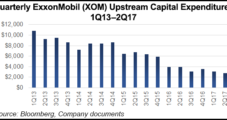

ExxonMobil Earnings Jump 97%, While Capex Falls 24%

North America’s top oil and gas company ExxonMobil Corp. on Friday reported a strong comeback earnings-wise for the second quarter, as oil and gas realizations increased and refining margins improved.

Chevron Reverses Losses, With Output Rising from Permian, LNG, GOM Projects

Chevron Corp. turned around a year-ago loss during the second quarter, while production increased and operating costs fell.

Upstream Global FIDs Tracking Double Time from 2016, Says Wood Mackenzie

Final investment decisions (FID) within the global upstream sector are on pace to double from 2016, marking a positive turning point for the long-depressed oil and natural gas markets.

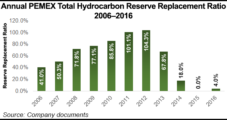

Pemex Eyeing International Collaboration for Mexico E&P Farm-Outs

When Brazil’s energy industry was reformed more than a decade ago, state oil company Petroleo Brasileiro SA, aka Petrobras, raised $70 billion through an initial public offering (IPO) amid a buying frenzy in the Sao Paulo stock exchange. Mexico’s state-owned Petroleos Mexicano (Pemex) had no such luck in the country’s oil and gas reform, but the company has no plans to go it alone.

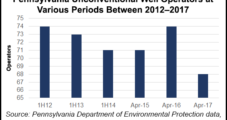

‘Incumbents,’ PE Deals Dominating Appalachian NatGas Consolidation

After years of relative inactivity, dealmaking in the Appalachian Basin is once again healthy but tenuous, as the region’s larger natural gas producers and private equity (PE) firms reassert their dominance in a market filled with both opportunities and risks.

Big Oil Shifting to Natural Gas But Eyeing Renewables

For the Big Oil majors, the portfolios are shifting considerably over the next decade toward natural gas and low breakeven oil, but they also are eyeing more penetration in renewables as investor sentiment toward carbon hardens, Wood Mackenzie researchers said Monday.