Sharply lower natural gas prices year/year in 2012, used under required 12-month average price tests, resulted in significant negative revisions for many domestic gas- and liquids-weighted producers, which rendered some current projects uneconomic and pushed a boat load of proved undeveloped reserves (PUD) out of the five-year development window, according to an analysis by Fitch Ratings.

Sharply

Articles from Sharply

SEC’s Natural Gas Price Tests Take Toll on E&Ps

Sharply lower natural gas prices in 2012 from 2011, used under required 12-month average price tests, resulted in significant negative revisions for many domestic gas- and liquids-weighted producers, rendering some current projects uneconomic and pushing a boat load of proved undeveloped reserves (PUD) out of the five-year development window, according to an analysis by Fitch Ratings.

Williams Pummeled by Northeast Ethane Rejection

Energy infrastructure giant Williams’ first quarter profits were pummeled on sharply lower natural gas liquids (NGL) margins and related ethane rejection at its pipeline partnership.

EOG’s Papa Sees Bakken Growth Rate Slowing, Eagle Ford Surging Ahead

Shares of EOG Resources Inc. rose sharply on Tuesday after the company reported a nearly 53% increase in net income for the first quarter of 2013, gains due in large part to hefty growth in crude oil production from the Eagle Ford Shale.

Late Cold Continuing Cash Market Gains; Futures Make New High

Cash market prices gained an average 16 cents Monday as weather forecasts turned sharply colder at Midwest points. Gains were widespread with only one location in the loss column, and trading points around the Great Lakes sported rises of 30 cents or more. April was able to trade within 3 cents of the $4 mark and made a new 17 month high for a spot contract. It settled up 1.0 cents at $3.882. May advanced 0.5 cent to $3.914. April crude oil added 29 cents to $93.74/bbl.

Range Sells Noncore Permian Assets for $275M

Continuing to focus ever more sharply on liquids-rich and oil projects, Range Resources Corp. has entered into an agreement to sell for $275 million some of its gassier Permian Basin properties in New Mexico and West Texas.

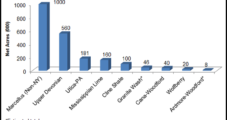

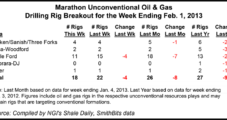

Marathon Output Rising Sharply in Eagle Ford, Bakken

Marathon Oil Corp. production targets are being raised sharply on growth in the Eagle Ford and Bakken shales, CEO Clarence Cazalot said last week. Targeted asset sales also continue, evidenced by the recent sale of a natural gas processor in Louisiana, he told analysts during a 4Q2012 conference call.

Marathon Oil: Eagle Ford, Bakken ‘Highest-Value Resource Plays’

Marathon Oil Corp. production targets are being raised sharply for its growing plays in the Eagle Ford and Bakken Shales, while the targeted sale of assets continues, as evidenced by a $170 million sale of a gas processing interest in Louisiana, CEO Clarence Cazalot said during a 4Q2012 conference call with financial analysts.

Marcellus Infrastructure Slowdown to Slice NatGas Gains, FBR Says

An infrastructure development slowdown across the Marcellus Shale region over the next 12 months will sharply reduce the rate of production growth, to 1.3 Bcf/d from growth of 2.3 Bcf/d in the last 12 months, according to FBR Capital Markets.

Marcellus Pipes Crunch Levels Off Production Boom

An infrastructure development slowdown across the Marcellus Shale region over the next 12 months will sharply reduce the rate of production growth, to 1.3 Bcf/d from growth of 2.3 Bcf/d in the last 12 months, according to FBR Capital Markets.